This Interpretation applies to an entity that hedges the foreign currency risk arising from its net investments in foreign operations and wishes to qualify for hedge accounting in accordance with AASB 9.

Preamble

Pronouncement

This compiled Interpretation applies to annual periods beginning on or after 1 January 2020. Earlier application is permitted for annual periods beginning after 24 July 2014 but before 1 January 2020. It incorporates relevant amendments made up to and including 21 May 2019.

Prepared on 2 March 2020 by the staff of the Australian Accounting Standards Board.

Obtaining copies of Interpretations

Compiled versions of Interpretations, original Interpretations and amending Standards (see Compilation Details) are available on the AASB website: www.aasb.gov.au.

Australian Accounting Standards Board

PO Box 204

Collins Street West

Victoria 8007

AUSTRALIA

Phone: (03) 9617 7600

E-mail: [email protected]

Website: www.aasb.gov.au

Other enquiries

Phone: (03) 9617 7600

E-mail: [email protected]

Copyright

© Commonwealth of Australia 2020

This compiled AASB Interpretation contains IFRS Foundation copyright material. Digital devices and links are copyright of the Commonwealth. Reproduction within Australia in unaltered form (retaining this notice) is permitted for personal and non-commercial use subject to the inclusion of an acknowledgment of the source. Requests and enquiries concerning reproduction and rights for commercial purposes within Australia should be addressed to The National Director, Australian Accounting Standards Board, PO Box 204, Collins Street West, Victoria 8007.

All existing rights in this material are reserved outside Australia. Reproduction outside Australia in unaltered form (retaining this notice) is permitted for personal and non-commercial use only. Further information and requests for authorisation to reproduce IFRS Foundation copyright material for commercial purposes outside Australia should be addressed to the IFRS Foundation at www.ifrs.org.

Rubric

AASB Interpretation 16 Hedges of a Net Investment in a Foreign Operation (as amended) is set out in paragraphs AusCF1 – Aus19.2 and the Appendix. Interpretations are listed in Australian Accounting Standard AASB 1048 Interpretation of Standards and AASB 1057 Application of Australian Accounting Standards sets out their application. In the absence of explicit guidance, AASB 108 Accounting Policies, Changes in Accounting Estimates and Errors provides a basis for selecting and applying accounting policies.

Comparison with IFRIC 16

AASB Interpretation 16 Hedges of a Net Investment in a Foreign Operation as amended incorporates Interpretation IFRIC 16 Hedges of a Net Investment in a Foreign Operation as issued and amended by the International Accounting Standards Board (IASB). Australian specific paragraphs (which are not included in IFRIC 16) are identified with the prefix “Aus”. Paragraphs that apply only to not-for-profit entities begin by identifying their limited applicability.

Tier 1

For-profit entities complying with AASB Interpretation 16 also comply with IFRIC 16.

Not-for-profit entities’ compliance with IFRIC 16 will depend on whether any “Aus” paragraphs that specifically apply to not-for-profit entities provide additional guidance or contain applicable requirements that are inconsistent with IFRIC 16.

AASB 1053 Application of Tiers of Australian Accounting Standards explains the two tiers of reporting requirements.

AASB Interpretation 16

Interpretation 16 was issued in August 2015.

This compiled version of Interpretation 16 applies to annual periods beginning on or after 1 January 2020. It incorporates relevant amendments contained in other AASB pronouncements up to and including 21 May 2019 (see Compilation Details).

Background

AusCF1

AusCF entities are:

(a) not-for-profit entities; and

(b) for-profit entities that are not applying the Conceptual Framework for Financial Reporting (as identified in AASB 1048 Interpretation of Standards).

For AusCF entities, the term ‘reporting entity’ is defined in AASB 1057 Application of Australian Accounting Standards and Statement of Accounting Concepts SAC 1 Definition of the Reporting Entity also applies. For-profit entities applying the Conceptual Framework for Financial Reporting are set out in paragraph Aus1.1 of the Conceptual Framework.

1

Many reporting entities have investments in foreign operations (as defined in AASB 121 paragraph 8). Such foreign operations may be subsidiaries, associates, joint ventures or branches. AASB 121 requires an entity to determine the functional currency of each of its foreign operations as the currency of the primary economic environment of that operation. When translating the results and financial position of a foreign operation into a presentation currency, the entity is required to recognise foreign exchange differences in other comprehensive income until it disposes of the foreign operation.

2

Hedge accounting of the foreign currency risk arising from a net investment in a foreign operation will apply only when the net assets of that foreign operation are included in the financial statements.[1] The item being hedged with respect to the foreign currency risk arising from the net investment in a foreign operation may be an amount of net assets equal to or less than the carrying amount of the net assets of the foreign operation.

3

AASB 9 requires the designation of an eligible hedged item and eligible hedging instruments in a hedge accounting relationship. If there is a designated hedging relationship, in the case of a net investment hedge, the gain or loss on the hedging instrument that is determined to be an effective hedge of the net investment is recognised in other comprehensive income and is included with the foreign exchange differences arising on translation of the results and financial position of the foreign operation.

4

An entity with many foreign operations may be exposed to a number of foreign currency risks. This Interpretation provides guidance on identifying the foreign currency risks that qualify as a hedged risk in the hedge of a net investment in a foreign operation.

5

AASB 9 allows an entity to designate either a derivative or a non-derivative financial instrument (or a combination of derivative and non-derivative financial instruments) as hedging instruments for foreign currency risk. This Interpretation provides guidance on where, within a group, hedging instruments that are hedges of a net investment in a foreign operation can be held to qualify for hedge accounting.

6

AASB 121 and AASB 9 require cumulative amounts recognised in other comprehensive income relating to both the foreign exchange differences arising on translation of the results and financial position of the foreign operation and the gain or loss on the hedging instrument that is determined to be an effective hedge of the net investment to be reclassified from equity to profit or loss as a reclassification adjustment when the parent disposes of the foreign operation. This Interpretation provides guidance on how an entity should determine the amounts to be reclassified from equity to profit or loss for both the hedging instrument and the hedged item.

This will be the case for consolidated financial statements, financial statements in which investments such as associates or joint ventures are accounted for using the equity method and financial statements that include a branch or a joint operation as defined in AASB 11 Joint Arrangements.

Scope

7

This Interpretation applies to an entity that hedges the foreign currency risk arising from its net investments in foreign operations and wishes to qualify for hedge accounting in accordance with AASB 9. For convenience this Interpretation refers to such an entity as a parent entity and to the financial statements in which the net assets of foreign operations are included as consolidated financial statements. All references to a parent entity apply equally to an entity that has a net investment in a foreign operation that is a joint venture, an associate or a branch.

8

This Interpretation applies only to hedges of net investments in foreign operations; it should not be applied by analogy to other types of hedge accounting.

Issues

9

Investments in foreign operations may be held directly by a parent entity or indirectly by its subsidiary or subsidiaries. The issues addressed in this Interpretation are:

(a) the nature of the hedged risk and the amount of the hedged item for which a hedging relationship may be designated:

(i) whether the parent entity may designate as a hedged risk only the foreign exchange differences arising from a difference between the functional currencies of the parent entity and its foreign operation, or whether it may also designate as the hedged risk the foreign exchange differences arising from the difference between the presentation currency of the parent entity’s consolidated financial statements and the functional currency of the foreign operation;

(ii) if the parent entity holds the foreign operation indirectly, whether the hedged risk may include only the foreign exchange differences arising from differences in functional currencies between the foreign operation and its immediate parent entity, or whether the hedged risk may also include any foreign exchange differences between the functional currency of the foreign operation and any intermediate or ultimate parent entity (ie whether the fact that the net investment in the foreign operation is held through an intermediate parent affects the economic risk to the ultimate parent).

(b) where in a group the hedging instrument can be held:

(i) whether a qualifying hedge accounting relationship can be established only if the entity hedging its net investment is a party to the hedging instrument or whether any entity in the group, regardless of its functional currency, can hold the hedging instrument;

(ii) whether the nature of the hedging instrument (derivative or non-derivative) or the method of consolidation affects the assessment of hedge effectiveness.

(c) what amounts should be reclassified from equity to profit or loss as reclassification adjustments on disposal of the foreign operation:

(i) when a foreign operation that was hedged is disposed of, what amounts from the parent entity’s foreign currency translation reserve in respect of the hedging instrument and in respect of that foreign operation should be reclassified from equity to profit or loss in the parent entity’s consolidated financial statements;

(ii) whether the method of consolidation affects the determination of the amounts to be reclassified from equity to profit or loss.

Consensus

Nature of the hedged risk and amount of the hedged item for which a hedging relationship may be designated

10

Hedge accounting may be applied only to the foreign exchange differences arising between the functional currency of the foreign operation and the parent entity’s functional currency.

11

In a hedge of the foreign currency risks arising from a net investment in a foreign operation, the hedged item can be an amount of net assets equal to or less than the carrying amount of the net assets of the foreign operation in the consolidated financial statements of the parent entity. The carrying amount of the net assets of a foreign operation that may be designated as the hedged item in the consolidated financial statements of a parent depends on whether any lower level parent of the foreign operation has applied hedge accounting for all or part of the net assets of that foreign operation and that accounting has been maintained in the parent’s consolidated financial statements.

12

The hedged risk may be designated as the foreign currency exposure arising between the functional currency of the foreign operation and the functional currency of any parent entity (the immediate, intermediate or ultimate parent entity) of that foreign operation. The fact that the net investment is held through an intermediate parent does not affect the nature of the economic risk arising from the foreign currency exposure to the ultimate parent entity.

13

An exposure to foreign currency risk arising from a net investment in a foreign operation may qualify for hedge accounting only once in the consolidated financial statements. Therefore, if the same net assets of a foreign operation are hedged by more than one parent entity within the group (for example, both a direct and an indirect parent entity) for the same risk, only one hedging relationship will qualify for hedge accounting in the consolidated financial statements of the ultimate parent. A hedging relationship designated by one parent entity in its consolidated financial statements need not be maintained by another higher level parent entity. However, if it is not maintained by the higher level parent entity, the hedge accounting applied by the lower level parent must be reversed before the higher level parent’s hedge accounting is recognised.

Where the hedging instrument can be held

14

A derivative or a non-derivative instrument (or a combination of derivative and non-derivative instruments) may be designated as a hedging instrument in a hedge of a net investment in a foreign operation. The hedging instrument(s) may be held by any entity or entities within the group, as long as the designation, documentation and effectiveness requirements of AASB 9 paragraph 6.4.1 that relate to a net investment hedge are satisfied. In particular, the hedging strategy of the group should be clearly documented because of the possibility of different designations at different levels of the group.

15

For the purpose of assessing effectiveness, the change in value of the hedging instrument in respect of foreign exchange risk is computed by reference to the functional currency of the parent entity against whose functional currency the hedged risk is measured, in accordance with the hedge accounting documentation. Depending on where the hedging instrument is held, in the absence of hedge accounting the total change in value might be recognised in profit or loss, in other comprehensive income, or both. However, the assessment of effectiveness is not affected by whether the change in value of the hedging instrument is recognised in profit or loss or in other comprehensive income. As part of the application of hedge accounting, the total effective portion of the change is included in other comprehensive income. The assessment of effectiveness is not affected by whether the hedging instrument is a derivative or a non-derivative instrument or by the method of consolidation.

Disposal of a hedged foreign operation

16

When a foreign operation that was hedged is disposed of, the amount reclassified to profit or loss as a reclassification adjustment from the foreign currency translation reserve in the consolidated financial statements of the parent in respect of the hedging instrument is the amount that AASB 9 paragraph 6.5.14 requires to be identified. That amount is the cumulative gain or loss on the hedging instrument that was determined to be an effective hedge.

17

The amount reclassified to profit or loss from the foreign currency translation reserve in the consolidated financial statements of a parent in respect of the net investment in that foreign operation in accordance with AASB 121 paragraph 48 is the amount included in that parent’s foreign currency translation reserve in respect of that foreign operation. In the ultimate parent’s consolidated financial statements, the aggregate net amount recognised in the foreign currency translation reserve in respect of all foreign operations is not affected by the consolidation method. However, whether the ultimate parent uses the direct or the step-by-step method of consolidation[2] may affect the amount included in its foreign currency translation reserve in respect of an individual foreign operation. The use of the step-by-step method of consolidation may result in the reclassification to profit or loss of an amount different from that used to determine hedge effectiveness. This difference may be eliminated by determining the amount relating to that foreign operation that would have arisen if the direct method of consolidation had been used. Making this adjustment is not required by AASB 121. However, it is an accounting policy choice that should be followed consistently for all net investments.

The direct method is the method of consolidation in which the financial statements of the foreign operation are translated directly into the functional currency of the ultimate parent. The step-by-step method is the method of consolidation in which the financial statements of the foreign operation are first translated into the functional currency of any intermediate parent(s) and then translated into the functional currency of the ultimate parent (or the presentation currency if different).

Effective date

18

[Deleted by the AASB]

Aus18.1

An entity shall apply this Interpretation for annual periods beginning on or after 1 January 2018. Earlier application is permitted for periods beginning after 24 July 2014 but before 1 January 2018. If an entity applies the Interpretation for a period beginning before 1 January 2018, it shall disclose that fact.

18A

[Deleted]

18B

AASB 2014-1 Amendments to Australian Accounting Standards, issued in June 2014, amended paragraphs 3, 5–7, 14, 16, AG1 and AG8(a) in the previous version of this Interpretation. Paragraph 18A, added by AASB 2014-1, was deleted by AASB 2014-7 Amendments to Australian Accounting Standards arising from AASB 9 (December 2014). An entity shall apply those amendments when it applies AASB 9.

Transition

19

AASB 108 specifies how an entity applies a change in accounting policy resulting from the initial application of an Interpretation. An entity is not required to comply with those requirements when first applying the Interpretation. If an entity had designated a hedging instrument as a hedge of a net investment but the hedge does not meet the conditions for hedge accounting in this Interpretation, the entity shall apply AASB 139 to discontinue that hedge accounting prospectively.

Aus19.1

Paragraph 19 shall not be applied by an entity that has previously applied Interpretation 16, unless required to do so by a Standard or another Interpretation.

Appendix -- Application guidance

This appendix is an integral part of the Interpretation.

AG1

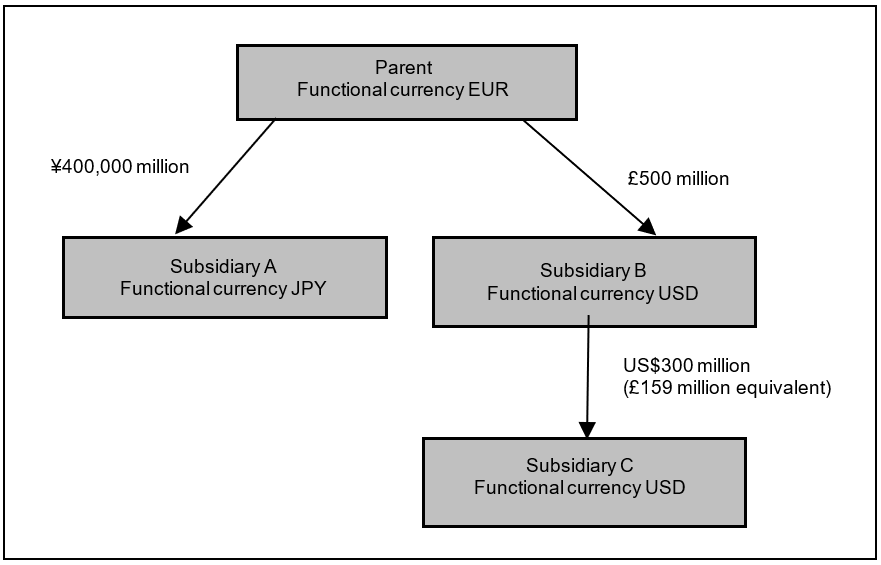

This appendix illustrates the application of the Interpretation using the corporate structure illustrated below. In all cases the hedging relationships described would be tested for effectiveness in accordance with AASB 9, although this testing is not discussed in this appendix. Parent, being the ultimate parent entity, presents its consolidated financial statements in its functional currency of euro (EUR). Each of the subsidiaries is wholly owned. Parent’s £500 million net investment in Subsidiary B (functional currency pounds sterling (GBP)) includes the £159 million equivalent of Subsidiary B’s US$300 million net investment in Subsidiary C (functional currency US dollars (USD)). In other words, Subsidiary B’s net assets other than its investment in Subsidiary C are £341 million.

Nature of hedged risk for which a hedging relationship may be designated (paragraphs 10–13)

AG2

Parent can hedge its net investment in each of Subsidiaries A, B and C for the foreign exchange risk between their respective functional currencies (Japanese yen (JPY), pounds sterling and US dollars) and euro. In addition, Parent can hedge the USD/GBP foreign exchange risk between the functional currencies of Subsidiary B and Subsidiary C. In its consolidated financial statements, Subsidiary B can hedge its net investment in Subsidiary C for the foreign exchange risk between their functional currencies of US dollars and pounds sterling. In the following examples the designated risk is the spot foreign exchange risk because the hedging instruments are not derivatives. If the hedging instruments were forward contracts, Parent could designate the forward foreign exchange risk.

Amount of hedged item for which a hedging relationship may be designated (paragraphs 10–13)

AG3

Parent wishes to hedge the foreign exchange risk from its net investment in Subsidiary C. Assume that Subsidiary A has an external borrowing of US$300 million. The net assets of Subsidiary A at the start of the reporting period are ¥400,000 million including the proceeds of the external borrowing of US$300 million.

AG4

The hedged item can be an amount of net assets equal to or less than the carrying amount of Parent’s net investment in Subsidiary C (US$300 million) in its consolidated financial statements. In its consolidated financial statements Parent can designate the US$300 million external borrowing in Subsidiary A as a hedge of the EUR/USD spot foreign exchange risk associated with its net investment in the US$300 million net assets of Subsidiary C. In this case, both the EUR/USD foreign exchange difference on the US$300 million external borrowing in Subsidiary A and the EUR/USD foreign exchange difference on the US$300 million net investment in Subsidiary C are included in the foreign currency translation reserve in Parent’s consolidated financial statements after the application of hedge accounting.

AG5

In the absence of hedge accounting, the total USD/EUR foreign exchange difference on the US$300 million external borrowing in Subsidiary A would be recognised in Parent’s consolidated financial statements as follows:

• USD/JPY spot foreign exchange rate change, translated to euro, in profit or loss, and

• JPY/EUR spot foreign exchange rate change in other comprehensive income.

Instead of the designation in paragraph AG4, in its consolidated financial statements Parent can designate the US$300 million external borrowing in Subsidiary A as a hedge of the GBP/USD spot foreign exchange risk between Subsidiary C and Subsidiary B. In this case, the total USD/EUR foreign exchange difference on the US$300 million external borrowing in Subsidiary A would instead be recognised in Parent’s consolidated financial statements as follows:

• the GBP/USD spot foreign exchange rate change in the foreign currency translation reserve relating to Subsidiary C,

• GBP/JPY spot foreign exchange rate change, translated to euro, in profit or loss, and

• JPY/EUR spot foreign exchange rate change in other comprehensive income.

AG6

Parent cannot designate the US$300 million external borrowing in Subsidiary A as a hedge of both the EUR/USD spot foreign exchange risk and the GBP/USD spot foreign exchange risk in its consolidated financial statements. A single hedging instrument can hedge the same designated risk only once. Subsidiary B cannot apply hedge accounting in its consolidated financial statements because the hedging instrument is held outside the group comprising Subsidiary B and Subsidiary C.

Where in a group can the hedging instrument be held (paragraphs 14 and 15)?

AG7

As noted in paragraph AG5, the total change in value in respect of foreign exchange risk of the US$300 million external borrowing in Subsidiary A would be recorded in both profit or loss (USD/JPY spot risk) and other comprehensive income (EUR/JPY spot risk) in Parent’s consolidated financial statements in the absence of hedge accounting. Both amounts are included for the purpose of assessing the effectiveness of the hedge designated in paragraph AG4 because the change in value of both the hedging instrument and the hedged item are computed by reference to the euro functional currency of Parent against the US dollar functional currency of Subsidiary C, in accordance with the hedge documentation. The method of consolidation (ie direct method or step-by-step method) does not affect the assessment of the effectiveness of the hedge.

Amounts reclassified to profit or loss on disposal of a foreign operation (paragraphs 16 and 17)

AG8

When Subsidiary C is disposed of, the amounts reclassified to profit or loss in Parent’s consolidated financial statements from its foreign currency translation reserve (FCTR) are:

(a) in respect of the US$300 million external borrowing of Subsidiary A, the amount that AASB 9 requires to be identified, ie the total change in value in respect of foreign exchange risk that was recognised in other comprehensive income as the effective portion of the hedge; and

(b) in respect of the US$300 million net investment in Subsidiary C, the amount determined by the entity’s consolidation method. If Parent uses the direct method, its FCTR in respect of Subsidiary C will be determined directly by the EUR/USD foreign exchange rate. If Parent uses the step-by-step method, its FCTR in respect of Subsidiary C will be determined by the FCTR recognised by Subsidiary B reflecting the GBP/USD foreign exchange rate, translated to Parent’s functional currency using the EUR/GBP foreign exchange rate. Parent’s use of the step-by-step method of consolidation in prior periods does not require it to or preclude it from determining the amount of FCTR to be reclassified when it disposes of Subsidiary C to be the amount that it would have recognised if it had always used the direct method, depending on its accounting policy.

Hedging more than one foreign operation (paragraphs 11, 13 and 15)

AG9

The following examples illustrate that in the consolidated financial statements of Parent, the risk that can be hedged is always the risk between its functional currency (euro) and the functional currencies of Subsidiaries B and C. No matter how the hedges are designated, the maximum amounts that can be effective hedges to be included in the foreign currency translation reserve in Parent’s consolidated financial statements when both foreign operations are hedged are US$300 million for EUR/USD risk and £341 million for EUR/GBP risk. Other changes in value due to changes in foreign exchange rates are included in Parent’s consolidated profit or loss. Of course, it would be possible for Parent to designate US$300 million only for changes in the USD/GBP spot foreign exchange rate or £500 million only for changes in the GBP/EUR spot foreign exchange rate.

Parent holds both USD and GBP hedging instruments

AG10

Parent may wish to hedge the foreign exchange risk in relation to its net investment in Subsidiary B as well as that in relation to Subsidiary C. Assume that Parent holds suitable hedging instruments denominated in US dollars and pounds sterling that it could designate as hedges of its net investments in Subsidiary B and Subsidiary C. The designations Parent can make in its consolidated financial statements include, but are not limited to, the following:

(a) US$300 million hedging instrument designated as a hedge of the US$300 million of net investment in Subsidiary C with the risk being the spot foreign exchange exposure (EUR/USD) between Parent and Subsidiary C and up to £341 million hedging instrument designated as a hedge of £341 million of the net investment in Subsidiary B with the risk being the spot foreign exchange exposure (EUR/GBP) between Parent and Subsidiary B.

(b) US$300 million hedging instrument designated as a hedge of the US$300 million of net investment in Subsidiary C with the risk being the spot foreign exchange exposure (GBP/USD) between Subsidiary B and Subsidiary C and up to £500 million hedging instrument designated as a hedge of £500 million of the net investment in Subsidiary B with the risk being the spot foreign exchange exposure (EUR/GBP) between Parent and Subsidiary B.

AG11

The EUR/USD risk from Parent’s net investment in Subsidiary C is a different risk from the EUR/GBP risk from Parent’s net investment in Subsidiary B. However, in the case described in paragraph AG10(a), by its designation of the USD hedging instrument it holds, Parent has already fully hedged the EUR/USD risk from its net investment in Subsidiary C. If Parent also designated a GBP instrument it holds as a hedge of its £500 million net investment in Subsidiary B, £159 million of that net investment, representing the GBP equivalent of its USD net investment in Subsidiary C, would be hedged twice for GBP/EUR risk in Parent’s consolidated financial statements.

AG12

In the case described in paragraph AG10(b), if Parent designates the hedged risk as the spot foreign exchange exposure (GBP/USD) between Subsidiary B and Subsidiary C, only the GBP/USD part of the change in the value of its US$300 million hedging instrument is included in Parent’s foreign currency translation reserve relating to Subsidiary C. The remainder of the change (equivalent to the GBP/EUR change on £159 million) is included in Parent’s consolidated profit or loss, as in paragraph AG5. Because the designation of the USD/GBP risk between Subsidiaries B and C does not include the GBP/EUR risk, Parent is also able to designate up to £500 million of its net investment in Subsidiary B with the risk being the spot foreign exchange exposure (GBP/EUR) between Parent and Subsidiary B.

Subsidiary B holds the USD hedging instrument

AG13

Assume that Subsidiary B holds US$300 million of external debt the proceeds of which were transferred to Parent by an inter-company loan denominated in pounds sterling. Because both its assets and liabilities increased by £159 million, Subsidiary B’s net assets are unchanged. Subsidiary B could designate the external debt as a hedge of the GBP/USD risk of its net investment in Subsidiary C in its consolidated financial statements. Parent could maintain Subsidiary B’s designation of that hedging instrument as a hedge of its US$300 million net investment in Subsidiary C for the GBP/USD risk (see paragraph 13) and Parent could designate the GBP hedging instrument it holds as a hedge of its entire £500 million net investment in Subsidiary B. The first hedge, designated by Subsidiary B, would be assessed by reference to Subsidiary B’s functional currency (pounds sterling) and the second hedge, designated by Parent, would be assessed by reference to Parent’s functional currency (euro). In this case, only the GBP/USD risk from Parent’s net investment in Subsidiary C has been hedged in Parent’s consolidated financial statements by the USD hedging instrument, not the entire EUR/USD risk. Therefore, the entire EUR/GBP risk from Parent’s £500 million net investment in Subsidiary B may be hedged in the consolidated financial statements of Parent.

AG14

However, the accounting for Parent’s £159 million loan payable to Subsidiary B must also be considered. If Parent’s loan payable is not considered part of its net investment in Subsidiary B because it does not satisfy the conditions in AASB 121 paragraph 15, the GBP/EUR foreign exchange difference arising on translating it would be included in Parent’s consolidated profit or loss. If the £159 million loan payable to Subsidiary B is considered part of Parent’s net investment, that net investment would be only £341 million and the amount Parent could designate as the hedged item for GBP/EUR risk would be reduced from £500 million to £341 million accordingly.

AG15

If Parent reversed the hedging relationship designated by Subsidiary B, Parent could designate the US$300 million external borrowing held by Subsidiary B as a hedge of its US$300 million net investment in Subsidiary C for the EUR/USD risk and designate the GBP hedging instrument it holds itself as a hedge of only up to £341 million of the net investment in Subsidiary B. In this case the effectiveness of both hedges would be computed by reference to Parent’s functional currency (euro). Consequently, both the USD/GBP change in value of the external borrowing held by Subsidiary B and the GBP/EUR change in value of Parent’s loan payable to Subsidiary B (equivalent to USD/EUR in total) would be included in the foreign currency translation reserve in Parent’s consolidated financial statements. Because Parent has already fully hedged the EUR/USD risk from its net investment in Subsidiary C, it can hedge only up to £341 million for the EUR/GBP risk of its net investment in Subsidiary B.

Illustrative example

This example accompanies, but is not part of, AASB Interpretation 16.

Disposal of a foreign operation (paragraphs 16 and 17)

IE1

This example illustrates the application of paragraphs 16 and 17 in connection with the reclassification adjustment on the disposal of a foreign operation.

Background

IE2

This example assumes the group structure set out in the application guidance and that Parent used a USD borrowing in Subsidiary A to hedge the EUR/USD risk of the net investment in Subsidiary C in Parent’s consolidated financial statements. Parent uses the step-by-step method of consolidation. Assume the hedge was fully effective and the full USD/EUR accumulated change in the value of the hedging instrument before disposal of Subsidiary C is €24 million (gain). This is matched exactly by the fall in value of the net investment in Subsidiary C, when measured against the functional currency of Parent (euro).

IE3

If the direct method of consolidation is used, the fall in the value of Parent’s net investment in Subsidiary C of €24 million would be reflected totally in the foreign currency translation reserve relating to Subsidiary C in Parent’s consolidated financial statements. However, because Parent uses the step-by-step method, this fall in the net investment value in Subsidiary C of €24 million would be reflected both in Subsidiary B’s foreign currency translation reserve relating to Subsidiary C and in Parent’s foreign currency translation reserve relating to Subsidiary B.

IE4

The aggregate amount recognised in the foreign currency translation reserve in respect of Subsidiaries B and C is not affected by the consolidation method. Assume that using the direct method of consolidation, the foreign currency translation reserves for Subsidiaries B and C in Parent’s consolidated financial statements are €62 million gain and €24 million loss respectively; using the step-by-step method of consolidation those amounts are €49 million gain and €11 million loss respectively.

Reclassification

IE5

When the investment in Subsidiary C is disposed of, AASB 9 requires the full €24 million gain on the hedging instrument to be reclassified to profit or loss. Using the step-by-step method, the amount to be reclassified to profit or loss in respect of the net investment in Subsidiary C would be only €11 million loss. Parent could adjust the foreign currency translation reserves of both Subsidiaries B and C by €13 million in order to match the amounts reclassified in respect of the hedging instrument and the net investment as would have been the case if the direct method of consolidation had been used, if that was its accounting policy. An entity that had not hedged its net investment could make the same reclassification.

Compilation details

AASB Interpretation 16 Hedges of a Net Investment in a Foreign Operation (as amended)

This compiled Interpretation applies to annual periods beginning on or after 1 January 2020. It takes into account amendments up to and including 21 May 2019 and was prepared on 2 March 2020 by the staff of the Australian Accounting Standards Board (AASB).

This compilation is not a separate Interpretation issued by the AASB. Instead, it is a representation of Interpretation 16 (August 2015) as amended by other pronouncements, which are listed in the table below.

Table of pronouncements

Table of amendments

Basis for Conclusions on IFRIC 16

IFRIC 16 Hedges of a Net Investment in a Foreign Operation

This Basis for Conclusions accompanies, but is not part of, AASB Interpretation 16. An IFRIC Basis for Conclusions may be amended to reflect any additional requirements in the AASB Interpretation or AASB Accounting Standards.

Introduction

BC1

This Basis for Conclusions summarises the IFRIC’s considerations in reaching its consensus. Individual IFRIC members gave greater weight to some factors than to others.

Background

BC2

The IFRIC was asked for guidance on accounting for the hedge of a net investment in a foreign operation in the consolidated financial statements. Interested parties had different views of the risks eligible for hedge accounting purposes. One issue is whether the risk arises from the foreign currency exposure to the functional currencies of the foreign operation and the parent entity, or whether it arises from the foreign currency exposure to the functional currency of the foreign operation and the presentation currency of the parent entity’s consolidated financial statements.

BC3

Concern was also raised about which entity within a group could hold a hedging instrument in a hedge of a net investment in a foreign operation and in particular whether the parent entity holding the net investment in a foreign operation must also hold the hedging instrument.

BC4

Accordingly, the IFRIC decided to develop guidance on the accounting for a hedge of the foreign currency risk arising from a net investment in a foreign operation.

BC5

The IFRIC published draft Interpretation D22 Hedges of a Net Investment in a Foreign Operation for public comment in July 2007 and received 45 comment letters in response to its proposals.

Consensus

Hedged risk and hedged item

Functional currency versus presentation currency (paragraph 10)

BC6

The IFRIC received a submission suggesting that the method of consolidation can affect the determination of the hedged risk in a hedge of a net investment in a foreign operation. The submission noted that consolidation can be completed by either the direct method or the step-by-step method. In the direct method of consolidation, each entity within a group is consolidated directly into the ultimate parent entity’s presentation currency when preparing the consolidated financial statements. In the step-by-step method, each intermediate parent entity prepares consolidated financial statements, which are then consolidated into its parent entity until the ultimate parent entity has prepared consolidated financial statements.

BC6

The IFRIC received a submission suggesting that the method of consolidation can affect the determination of the hedged risk in a hedge of a net investment in a foreign operation. The submission noted that consolidation can be completed by either the direct method or the step-by-step method. In the direct method of consolidation, each entity within a group is consolidated directly into the ultimate parent entity’s presentation currency when preparing the consolidated financial statements. In the step-by-step method, each intermediate parent entity prepares consolidated financial statements, which are then consolidated into its parent entity until the ultimate parent entity has prepared consolidated financial statements.

BC7

The submission stated that if the direct method was required, the risk that qualifies for hedge accounting in a hedge of a net investment in a foreign operation would arise only from exposure between the functional currency of the foreign operation and the presentation currency of the group. This is because each foreign operation is translated only once into the presentation currency. In contrast, the submission stated that if the step-by-step method was required, the hedged risk that qualifies for hedge accounting is the risk between the functional currencies of the foreign operation and the immediate parent entity into which the entity was consolidated. This is because each foreign operation is consolidated directly into its immediate parent entity.

BC8

In response to this, the IFRIC noted that IAS 21 The Effects of Changes in Foreign Exchange Rates does not specify a method of consolidation for foreign operations. Furthermore, paragraph BC18 of the Basis for Conclusions on IAS 21 states that the method of translating financial statements will result in the same amounts in the presentation currency regardless of whether the direct method or the step-by-step method is used. The IFRIC therefore concluded that the consolidation mechanism should not determine what risk qualifies for hedge accounting in the hedge of a net investment in a foreign operation.

BC9

However, the IFRIC noted that its conclusion would not resolve the divergence of views on the foreign currency risk that may be designated as a hedge relationship in the hedge of a net investment in a foreign operation. The IFRIC therefore decided that an Interpretation was needed.

BC10

The IFRIC considered whether the risk that qualifies for hedge accounting in a hedge of a net investment in a foreign operation arises from the exposure to the functional currency of the foreign operation in relation to the presentation currency of the group or the functional currency of the parent entity, or both.

BC11

The answer to this question is important when the presentation currency of the group is different from an intermediate or ultimate parent entity’s functional currency. If the presentation currency of the group and the functional currency of the parent entity are the same, the exchange rate being hedged would be identified as that between the parent entity’s functional currency and the foreign operation’s functional currency. No further translation adjustment would be required to prepare the consolidated financial statements. However, when the functional currency of the parent entity is different from the presentation currency of the group, a translation adjustment will be included in other comprehensive income to present the consolidated financial statements in a different presentation currency. The issue, therefore, is how to determine which foreign currency risk may be designated as the hedged risk in accordance with IAS 39 Financial Instruments: Recognition and Measurement[1] in the hedge of a net investment in a foreign operation.

IFRS 9 Financial Instruments replaced the hedge accounting requirements in IAS 39. However, the requirements regarding hedges of a net investment in a foreign operation were retained from IAS 39 and relocated to IFRS 9.

BC12

The IFRIC noted the following arguments for permitting hedge accounting for a hedge of the presentation currency:

(a) If the presentation currency of the group is different from the ultimate parent entity’s functional currency, a difference arises on translation that is recognised in other comprehensive income. It is argued that a reason for allowing hedge accounting for a net investment in a foreign operation is to remove from the financial statements the fluctuations resulting from the translation to a presentation currency. If an entity is not allowed to use hedge accounting for the exposure to the presentation currency of the group when it is different from the functional currency of the parent entity, there is likely to be an amount included in other comprehensive income that cannot be offset by hedge accounting.

(b) IAS 21 requires an entity to reclassify from equity to profit or loss as a reclassification adjustment any foreign currency translation gains and losses included in other comprehensive income on disposal of a foreign operation. An amount in other comprehensive income arising from a different presentation currency is therefore included in the amount reclassified to profit or loss on disposal. The entity should be able to include the amount in a hedging relationship if at some stage it is recognised along with other reclassified translation amounts.

BC13

The IFRIC noted the following arguments for allowing an entity to designate hedging relationships solely on the basis of differences between functional currencies:

(a) The functional currency of an entity is determined on the basis of the primary economic environment in which that entity operates (ie the environment in which it generates and expends cash). However, the presentation currency is an elective currency that can be changed at any time. To present amounts in a presentation currency is merely a numerical convention necessary for the preparation of financial statements that include a foreign operation. The presentation currency will have no economic effect on the parent entity. Indeed, a parent entity may choose to present financial statements in more than one presentation currency, but can have only one functional currency.

(b) IAS 39 requires a hedging relationship to be effective in offsetting changes in fair values or cash flows attributable to the hedged risk. A net investment in a foreign operation gives rise to an exposure to changes in exchange rate risk for a parent entity. An economic exchange rate risk arises only from an exposure between two or more functional currencies, not from a presentation currency.

BC14

When comparing the arguments in paragraphs BC12 and BC13, the IFRIC concluded that the presentation currency does not create an exposure to which an entity may apply hedge accounting. The functional currency is determined on the basis of the primary economic environment in which the entity operates. Accordingly, functional currencies create an economic exposure to changes in cash flows or fair values; a presentation currency never will. No commentators on the draft Interpretation disagreed with the IFRIC’s conclusion.

Eligible risk (paragraph 12)

BC15

The IFRIC considered which entity’s (or entities’) functional currency may be used as a reference point for the hedged risk in a net investment hedge. Does the risk arise from the functional currency of:

(a) the immediate parent entity that holds directly the foreign operation;

(b) the ultimate parent entity that is preparing its financial statements; or

(c) the immediate, an intermediate or the ultimate parent entity, depending on what risk that entity decides to hedge, as designated at the inception of the hedge?

BC15

The IFRIC considered which entity’s (or entities’) functional currency may be used as a reference point for the hedged risk in a net investment hedge. Does the risk arise from the functional currency of:

(a) the immediate parent entity that holds directly the foreign operation;

(b) the ultimate parent entity that is preparing its financial statements; or

(c) the immediate, an intermediate or the ultimate parent entity, depending on what risk that entity decides to hedge, as designated at the inception of the hedge?

BC16

The IFRIC concluded that the risk from the exposure to a different functional currency arises for any parent entity whose functional currency is different from that of the identified foreign operation. The immediate parent entity is exposed to changes in the exchange rate of its directly held foreign operation’s functional currency. However, indirectly every entity up the chain of entities to the ultimate parent entity is also exposed to changes in the exchange rate of the foreign operation’s functional currency.

BC17

Permitting only the ultimate parent entity to hedge its net investments would ignore the exposures arising on net investments in other parts of the entity. Conversely, permitting only the immediate parent entity to undertake a net investment hedge would imply that an indirect investment does not create a foreign currency exposure for that indirect parent entity.

BC18

The IFRIC concluded that a group must identify which risk (ie the functional currency of which parent entity and of which net investment in a foreign operation) is being hedged. The specified parent entity, the hedged risk and hedging instrument should all be designated and documented at the inception of the hedge relationship. As a result of comments received on the draft Interpretation, the IFRIC decided to emphasise that this documentation should also include the entity’s strategy in undertaking the hedge as required by IAS 39.

Amount of hedged item that may be hedged (paragraphs 11 and 13)

BC19

In the draft Interpretation the IFRIC noted that, in financial statements that include a foreign operation, an entity cannot hedge the same risk more than once. This comment was intended to remind entities that IAS 39 does not permit multiple hedges of the same risk. Some respondents asked the IFRIC to clarify the situations in which the IFRIC considered that the same risk was being hedged more than once. In particular, the IFRIC was asked whether the same risk could be hedged by different entities within a group as long as the amount of risk being hedged was not duplicated.

BC19

In the draft Interpretation the IFRIC noted that, in financial statements that include a foreign operation, an entity cannot hedge the same risk more than once. This comment was intended to remind entities that IAS 39 does not permit multiple hedges of the same risk. Some respondents asked the IFRIC to clarify the situations in which the IFRIC considered that the same risk was being hedged more than once. In particular, the IFRIC was asked whether the same risk could be hedged by different entities within a group as long as the amount of risk being hedged was not duplicated.

BC20

In its redeliberations, the IFRIC decided to clarify that the carrying amount of the net assets of a foreign operation that may be hedged in the consolidated financial statements of a parent depends on whether any lower level parent of the foreign operation has hedged all or part of the net assets of that foreign operation and that accounting has been maintained in the parent’s consolidated financial statements. An intermediate parent entity can hedge some or all of the risk of its net investment in a foreign operation in its own consolidated financial statements. However, such hedges will not qualify for hedge accounting at the ultimate parent entity level if the ultimate parent entity has also hedged the same risk. Alternatively, if the risk has not been hedged by the ultimate parent entity or another intermediate parent entity, the hedge relationship that qualified in the immediate parent entity’s consolidated financial statements will also qualify in the ultimate parent entity’s consolidated financial statements.

BC21

In its redeliberations, the IFRIC also decided to add guidance to the Interpretation to illustrate the importance of careful designation of the amount of the risk being hedged by each entity in the group.

Hedging instrument

Location of the hedging instrument (paragraph 14) and assessment of hedge effectiveness (paragraph 15)

BC22

The IFRIC discussed where in a group structure a hedging instrument may be held in a hedge of a net investment in a foreign operation. Guidance on the hedge of a net investment in a foreign operation was originally included in IAS 21. This guidance was moved to IAS 39 to ensure that the hedge accounting guidance included in paragraph 88 of IAS 39 would also apply to the hedges of net investments in foreign operations.

BC22

The IFRIC discussed where in a group structure a hedging instrument may be held in a hedge of a net investment in a foreign operation. Guidance on the hedge of a net investment in a foreign operation was originally included in IAS 21. This guidance was moved to IAS 39 to ensure that the hedge accounting guidance included in paragraph 88 of IAS 39 would also apply to the hedges of net investments in foreign operations.

BC23

The IFRIC concluded that any entity within the group, other than the foreign operation being hedged, may hold the hedging instrument, as long as the hedging instrument is effective in offsetting the risk arising from the exposure to the functional currency of the foreign operation and the functional currency of the specified parent entity. The functional currency of the entity holding the instrument is irrelevant in determining effectiveness.

BC24

The IFRIC concluded that the foreign operation being hedged could not hold the hedging instrument because that instrument would be part of, and denominated in the same currency as, the net investment it was intended to hedge. In this circumstance, hedge accounting is unnecessary. The foreign exchange differences between the parent’s functional currency and both the hedging instrument and the functional currency of the net investment will automatically be included in the group’s foreign currency translation reserve as part of the consolidation process. The balance of the discussion in this Basis for Conclusions does not repeat this restriction.[2]

Paragraph BC24 was deleted and paragraphs BC24A–BC24D and paragraph BC40A added as a consequence of Improvements to IFRSs issued in April 2009.

BC24A

Paragraph 14 of IFRIC 16 originally stated that the hedging instrument could not be held by the foreign operation whose net investment was being hedged. The restriction was included in draft Interpretation D22 (from which IFRIC 16 was developed) and attracted little comment from respondents. As originally explained in paragraph BC24, the IFRIC concluded, as part of its redeliberations, that the restriction was appropriate because the foreign exchange differences between the parent’s functional currency and both the hedging instrument and the functional currency of the net investment would automatically be included in the group’s foreign currency translation reserve as part of the consolidation process.

BC24B

After IFRIC 16 was issued, it was brought to the attention of the International Accounting Standards Board that this conclusion was not correct. Without hedge accounting, part of the foreign exchange difference arising from the hedging instrument would be included in consolidated profit or loss. Therefore, in Improvements to IFRSs issued in April 2009, the Board amended paragraph 14 of IFRIC 16 to remove the restriction on the entity that can hold hedging instruments and deleted paragraph BC24.

BC24C

Some respondents to the exposure draft Post-implementation Revisions to IFRIC Interpretations (ED/2009/1) agreed that a parent entity should be able to use a derivative held by the foreign operation being hedged as a hedge of the net investment in that foreign operation. However, those respondents recommended that the amendment should apply only to derivative instruments held by the foreign operation being hedged. They asserted that a non-derivative financial instrument would be an effective hedge of the net investment only if it were issued by the foreign operation in its own functional currency and this would have no foreign currency impact on the profit or loss of the consolidated group. Consequently, they thought that the rationale described in paragraph BC24B to support the amendment did not apply to non-derivative instruments.

BC24D

In its redeliberations, the Board confirmed its previous decision that the amendment should not be restricted to derivative instruments. The Board noted that paragraphs AG13–AG15 of IFRIC 16 illustrate that a non-derivative instrument held by the foreign operation does not need to be considered to be part of the parent’s net investment. As a result, even if it is denominated in the foreign operation’s functional currency a non-derivative instrument could still affect the profit or loss of the consolidated group. Consequently, although it could be argued that the amendment was not required to permit non-derivative instruments to be designated as hedges, the Board decided that the proposal should not be changed.

BC25

The IFRIC also concluded that to apply the conclusion in paragraph BC23 when determining the effectiveness of a hedging instrument in the hedge of a net investment, an entity computes the gain or loss on the hedging instrument by reference to the functional currency of the parent entity against whose functional currency the hedged risk is measured, in accordance with the hedge documentation. This is the same regardless of the type of hedging instrument used. This ensures that the effectiveness of the instrument is determined on the basis of changes in fair value or cash flows of the hedging instrument, compared with the changes in the net investment as documented. Thus, any effectiveness test is not dependent on the functional currency of the entity holding the instrument. In other words, the fact that some of the change in the hedging instrument is recognised in profit or loss by one entity within the group and some is recognised in other comprehensive income by another does not affect the assessment of hedge effectiveness.

BC26

In the draft Interpretation the IFRIC noted Question F.2.14 in the guidance on implementing IAS 39, on the location of the hedging instrument, and considered whether that guidance could be applied by analogy to a net investment hedge. The answer to Question F.2.14 concludes:

IAS 39 does not require that the operating unit that is exposed to the risk being hedged be a party to the hedging instrument.

This was the only basis for the IFRIC’s conclusion regarding which entity could hold the hedging instrument provided in the draft Interpretation. Some respondents argued that the Interpretation should not refer to implementation guidance as the sole basis for an important conclusion.[3]

IFRS 9 replaced IAS 39.

BC27

In its redeliberations, the IFRIC considered both the International Accounting Standards Board’s amendment to IAS 21 in 2005 and the objective of hedging a net investment described in IAS 39 in addition to the guidance on implementing IAS 39.

BC28

In 2005 the Board was asked to clarify which entity is the reporting entity in IAS 21 and therefore what instruments could be considered part of a reporting entity’s net investment in a foreign operation. In particular, constituents questioned whether a monetary item must be transacted between the foreign operation and the reporting entity to be considered part of the net investment in accordance with IAS 21 paragraph 15, or whether it could be transacted between the foreign operation and any member of the consolidated group.

BC29

In response the Board added IAS 21 paragraph 15A to clarify that ‘The entity that has a monetary item receivable from or payable to a foreign operation described in paragraph 15 may be any subsidiary of the group.’ The Board explained its reasons for the amendment in paragraph BC25D of the Basis for Conclusions:

The Board concluded that the accounting treatment in the consolidated financial statements should not be dependent on the currency in which the monetary item is denominated, nor on which entity within the group conducts the transaction with the foreign operation.

In other words, the Board concluded that the relevant reporting entity is the group rather than the individual entity and that the net investment must be viewed from the perspective of the group. It follows, therefore, that the group’s net investment in any foreign operation, and its foreign currency exposure, can be determined only at the relevant parent entity level. The IFRIC similarly concluded that the fact that the net investment is held through an intermediate entity does not affect the economic risk.

BC30

Consistently with the Board’s conclusion with respect to monetary items that are part of the net investment, the IFRIC concluded that monetary items (or derivatives) that are hedging instruments in a hedge of a net investment may be held by any entity within the group and the functional currency of the entity holding the monetary items can be different from those of either the parent or the foreign operation. The IFRIC, like the Board, agreed with constituents who noted that a hedging item denominated in a currency that is not the functional currency of the entity holding it does not expose the group to a greater foreign currency exchange difference than arises when the instrument is denominated in that functional currency.

BC31

The IFRIC noted that its conclusions that the hedging instrument can be held by any entity in the group and that the foreign currency is determined at the relevant parent entity level have implications for the designation of hedged risks. As illustrated in paragraph AG5 of the application guidance, these conclusions make it possible for an entity to designate a hedged risk that is not apparent in the currencies of the hedged item or the foreign operation. This possibility is unique to hedges of net investments. Consequently, the IFRIC specified that the conclusions in the Interpretation should not be applied by analogy to other types of hedge accounting.

BC32

The IFRIC also noted that the objective of hedge accounting as set out in IAS 39 is to achieve offsetting changes in the values of the hedging instrument and of the net investment attributable to the hedged risk. Changes in foreign currency rates affect the value of the entire net investment in a foreign operation, not only the portion IAS 21 requires to be recognised in profit or loss in the absence of hedge accounting but also the portion recognised in other comprehensive income in the parent’s consolidated financial statements. As noted in paragraph BC25, it is the total change in the hedging instrument as result of a change in the foreign currency rate with respect to the parent entity against whose functional currency the hedged risk is measured that is relevant, not the component of comprehensive income in which it is recognised.

Reclassification from other comprehensive income to profit or loss (paragraphs 16 and 17)

BC33

In response to requests from some respondents for clarification, the IFRIC discussed what amounts from the parent entity’s foreign currency translation reserve in respect of both the hedging instrument and the foreign operation should be recognised in profit or loss in the parent entity’s consolidated financial statements when the parent disposes of a foreign operation that was hedged. The IFRIC noted that the amounts to be reclassified from equity to profit or loss as reclassification adjustments on the disposition are:

(a) the cumulative amount of gain or loss on a hedging instrument determined to be an effective hedge that has been reflected in other comprehensive income (IAS 39 paragraph 102), and

(b) the cumulative amount reflected in the foreign currency translation reserve in respect of that foreign operation (IAS 21 paragraph 48).

BC34

The IFRIC noted that when an entity hedges a net investment in a foreign operation, IAS 39 requires it to identify the cumulative amount included in the group’s foreign currency translation reserve as a result of applying hedge accounting, ie the amount determined to be an effective hedge. Therefore, the IFRIC concluded that when a foreign operation that was hedged is disposed of, the amount reclassified to profit or loss from the foreign currency translation reserve in respect of the hedging instrument in the consolidated financial statements of the parent should be the amount that IAS 39 requires to be identified.

Effect of consolidation method

BC35

Some respondents to the draft Interpretation argued that the method of consolidation creates a difference in the amounts included in the ultimate parent entity’s foreign currency translation reserve for individual foreign operations that are held through intermediate parents. These respondents noted that this difference may become evident only when the ultimate parent entity disposes of a second tier subsidiary (ie an indirect subsidiary).

BC36

The difference becomes apparent in the determination of the amount of the foreign currency translation reserve that is subsequently reclassified to profit or loss. An ultimate parent entity using the direct method of consolidation would reclassify the cumulative foreign currency translation reserve that arose between its functional currency and that of the foreign operation. An ultimate parent entity using the step-by-step method of consolidation might reclassify the cumulative foreign currency translation reserve reflected in the financial statements of the intermediate parent, ie the amount that arose between the functional currency of the foreign operation and that of the intermediate parent, translated into the functional currency of the ultimate parent.

BC37

In its redeliberations, the IFRIC noted that the use of the step-by-step method of consolidation does create such a difference for an individual foreign operation although the aggregate net amount of foreign currency translation reserve for all the foreign operations is the same under either method of consolidation. At the same time, the IFRIC noted that the method of consolidation should not create such a difference for an individual foreign operation, on the basis of its conclusion that the economic risk is determined in relation to the ultimate parent’s functional currency.

BC38

The IFRIC noted that the amount of foreign currency translation reserve for an individual foreign operation determined by the direct method of consolidation reflects the economic risk between the functional currency of the foreign operation and that of the ultimate parent (if the parent’s functional and presentation currencies are the same). However, the IFRIC noted that IAS 21 does not require an entity to use this method or to make adjustments to produce the same result. The IFRIC also noted that a parent entity is not precluded from determining the amount of the foreign currency translation reserve in respect of a foreign operation it has disposed of as if the direct method of consolidation had been used in order to reclassify the appropriate amount to profit or loss. However, it also noted that making such an adjustment on the disposal of a foreign operation is an accounting policy choice and should be followed consistently for the disposal of all net investments.

BC39

The IFRIC noted that this issue arises when the net investment disposed of was not hedged and therefore is not strictly within the scope of the Interpretation. However, because it was a topic of considerable confusion and debate, the IFRIC decided to include a brief example illustrating its conclusions.

Transition (paragraph 19)

BC40

In response to respondents’ comments, the IFRIC clarified the Interpretation’s transitional requirements. The IFRIC decided that entities should apply the conclusions in this Interpretation to existing hedging relationships on adoption and cease hedge accounting for those that no longer qualify. However, previous hedge accounting is not affected. This is similar to the transition requirements in IFRS 1 First-time Adoption of International Financial Reporting Standards paragraph 30,[4] for relationships accounted for as hedges under previous GAAP.

Paragraph B6 in the revised version of IFRS 1 issued in November 2008.

Effective date of amended paragraph 14

BC40A

The Board amended paragraph 14 in April 2009. In ED/2009/01 the Board proposed that the amendment should be effective for annual periods beginning on or after 1 October 2008, at the same time as IFRIC 16. Respondents to the exposure draft were concerned that permitting application before the amendment was issued might imply that an entity could designate hedge relationships retrospectively, contrary to the requirements of IAS 39. Consequently, the Board decided that an entity should apply the amendment to paragraph 14 made in April 2009 for annual periods beginning on or after 1 July 2009. The Board also decided to permit early application but noted that early application is possible only if the designation, documentation and effectiveness requirements of paragraph 88 of IAS 39 and of IFRIC 16 are satisfied at the application date.

Summary of main changes from the draft Interpretation

BC41

The main changes from the IFRIC’s proposals are as follows:

(a) Paragraph 11 clarifies that the carrying amount of the net assets of a foreign operation that may be hedged in the consolidated financial statements of a parent depends on whether any lower level parent of the foreign operation has hedged all or part of the net assets of that foreign operation and that accounting has been maintained in the parent’s consolidated financial statements.

(b) Paragraph 15 clarifies that the assessment of effectiveness is not affected by whether the hedging instrument is a derivative or a non-derivative instrument or by the method of consolidation.

(c) Paragraphs 16 and 17 and the illustrative example clarify what amounts should be reclassified from equity to profit or loss as reclassification adjustments on disposal of the foreign operation.

(d) Paragraph 19 clarifies transitional requirements.

(e) The appendix of application guidance was added to the Interpretation. Illustrative examples accompanying the draft Interpretation were removed.

(f) The Basis for Conclusions was changed to set out more clearly the reasons for the IFRIC’s conclusions.

Deleted IFRIC 16 text

Deleted IFRIC 16 text is not part of AASB Interpretation 16.

18

An entity shall apply this Interpretation for annual periods beginning on or after 1 October 2008. An entity shall apply the amendment to paragraph 14 made by Improvements to IFRSs issued in April 2009 for annual periods beginning on or after 1 July 2009. Earlier application of both is permitted. If an entity applies this Interpretation for a period beginning before 1 October 2008, or the amendment to paragraph 14 before 1 July 2009, it shall disclose that fact.