Appendix -- Application guidance

This appendix is an integral part of the Interpretation.

AG1

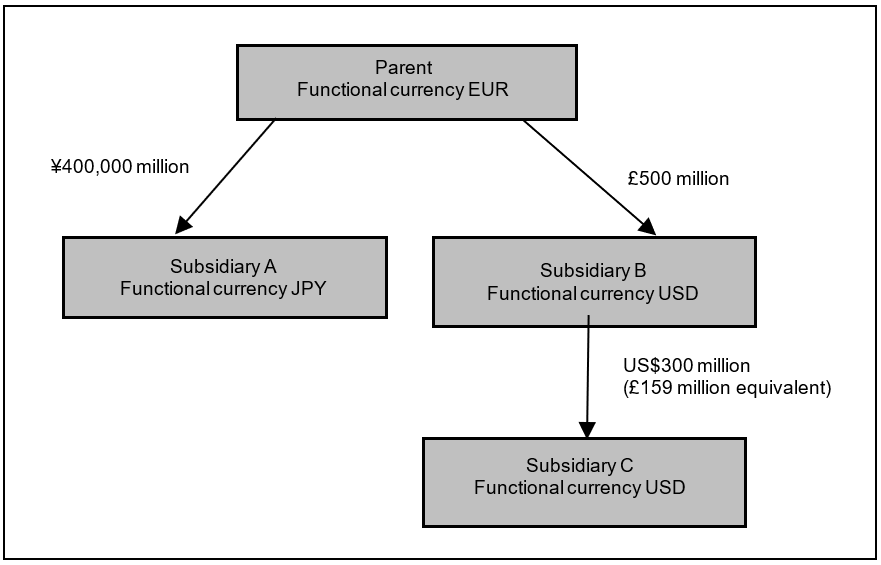

This appendix illustrates the application of the Interpretation using the corporate structure illustrated below. In all cases the hedging relationships described would be tested for effectiveness in accordance with AASB 9, although this testing is not discussed in this appendix. Parent, being the ultimate parent entity, presents its consolidated financial statements in its functional currency of euro (EUR). Each of the subsidiaries is wholly owned. Parent’s £500 million net investment in Subsidiary B (functional currency pounds sterling (GBP)) includes the £159 million equivalent of Subsidiary B’s US$300 million net investment in Subsidiary C (functional currency US dollars (USD)). In other words, Subsidiary B’s net assets other than its investment in Subsidiary C are £341 million.

Nature of hedged risk for which a hedging relationship may be designated (paragraphs 10–13)

AG2

Parent can hedge its net investment in each of Subsidiaries A, B and C for the foreign exchange risk between their respective functional currencies (Japanese yen (JPY), pounds sterling and US dollars) and euro. In addition, Parent can hedge the USD/GBP foreign exchange risk between the functional currencies of Subsidiary B and Subsidiary C. In its consolidated financial statements, Subsidiary B can hedge its net investment in Subsidiary C for the foreign exchange risk between their functional currencies of US dollars and pounds sterling. In the following examples the designated risk is the spot foreign exchange risk because the hedging instruments are not derivatives. If the hedging instruments were forward contracts, Parent could designate the forward foreign exchange risk.

Amount of hedged item for which a hedging relationship may be designated (paragraphs 10–13)

AG3

Parent wishes to hedge the foreign exchange risk from its net investment in Subsidiary C. Assume that Subsidiary A has an external borrowing of US$300 million. The net assets of Subsidiary A at the start of the reporting period are ¥400,000 million including the proceeds of the external borrowing of US$300 million.

AG4

The hedged item can be an amount of net assets equal to or less than the carrying amount of Parent’s net investment in Subsidiary C (US$300 million) in its consolidated financial statements. In its consolidated financial statements Parent can designate the US$300 million external borrowing in Subsidiary A as a hedge of the EUR/USD spot foreign exchange risk associated with its net investment in the US$300 million net assets of Subsidiary C. In this case, both the EUR/USD foreign exchange difference on the US$300 million external borrowing in Subsidiary A and the EUR/USD foreign exchange difference on the US$300 million net investment in Subsidiary C are included in the foreign currency translation reserve in Parent’s consolidated financial statements after the application of hedge accounting.

AG5

In the absence of hedge accounting, the total USD/EUR foreign exchange difference on the US$300 million external borrowing in Subsidiary A would be recognised in Parent’s consolidated financial statements as follows:

• USD/JPY spot foreign exchange rate change, translated to euro, in profit or loss, and

• JPY/EUR spot foreign exchange rate change in other comprehensive income.

Instead of the designation in paragraph AG4, in its consolidated financial statements Parent can designate the US$300 million external borrowing in Subsidiary A as a hedge of the GBP/USD spot foreign exchange risk between Subsidiary C and Subsidiary B. In this case, the total USD/EUR foreign exchange difference on the US$300 million external borrowing in Subsidiary A would instead be recognised in Parent’s consolidated financial statements as follows:

• the GBP/USD spot foreign exchange rate change in the foreign currency translation reserve relating to Subsidiary C,

• GBP/JPY spot foreign exchange rate change, translated to euro, in profit or loss, and

• JPY/EUR spot foreign exchange rate change in other comprehensive income.

AG6

Parent cannot designate the US$300 million external borrowing in Subsidiary A as a hedge of both the EUR/USD spot foreign exchange risk and the GBP/USD spot foreign exchange risk in its consolidated financial statements. A single hedging instrument can hedge the same designated risk only once. Subsidiary B cannot apply hedge accounting in its consolidated financial statements because the hedging instrument is held outside the group comprising Subsidiary B and Subsidiary C.

Where in a group can the hedging instrument be held (paragraphs 14 and 15)?

AG7

As noted in paragraph AG5, the total change in value in respect of foreign exchange risk of the US$300 million external borrowing in Subsidiary A would be recorded in both profit or loss (USD/JPY spot risk) and other comprehensive income (EUR/JPY spot risk) in Parent’s consolidated financial statements in the absence of hedge accounting. Both amounts are included for the purpose of assessing the effectiveness of the hedge designated in paragraph AG4 because the change in value of both the hedging instrument and the hedged item are computed by reference to the euro functional currency of Parent against the US dollar functional currency of Subsidiary C, in accordance with the hedge documentation. The method of consolidation (ie direct method or step-by-step method) does not affect the assessment of the effectiveness of the hedge.

Amounts reclassified to profit or loss on disposal of a foreign operation (paragraphs 16 and 17)

AG8

When Subsidiary C is disposed of, the amounts reclassified to profit or loss in Parent’s consolidated financial statements from its foreign currency translation reserve (FCTR) are:

(a) in respect of the US$300 million external borrowing of Subsidiary A, the amount that AASB 9 requires to be identified, ie the total change in value in respect of foreign exchange risk that was recognised in other comprehensive income as the effective portion of the hedge; and

(b) in respect of the US$300 million net investment in Subsidiary C, the amount determined by the entity’s consolidation method. If Parent uses the direct method, its FCTR in respect of Subsidiary C will be determined directly by the EUR/USD foreign exchange rate. If Parent uses the step-by-step method, its FCTR in respect of Subsidiary C will be determined by the FCTR recognised by Subsidiary B reflecting the GBP/USD foreign exchange rate, translated to Parent’s functional currency using the EUR/GBP foreign exchange rate. Parent’s use of the step-by-step method of consolidation in prior periods does not require it to or preclude it from determining the amount of FCTR to be reclassified when it disposes of Subsidiary C to be the amount that it would have recognised if it had always used the direct method, depending on its accounting policy.

Hedging more than one foreign operation (paragraphs 11, 13 and 15)

AG9

The following examples illustrate that in the consolidated financial statements of Parent, the risk that can be hedged is always the risk between its functional currency (euro) and the functional currencies of Subsidiaries B and C. No matter how the hedges are designated, the maximum amounts that can be effective hedges to be included in the foreign currency translation reserve in Parent’s consolidated financial statements when both foreign operations are hedged are US$300 million for EUR/USD risk and £341 million for EUR/GBP risk. Other changes in value due to changes in foreign exchange rates are included in Parent’s consolidated profit or loss. Of course, it would be possible for Parent to designate US$300 million only for changes in the USD/GBP spot foreign exchange rate or £500 million only for changes in the GBP/EUR spot foreign exchange rate.

Parent holds both USD and GBP hedging instruments

AG10

Parent may wish to hedge the foreign exchange risk in relation to its net investment in Subsidiary B as well as that in relation to Subsidiary C. Assume that Parent holds suitable hedging instruments denominated in US dollars and pounds sterling that it could designate as hedges of its net investments in Subsidiary B and Subsidiary C. The designations Parent can make in its consolidated financial statements include, but are not limited to, the following:

(a) US$300 million hedging instrument designated as a hedge of the US$300 million of net investment in Subsidiary C with the risk being the spot foreign exchange exposure (EUR/USD) between Parent and Subsidiary C and up to £341 million hedging instrument designated as a hedge of £341 million of the net investment in Subsidiary B with the risk being the spot foreign exchange exposure (EUR/GBP) between Parent and Subsidiary B.

(b) US$300 million hedging instrument designated as a hedge of the US$300 million of net investment in Subsidiary C with the risk being the spot foreign exchange exposure (GBP/USD) between Subsidiary B and Subsidiary C and up to £500 million hedging instrument designated as a hedge of £500 million of the net investment in Subsidiary B with the risk being the spot foreign exchange exposure (EUR/GBP) between Parent and Subsidiary B.

AG11

The EUR/USD risk from Parent’s net investment in Subsidiary C is a different risk from the EUR/GBP risk from Parent’s net investment in Subsidiary B. However, in the case described in paragraph AG10(a), by its designation of the USD hedging instrument it holds, Parent has already fully hedged the EUR/USD risk from its net investment in Subsidiary C. If Parent also designated a GBP instrument it holds as a hedge of its £500 million net investment in Subsidiary B, £159 million of that net investment, representing the GBP equivalent of its USD net investment in Subsidiary C, would be hedged twice for GBP/EUR risk in Parent’s consolidated financial statements.

AG12

In the case described in paragraph AG10(b), if Parent designates the hedged risk as the spot foreign exchange exposure (GBP/USD) between Subsidiary B and Subsidiary C, only the GBP/USD part of the change in the value of its US$300 million hedging instrument is included in Parent’s foreign currency translation reserve relating to Subsidiary C. The remainder of the change (equivalent to the GBP/EUR change on £159 million) is included in Parent’s consolidated profit or loss, as in paragraph AG5. Because the designation of the USD/GBP risk between Subsidiaries B and C does not include the GBP/EUR risk, Parent is also able to designate up to £500 million of its net investment in Subsidiary B with the risk being the spot foreign exchange exposure (GBP/EUR) between Parent and Subsidiary B.

Subsidiary B holds the USD hedging instrument

AG13

Assume that Subsidiary B holds US$300 million of external debt the proceeds of which were transferred to Parent by an inter-company loan denominated in pounds sterling. Because both its assets and liabilities increased by £159 million, Subsidiary B’s net assets are unchanged. Subsidiary B could designate the external debt as a hedge of the GBP/USD risk of its net investment in Subsidiary C in its consolidated financial statements. Parent could maintain Subsidiary B’s designation of that hedging instrument as a hedge of its US$300 million net investment in Subsidiary C for the GBP/USD risk (see paragraph 13) and Parent could designate the GBP hedging instrument it holds as a hedge of its entire £500 million net investment in Subsidiary B. The first hedge, designated by Subsidiary B, would be assessed by reference to Subsidiary B’s functional currency (pounds sterling) and the second hedge, designated by Parent, would be assessed by reference to Parent’s functional currency (euro). In this case, only the GBP/USD risk from Parent’s net investment in Subsidiary C has been hedged in Parent’s consolidated financial statements by the USD hedging instrument, not the entire EUR/USD risk. Therefore, the entire EUR/GBP risk from Parent’s £500 million net investment in Subsidiary B may be hedged in the consolidated financial statements of Parent.

AG14

However, the accounting for Parent’s £159 million loan payable to Subsidiary B must also be considered. If Parent’s loan payable is not considered part of its net investment in Subsidiary B because it does not satisfy the conditions in AASB 121 paragraph 15, the GBP/EUR foreign exchange difference arising on translating it would be included in Parent’s consolidated profit or loss. If the £159 million loan payable to Subsidiary B is considered part of Parent’s net investment, that net investment would be only £341 million and the amount Parent could designate as the hedged item for GBP/EUR risk would be reduced from £500 million to £341 million accordingly.

AG15

If Parent reversed the hedging relationship designated by Subsidiary B, Parent could designate the US$300 million external borrowing held by Subsidiary B as a hedge of its US$300 million net investment in Subsidiary C for the EUR/USD risk and designate the GBP hedging instrument it holds itself as a hedge of only up to £341 million of the net investment in Subsidiary B. In this case the effectiveness of both hedges would be computed by reference to Parent’s functional currency (euro). Consequently, both the USD/GBP change in value of the external borrowing held by Subsidiary B and the GBP/EUR change in value of Parent’s loan payable to Subsidiary B (equivalent to USD/EUR in total) would be included in the foreign currency translation reserve in Parent’s consolidated financial statements. Because Parent has already fully hedged the EUR/USD risk from its net investment in Subsidiary C, it can hedge only up to £341 million for the EUR/GBP risk of its net investment in Subsidiary B.