The objective of this Standard is to prescribe the accounting for a service concession arrangement by a grantor that is a public sector entity.

Preamble

Pronouncement

This compiled Standard applies to annual reporting periods beginning on or after 1 July 2021. Earlier application is permitted. It incorporates relevant amendments made up to and including 21 June 2021.

Prepared on 17 August 2021 by the staff of the Australian Accounting Standards Board.

Compilation no. 4

Compilation date: 30 June 2021

Obtaining copies of Accounting Standards

Compiled versions of Standards, original Standards and amending Standards (see Compilation Details) are available on the AASB website: www.aasb.gov.au.

Australian Accounting Standards Board

PO Box 204

Collins Street West

Victoria 8007

AUSTRALIA

Phone: (03) 9617 7600

E-mail: [email protected]

Website: www.aasb.gov.au

Other enquiries

Phone: (03) 9617 7600

E-mail: [email protected]

Copyright

© Commonwealth of Australia 2021

Publication based on a Final IFAC Publication

This compiled AASB Standard is based on International Public Sector Accounting Standard IPSAS 32 Service Concession Arrangements: Grantor of the International Public Sector Accounting Standards Board (IPSASB), published by the International Federation of Accountants (IFAC) in April 2016, and is used with permission of IFAC.

Reproduction within Australia in English in unaltered form (retaining this notice) is permitted for personal and non-commercial use subject to the inclusion of an acknowledgment of the source. Requests and enquiries concerning reproduction and rights for commercial purposes should be addressed to The National Director, Australian Accounting Standards Board, PO Box 204, Collins Street West, Victoria 8007, Australia. The AASB acknowledges that IFAC is the owner of copyright in the IPSAS incorporated in this Australian Standard throughout the world.

All other existing rights in this material are reserved outside Australia. Further information and requests for authorisation to reproduce for commercial purposes outside Australia should be addressed to the International Federation of Accountants at [email protected].

Rubric

Australian Accounting Standard AASB 1059 Service Concession Arrangements: Grantors (as amended) is set out in paragraphs 1 – 29 and Appendices A – E. All the paragraphs have equal authority. Paragraphs in bold type state the main principles. Terms defined in Appendix A are in italics the first time they appear in the Standard. AASB 1059 is to be read in the context of other Australian Accounting Standards, including AASB 1048 Interpretation of Standards, which identifies the Australian Accounting Interpretations, and AASB 1057 Application of Australian Accounting Standards. In the absence of explicit guidance, AASB 108 Accounting Policies, Changes in Accounting Estimates and Errors provides a basis for selecting and applying accounting policies.

Comparison with international pronouncements

AASB 1059 Service Concession Arrangements: Grantors as amended applies to all public sector entities, irrespective of whether they are for-profit or not-for-profit entities.

AASB 1059 and IPSAS

AASB 1059 is based on IPSAS 32 Service Concession Arrangements: Grantor. However, public sector entities that comply with AASB 1059 may not be in compliance with IPSAS 32 because of differences between the Standards. The more significant differences include the following:

(a) AASB 1059 applies to public sector entities in both the for-profit and not-for-profit sectors, whereas IPSAS 32 applies only to not-for-profit public sector entities;

(b) AASB 1059 requires the grantor to initially measure a service concession asset provided by the operator at current replacement cost in accordance with the cost approach to fair value in AASB 13 Fair Value Measurement. IPSAS 32 specifies measurement at fair value generally;

(c) an existing asset of the grantor, including a previously unrecognised identifiable intangible asset or land under roads, that is reclassified as a service concession asset is measured at fair value (current replacement cost) at the date of reclassification under AASB 1059. IPSAS 32 does not permit such remeasurement or the recognition of previously unrecognised identifiable intangible assets or land under roads;

(d) AASB 1059 requires the grantor to recognise a financial liability where the grantor has a contractual obligation to pay cash to the operator for third-party usage of a service concession asset, with or without guaranteeing a minimum amount to the operator. IPSAS 32 refers to such an arrangement as a ‘shadow toll’ arrangement and requires the grantor to account for the payments as an expense when paid instead of recognising a financial liability at the commencement of the arrangement;

(e) AASB 1059 provides more guidance on the term ‘public service’ than IPSAS 32; and

(f) IPSAS 32 includes additional application guidance for other revenues. Other revenues relate to compensation by the operator to the grantor for access to the service concession asset by providing the grantor with a series of predetermined inflows of resources such as an upfront payment or a stream of payments (eg rent payments) and revenue-sharing provisions.

AASB 1059 and IFRS Standards

Public sector entities, including for-profit entities, that comply with AASB 1059 may not be in compliance with International Financial Reporting Standards issued by the International Accounting Standards Board (IASB). The IASB has issued an IFRIC Interpretation addressing the accounting by private sector operators of service concession arrangements but has not issued a pronouncement regarding the accounting by grantors.

AASB 1059 requires a grantor to initially measure a service concession asset at current replacement cost in accordance with the cost approach to fair value in AASB 13. However, AASB 13 and the corresponding IFRS 13 Fair Value Measurement do not specify which valuation technique to use. Instead IFRS 13 requires the use of valuation techniques that are appropriate in the circumstances and for which sufficient data are available to measure fair value, maximising the use of relevant observable inputs and minimising the use of unobservable inputs. Three widely used valuation techniques set out in IFRS 13 are the market approach, the cost approach and the income approach. The requirement of AASB 1059 to initially measure a service concession asset at current replacement cost in accordance with the cost approach may not be compliant with IFRS 13.

AASB 1059 requires a grantor to recognise an identifiable intangible asset as a service concession asset where the grantor controls the asset as set out in paragraph 5 or 6, even if the asset does not qualify for recognition under AASB 138/IAS 38 Intangible Assets. This Standard also permits revaluation of the asset in the absence of an active market.

AASB 15 Revenue from Contracts with Customers requires a licensor of intellectual property to recognise revenue from granting the licence using either the right-to-use or right-to-access methods, depending on the specific facts and circumstances. The general requirement in AASB 1059 to recognise revenue from granting a right to the operator over the term of the service concession arrangement on an appropriate basis may not be compliant with IFRS 15 Revenue from Contracts with Customers.

Consequently, a public sector grantor that is a for-profit entity may not be able to state that its financial statements comply with IFRS Standards.

Accounting Standard AASB 1059

The Australian Accounting Standards Board made Accounting Standard AASB 1059 Service Concession Arrangements: Grantors under section 334 of the Corporations Act 2001 on 14 July 2017.

This compiled version of AASB 1059 applies to annual periods beginning on or after 1 July 2021. It incorporates relevant amendments contained in other AASB Standards made by the AASB up to and including 21 June 2021 (see Compilation Details).

Objective

1

The objective of this Standard is to prescribe the accounting for a service concession arrangement by a grantor that is a public sector entity.

Scope (paragraphs B1-B3)

2

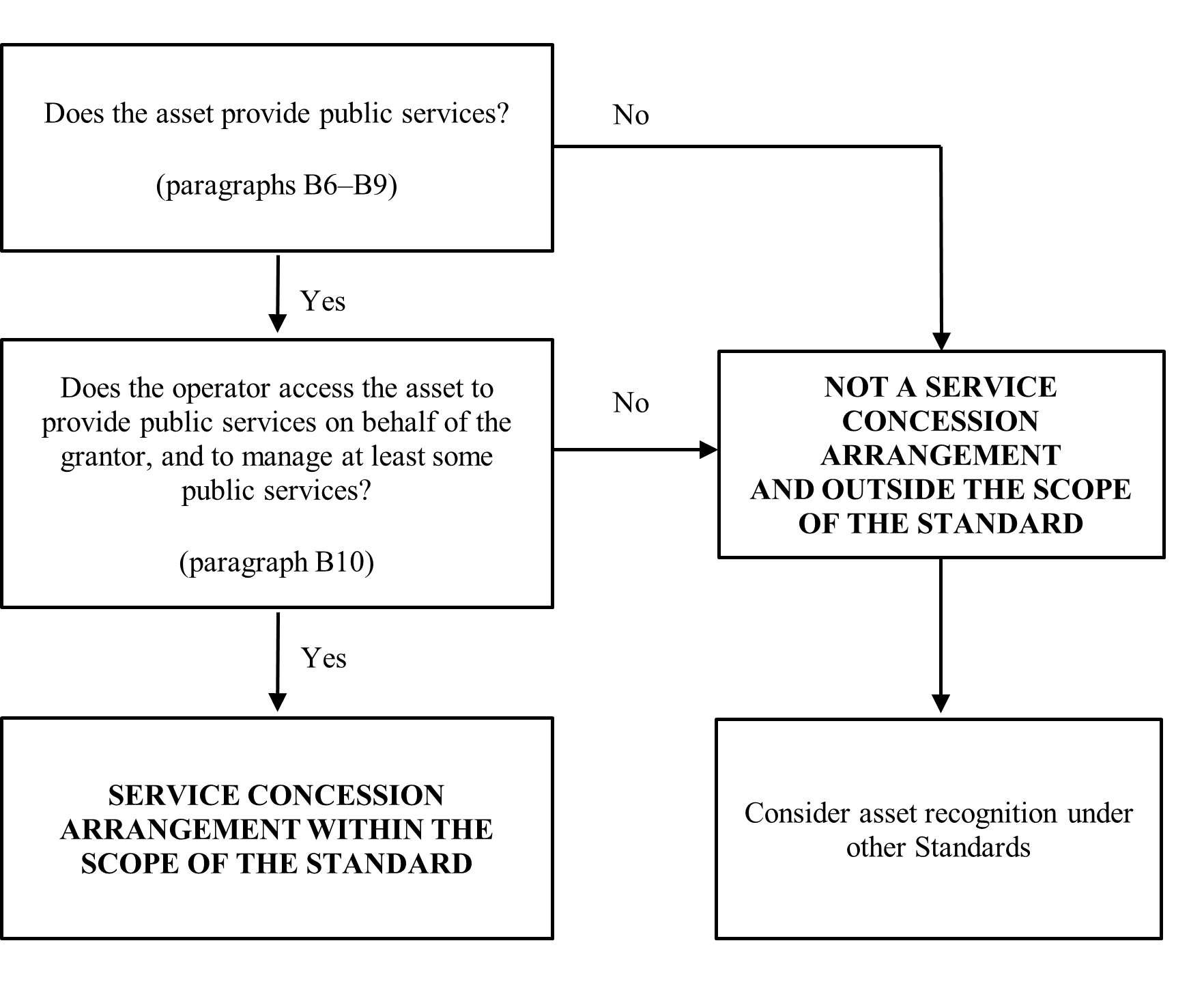

This Standard shall be applied to service concession arrangements, which involve an operator:

(a) providing public services related to a service concession asset on behalf of a grantor; and

(b) managing at least some of those services under its own discretion, rather than at the direction of the grantor.

3

Arrangements outside the scope of this Standard include those that do not involve the delivery of a public service, those where the operator manages the public services merely as an agent of the grantor, and those that involve service and management components where the asset is not controlled by the grantor as described in paragraph 5, or paragraph 6 for a whole-of-life asset.

4

This Standard does not specify the accounting by operators. Guidance on accounting for service concession arrangements by private sector operators can be found in AASB Interpretation 12 Service Concession Arrangements.

Recognition and measurement of service concession assets (paragraphs B14-B59)

5

The grantor shall recognise an asset provided by the operator and an upgrade to or a major component replacement for an existing asset of the grantor as a service concession asset if the grantor controls the asset. The grantor controls the asset if, and only if:

(a) the grantor controls or regulates what services the operator must provide with the asset, to whom it must provide them, and at what price; and

(b) the grantor controls – through ownership, beneficial entitlement or otherwise – any significant residual interest in the asset at the end of the term of the arrangement.

6

The grantor shall recognise an asset that will be used in a service concession arrangement for its entire economic life (a ‘whole-of-life’ asset) if the conditions in paragraph 5(a) are met. In this case, the condition in paragraph 5(b) is not relevant and therefore the grantor controls the whole-of-life asset if the conditions in paragraph 5(a) are met.

7

The grantor shall initially measure the service concession asset recognised in accordance with paragraph 5 (or paragraph 6 for a whole-of-life asset) at current replacement cost in accordance with the cost approach to fair value in AASB 13 Fair Value Measurement.

8

Where an existing asset of the grantor meets the conditions specified in paragraph 5 (or paragraph 6 for a whole-of-life asset), the grantor shall reclassify the existing asset as a service concession asset and shall measure the asset at current replacement cost in accordance with the cost approach to fair value in AASB 13 as at the date of reclassification. The grantor shall recognise any difference at that date between the carrying amount of the asset and its fair value (current replacement cost) as if it is a revaluation of the asset. This approach does not mean that the grantor has adopted the revaluation model.

9

After initial recognition or reclassification, the grantor shall account for a service concession asset during the term of the service concession arrangement as follows:

(a) depreciate or amortise the depreciable amount of the asset over the useful life in accordance with AASB 116 Property, Plant and Equipment or AASB 138 Intangible Assets, as appropriate, with any impairment recognised in accordance with AASB 136 Impairment of Assets; and

(b) references to fair value in other Standards shall be read as references to current replacement cost for service concession assets. For example, this means that current replacement cost is the basis for fair value measurement of service concession assets under a revaluation model. Furthermore, the active market requirements in AASB 138 for the revaluation of an intangible asset shall not apply.

10

The grantor shall account for a service concession asset after the end of the term of the service concession arrangement in accordance with other Accounting Standards and as specified below. In particular:

(a) the grantor reclassifies the asset based on its nature or function;

(b) references to fair value in other Standards shall no longer be read as references to current replacement cost. For example, any of the approaches in AASB 13 to fair value measurement may be applied to the asset under a revaluation model, as appropriate. Furthermore, the active market requirements in AASB 138 for the revaluation of an intangible asset shall apply; and

(c) the grantor derecognises the asset in accordance with AASB 116 or AASB 138, as appropriate, only when the grantor loses control of the asset. For example, internally generated intangible assets that were recognised as service concession assets (including those that do not qualify for recognition under AASB 138) are not derecognised at the end of the term of the service concession arrangement, unless the grantor loses control of the asset at that time.

Recognition and measurement of liabilities (paragraphs B60-B74)

11

Where the grantor recognises a service concession asset in accordance with paragraph 5 (or paragraph 6 for a whole-of-life asset), the grantor shall also recognise a liability. The grantor shall not recognise a liability when an existing asset of the grantor is reclassified as a service concession asset in accordance with paragraph 8, except in circumstances where additional consideration is provided by the operator, as noted in paragraph 12.

12

The liability recognised in accordance with paragraph 11 shall be initially measured at the same amount as the service concession asset, adjusted by the amount of any other consideration (eg the transfer of an existing asset) from the grantor to the operator, or from the operator to the grantor.

13

The nature of the liability recognised is based on the nature of the consideration exchanged between the grantor and the operator. The nature of the consideration given by the grantor to the operator is determined by reference to the terms of the contract.

14

In exchange for the service concession asset, the grantor might compensate the operator for the service concession asset by any combination of:

(a) making payments to the operator (the ‘financial liability’ model); and

(b) compensating the operator by other means (the ‘grant of a right to the operator’ model), such as granting the operator:

(i) the right to earn revenue from third-party users of the service concession asset; or

(ii) access to another revenue-generating asset for the operator’s use (eg a private wing of a hospital where the remainder of the hospital is used by the grantor to treat public patients or a private parking facility adjacent to a public facility).

Financial liability model

15

Where the grantor has a contractual obligation to deliver cash or another financial asset to the operator for the construction, development, acquisition or upgrade of a service concession asset, the grantor shall account for the liability recognised in accordance with paragraph 11 as a financial liability.

16

The grantor has a contractual obligation to pay cash if it has agreed to pay the operator specified or determinable amounts, such as payments relating to the following:

(a) third-party usage of a service concession asset, with or without guaranteeing a minimum amount to the operator; or

(b) the shortfall, if any, between amounts received by the operator from users of the service concession asset and any other specified or determinable amounts payable by the grantor, even if the payment is contingent on the operator ensuring that the service concession asset meets specified quality or efficiency requirements.

17

AASB 9 Financial Instruments, AASB 132 Financial Instruments: Presentation and AASB 7 Financial Instruments: Disclosures apply to the financial liability recognised under paragraph 11, except where this Standard specifies otherwise.

18

The grantor shall allocate the payments to the operator under the contract and account for them according to their substance as payments relating to the liability recognised in accordance with paragraph 11 or charges for services provided by or to be provided by the operator (including the future replacement of components of the service concession asset).

19

Charges for services provided by the operator (other than replacement components) in a service concession arrangement determined in accordance with paragraph 18 shall be accounted for in accordance with other relevant Standards.

20

Where the asset and service components of a service concession arrangement are separately identifiable, the service component of payments from the grantor to the operator shall be allocated accordingly (see paragraph B53). Where the asset and service components are not separately identifiable, the service component of payments from the grantor to the operator shall be determined using estimation techniques (see paragraph B54).

Grant of a right to the operator model

21

Where the grantor does not have a contractual obligation to pay cash or another financial asset to the operator for the construction, development, acquisition, or upgrade of a service concession asset, and instead grants the operator the right to earn revenue from third-party users or access to another revenue-generating asset, the grantor shall account for the liability recognised in accordance with paragraph 11 as the unearned portion of the revenue arising from the exchange of assets between the grantor and the operator.

22

The grantor shall recognise revenue, and accordingly reduce the liability noted in paragraph 21, according to the economic substance of the service concession arrangement (see paragraph B71).

23

Where the grantor compensates the operator for the service concession asset and the provision of services by granting the operator the right to earn revenue from third-party users of the service concession asset or access to another revenue-generating asset, the exchange is regarded as a transaction that will generate revenue for the grantor. As the right granted to the operator to access the grantor’s underlying service concession asset is effective for the period of the service concession arrangement, the grantor does not recognise revenue from the exchange immediately. Instead, a liability is recognised for revenue that is not yet earned. The revenue is then recognised according to the economic substance of the service concession arrangement, and the liability is reduced as revenue is recognised.

Dividing the arrangement

24

If the grantor compensates the operator for the provision of a service concession asset partly by incurring a financial liability and partly by the grant of a right to the operator, it is necessary to account separately for each part of the total liability recognised in accordance with paragraph 11. The amount initially recognised for the total liability shall be the same amount as that specified in paragraph 12.

25

The grantor shall account for each part of the liability referred to in paragraph 24 in accordance with paragraphs 15–23. The financial liability part shall be measured first, and the remainder of the total liability allocated to the part related to the grant of the right to the operator (see paragraphs B73 and B74).

Other revenues

27

The grantor shall account for revenues arising from a service concession arrangement, other than those specified in paragraphs 21–23, in accordance with AASB 15 Revenue from Contracts with Customers or AASB 1058 Income of Not-for-Profit Entities, as appropriate.

Presentation and disclosure (paragraphs B79-B80)

28

The objective of the disclosure requirements is for an entity to disclose sufficient information to enable users of financial statements to understand the nature, amount, timing and uncertainty of assets, liabilities, revenue and cash flows arising from service concession arrangements. To achieve this, an entity shall consider disclosing qualitative and quantitative information about its service concession arrangements, including the following:

(a) a description of the arrangements;

(b) significant terms of the arrangements that may affect the amount, timing and uncertainty of future cash flows (eg the period of the arrangement, re-pricing dates and the basis upon which re-pricing or renegotiation is determined);

(c) the nature and extent (eg quantity, time period, or amount, as appropriate) of:

(i) rights to receive specified services from the operator;

(ii) the carrying amount of service concession assets as at the end of the reporting period, including separate disclosure for existing assets of the grantor reclassified as service concession assets during the reporting period;

(iii) rights to receive specified assets at the end of an arrangement;

(iv) renewal and termination options;

(v) other rights and obligations (eg major overhaul of service concession assets); and

(vi) obligations to provide the operator with access to service concession assets or other revenue-generating assets; and

(d) changes in arrangements occurring during the reporting period.

29

The disclosures provided by an entity in accordance with paragraph 28 are provided individually for each material service concession arrangement or in aggregate for service concession arrangements involving services of a similar nature, in addition to disclosures required by AASB 116 and AASB 138. Service concession assets of a similar nature may form a subset of a class of assets disclosed in accordance with AASB 116 or AASB 138 or may be included in more than one class of assets disclosed in accordance with AASB 116 or AASB 138. For example, for the purposes of AASB 116, a toll bridge may be included in the same class as other bridges, and for the purposes of paragraph 28 may be included with service concession assets reported in aggregate as toll roads.

Appendix A -- Defined terms

This appendix is an integral part of the Standard.

contract

A[1]

An agreement between two or more parties that creates enforceable rights and obligations.

grantor

A[2]

The entity that grants the right to access the service concession asset to the operator.

operator

A[3]

The entity that has a right of access to the service concession asset to provide public services.

service concession arrangement

A[4]

A contract effective during the reporting period between a grantor and an operator in which:

(a) the operator has the right of access to the service concession asset (or assets) to provide public services on behalf of the grantor for a specified period of time;

(b) the operator is responsible for at least some of the management of the public services provided through the asset and does not act merely as an agent on behalf of the grantor; and

(c) the operator is compensated for its services over the period of the service concession arrangement.

service concession asset

A[5]

An asset (other than goodwill) to which the operator has the right of access to provide public services on behalf of the grantor in a service concession arrangement that:

(a) the operator constructs, develops, upgrades or replaces major components, or acquires from a third party or is an existing asset of the operator; or

(b) is an existing asset of the grantor, including a previously unrecognised identifiable intangible asset and land under roads, or an upgrade to or replacement of a major component of an existing asset of the grantor.

Appendix B -- Application guidance

This appendix is an integral part of the Standard.

Scope (paragraphs 2–4)

B1

This Standard is informed by AASB Interpretation 12, which sets out the accounting requirements for the private sector operator in a service concession arrangement. For example, the principles for recognition of a service concession asset are broadly consistent with AASB Interpretation 12. However, because this Standard deals with the accounting by the public sector grantor, this Standard addresses the issues identified in AASB Interpretation 12 from the grantor’s point of view, as follows:

(a) the grantor recognises a financial liability when it is obliged to make a payment or series of payments to the operator for provision of a service concession asset (ie constructed, developed, acquired or upgraded). Under paragraphs 12, 14 and 20 of AASB Interpretation 12, the operator recognises revenue for the construction, development, acquisition, upgrade and operation services it provides. Under paragraph 16 of AASB Interpretation 12, the operator recognises a financial asset;

(b) the grantor recognises a liability when it grants the operator the right to earn revenue from third-party users of the service concession asset or another revenue-generating asset. Under paragraph 17 of AASB Interpretation 12, the operator recognises an intangible asset; and

(c) the grantor derecognises an asset it grants to the operator and over which it no longer has control and reduces the liability recognised under paragraph 11 of this Standard. Under paragraph 27 of AASB Interpretation 12, the operator accounts for the asset as part of the transaction price if the asset forms part of the consideration payable by the grantor for the services.

B2

Paragraph 2 of this Standard specifies that an arrangement within the scope of this Standard involves an operator providing a public service related to a service concession asset on behalf of a grantor. In many jurisdictions, governments have introduced contractual service arrangements to attract private sector participation in the development, financing, operation and maintenance of infrastructure and other assets used to provide public services. The assets may already exist, or may be constructed or upgraded during the period of the service arrangement. An arrangement within the scope of this Standard typically involves an operator constructing the assets used to provide the public services or upgrading the assets (for example, by increasing their capacity) and operating and maintaining the assets for a specified period of time. Such arrangements are often described as build-operate-transfer or rehabilitate-operate-transfer service concession arrangements or public-private partnerships (PPPs).

B3

Paragraph 3 of the Standard illustrates the types of arrangements that are outside the scope of this Standard, such as arrangements that do not deliver a public service (for example, assets used for commercial purposes), arrangements where the operator does not provide and manage at least some of the public services under its own discretion (for example, outsourcing service agreements where the public sector entity has control of the asset) and arrangements that involve service and management components where the asset is not controlled by the grantor (for example, privatised assets that are subject to price regulation).

Definitions (Appendix A)

Public service

B4

Appendix A defines a service concession arrangement. A feature of a service concession arrangement is the public service nature of the obligation to be undertaken by the operator in a commercial transaction. The public service nature of the services to be provided using the service concession asset is assessed irrespective of the identity of the party that operates the services. A service concession arrangement contractually obliges the operator to provide some, if not all, of the services to the public on behalf of the public sector entity. Other common features of a service concession arrangement within the scope of this Standard are:

(a) the grantor is a public sector entity;

(b) the operator is responsible for at least some of the management of the service concession asset and related services and does not merely act as an agent on behalf of the grantor;

(c) the arrangement sets or limits the initial prices to be levied by the operator and regulates price revisions over the period of the service concession arrangement;

(d) the operator is obliged to hand over the service concession asset to the grantor in a specified condition at the end of the period of the arrangement, for little or no incremental consideration, irrespective of which party initially financed it; and

(e) the arrangement is governed by a contract that sets out performance standards, mechanisms for adjusting prices, and arrangements for arbitrating disputes.

B5

Appendix A defines a service concession asset. Examples of service concession assets include roads (and land under roads), bridges, tunnels, prisons, hospitals, airports, water distribution facilities, energy supply and telecommunication networks, permanent installations for military and other operations, registries and databases, and other tangible or intangible assets that are expected to be used during more than one reporting period in delivering public services.

Asset provides public services

B6

Assessing whether an asset provides public services requires judgement, taking into account the nature and relative significance of each component and the services provided. For example, a courthouse building provides multiple services, such as courts, administrative offices and associated services. However, the primary purpose of the building is to provide court services, which are considered to be public services. The court services are necessary or essential to the general public and are generally expected to be provided by a public sector entity in accordance with government policy or regulation. The court services are accessible to the public, even if it is a subset of the community that uses the services. The services provided by the administrative offices may be unrelated to the court services and therefore considered ancillary if they are insignificant to the arrangement as a whole, and in that case would not affect the assessment that the building provides public services. However, if the unrelated administrative services were significant to the arrangement as a whole, the courthouse building might be assessed as not providing public services.

B6

Assessing whether an asset provides public services requires judgement, taking into account the nature and relative significance of each component and the services provided. For example, a courthouse building provides multiple services, such as courts, administrative offices and associated services. However, the primary purpose of the building is to provide court services, which are considered to be public services. The court services are necessary or essential to the general public and are generally expected to be provided by a public sector entity in accordance with government policy or regulation. The court services are accessible to the public, even if it is a subset of the community that uses the services. The services provided by the administrative offices may be unrelated to the court services and therefore considered ancillary if they are insignificant to the arrangement as a whole, and in that case would not affect the assessment that the building provides public services. However, if the unrelated administrative services were significant to the arrangement as a whole, the courthouse building might be assessed as not providing public services.

B7

If an arrangement provides public services principally through a primary asset, and a secondary asset is used or is mainly used to complement the primary asset, such as student accommodation for a public university, the secondary asset would be regarded as providing public services as well. As another example, a hospital car park constructed by an operator as part of the arrangement to construct a hospital that largely provides public services would be considered part of the hospital service concession arrangement. The car park may provide limited ancillary services without affecting the assessment that the car park is used to provide public services. However, if the car park was not constructed as part of the hospital service concession arrangement (eg subsequent to the construction of the hospital or with a different party) and is largely of a commercial nature (eg car parking is available to the general public, including hospital patrons), the car park would be regarded as an asset that does not provide public services, and therefore outside the scope of this Standard.

B8

Where the services provided by an asset are used wholly internally by a public sector entity for the purpose of assisting the public sector entity to deliver public services, but managed by an external party, the arrangement is likely to be an outsourcing arrangement or a lease, rather than a service concession arrangement. For example, the provision of information technology services to a government department providing emergency services to the public is likely to be an outsourcing contract, which may contain a lease of the information technology hardware. The accompanying Implementation Guidance also illustrates common types of arrangements.

B9

For an asset to provide public services, it is not necessary for the public to have physical access to the asset. For example, a military base provides public services (defence activities) even though the public is unlikely to have physical access to the military base.

Operator manages at least some of the public services

B10

For an arrangement to be within the scope of this Standard, the operator must be responsible for providing public services through the service concession asset and for managing at least some of the public services and related services, and not act merely as an agent on behalf of the grantor through an outsourcing arrangement. For example, an operator in an arrangement to construct and operate a hospital in accordance with the grantor’s directions would need to provide services more managerial in nature than cleaning, building maintenance and security services for the hospital after its construction in order for the arrangement to be considered a service concession arrangement. Cleaning, building maintenance and security services would generally be regarded as relatively insignificant to the public services provided by the hospital. Therefore, if the operator is responsible only for constructing the hospital and then providing all or any of those services, the operator is unlikely to be considered to be responsible for some of the management of the public services provided by the hospital. However, if after constructing the hospital the operator also provides scheduling of staff and resources (even if provided by the grantor), the operator is likely to be responsible for some of the management of the hospital public services, and not acting like an agent of the grantor. In contrast, if the maintenance contributes significantly to the public services provided by the asset, then the operator would be responsible for at least some of the management of the public services provided by the asset. For example, this would be the case for an arrangement where an operator constructs and maintains (at its discretion) a toll road on behalf of the grantor, because maintenance services are a significant component of the public services provided by the toll road.

B10

For an arrangement to be within the scope of this Standard, the operator must be responsible for providing public services through the service concession asset and for managing at least some of the public services and related services, and not act merely as an agent on behalf of the grantor through an outsourcing arrangement. For example, an operator in an arrangement to construct and operate a hospital in accordance with the grantor’s directions would need to provide services more managerial in nature than cleaning, building maintenance and security services for the hospital after its construction in order for the arrangement to be considered a service concession arrangement. Cleaning, building maintenance and security services would generally be regarded as relatively insignificant to the public services provided by the hospital. Therefore, if the operator is responsible only for constructing the hospital and then providing all or any of those services, the operator is unlikely to be considered to be responsible for some of the management of the public services provided by the hospital. However, if after constructing the hospital the operator also provides scheduling of staff and resources (even if provided by the grantor), the operator is likely to be responsible for some of the management of the hospital public services, and not acting like an agent of the grantor. In contrast, if the maintenance contributes significantly to the public services provided by the asset, then the operator would be responsible for at least some of the management of the public services provided by the asset. For example, this would be the case for an arrangement where an operator constructs and maintains (at its discretion) a toll road on behalf of the grantor, because maintenance services are a significant component of the public services provided by the toll road.

Changes in an arrangement

B11

A grantor assesses at the commencement of an arrangement whether an asset provides public services and whether the operator is responsible for providing and managing at least some of the public services provided through the asset and does not act merely as an agent on behalf of the grantor. The initial assessment applies for the duration of the service concession arrangement. Where there is a significant modification to the terms and conditions of the arrangement, the arrangement should be reassessed to determine whether the asset still provides public services, and whether the operator is responsible for providing and managing at least some of the public services provided through the asset under its own discretion – and therefore whether the arrangement is still within the scope of this Standard. If service concession accounting is no longer appropriate, the grantor determines whether the service concession asset and liabilities continue to be recognised and accounted for under other Accounting Standards or else derecognised.

B11

A grantor assesses at the commencement of an arrangement whether an asset provides public services and whether the operator is responsible for providing and managing at least some of the public services provided through the asset and does not act merely as an agent on behalf of the grantor. The initial assessment applies for the duration of the service concession arrangement. Where there is a significant modification to the terms and conditions of the arrangement, the arrangement should be reassessed to determine whether the asset still provides public services, and whether the operator is responsible for providing and managing at least some of the public services provided through the asset under its own discretion – and therefore whether the arrangement is still within the scope of this Standard. If service concession accounting is no longer appropriate, the grantor determines whether the service concession asset and liabilities continue to be recognised and accounted for under other Accounting Standards or else derecognised.

Contracts

B12

Appendix A also defines a contract. The term ‘agreement’ in the definition of a ‘contract’ encompasses an arrangement entered into under the direction of another party (eg when assets are transferred to an entity with a directive that they be deployed to provide specified services).

B13

Contracts can be written, oral or implied by an entity’s customary practices in performing or conducting its activities. For not-for-profit entities, Appendix F to AASB 15 includes guidance regarding when an agreement creates enforceable rights and obligations.

Recognition and initial measurement of service concession assets (paragraphs 5–10)

Recognition of service concession assets

B14

A service concession arrangement typically includes many assets, rather than one asset. References in this Standard to a service concession asset apply to all of the assets encompassed by the arrangement. If a service concession arrangement encompasses a business as defined in AASB 3 Business Combinations, the grantor shall recognise the assets (including any identifiable intangible assets) and liabilities of the business when the conditions in paragraph 5 or 6 are satisfied. Goodwill shall not be recognised by the grantor.

Control

B15

Paragraph 5 of this Standard specifies the conditions under which an asset, other than a whole-of-life asset, is recognised by the grantor. Paragraph 6 of the Standard specifies the condition under which a whole-of-life asset is recognised by the grantor. The assessment of whether a service concession asset should be recognised in accordance with paragraph 5 (or paragraph 6 for a whole-of-life asset) is made on the basis of all of the facts and circumstances of the arrangement.

B15

Paragraph 5 of this Standard specifies the conditions under which an asset, other than a whole-of-life asset, is recognised by the grantor. Paragraph 6 of the Standard specifies the condition under which a whole-of-life asset is recognised by the grantor. The assessment of whether a service concession asset should be recognised in accordance with paragraph 5 (or paragraph 6 for a whole-of-life asset) is made on the basis of all of the facts and circumstances of the arrangement.

B16

The fundamental principle reflected in paragraphs 5 and 6 is determining whether the grantor controls the underlying asset or assets of a service concession arrangement. The ability to exclude or regulate the access of others to the benefits of an asset is an essential element of control that distinguishes an entity’s assets from public goods that all entities can access and benefit from. If the service concession arrangement provides for the grantor to control the price (for example, the contract may set the initial prices to be levied by the operator and regulate price revisions over the period of the service concession arrangement), the services to be provided and to whom the services must be provided, then the grantor controls the service concession asset regardless of whether there is any regulation by a third-party regulator.

B17

Control should be distinguished from management. If the grantor has both the degree of control described in paragraph 5(a) and any significant residual interest in the asset (as noted in paragraph 5(b)), the operator is only managing the asset on the grantor’s behalf – even though, in many cases, it may have wide managerial discretion.

B18

The control or regulation referred to in paragraph 5(a) could be by contract, or otherwise. If the contract specifies that the grantor controls or regulates the price, the services to be provided and to whom the operator must provide the services, the conditions specified in paragraph 5(a) are met.

Regulation

B19

If a service concession contract by itself does not result in the grantor having explicit control over the services and/or pricing of the services, the grantor might still have control of the service concession asset as a result of regulation by a third party. Regulation of what services the operator must provide, to whom it must provide them, and at what price, in the manner specified in paragraph 5(a), is a means by which a grantor can demonstrate control of the substantive benefits of the service concession asset. Grantor control of a service concession asset through regulation does not require the contract to refer to the regulation or the grantor to control or be related to the regulator. The third-party regulator might, for example, regulate other entities that operate in the same industry or sector as the grantor. This includes circumstances in which the grantor buys all of the services as well as those in which some or all of the services are bought by other users.

B19

If a service concession contract by itself does not result in the grantor having explicit control over the services and/or pricing of the services, the grantor might still have control of the service concession asset as a result of regulation by a third party. Regulation of what services the operator must provide, to whom it must provide them, and at what price, in the manner specified in paragraph 5(a), is a means by which a grantor can demonstrate control of the substantive benefits of the service concession asset. Grantor control of a service concession asset through regulation does not require the contract to refer to the regulation or the grantor to control or be related to the regulator. The third-party regulator might, for example, regulate other entities that operate in the same industry or sector as the grantor. This includes circumstances in which the grantor buys all of the services as well as those in which some or all of the services are bought by other users.

Regulation of pricing

B20

Control or regulation of the pricing of the services is one of the three factors set out in paragraph 5(a) to be considered in determining whether the grantor controls an asset and should recognise it as a service concession asset. For example, a regulated price includes a specified price, which may be zero, that the operator can charge for the services of the asset. The grantor would also have to control the services to be provided and the recipients of the services in order to recognise a service concession asset. This approach is consistent with the fundamental principle in paragraph B16 of an entity controlling an asset if it has the ability to exclude or regulate the access of others to the benefits of the asset. For example, for the purpose of paragraph 5(a), the grantor does not need to have complete control of the price: it is sufficient for the price to be regulated by the grantor, or by a third-party regulator (eg by a capping mechanism). Prices are regarded as controlled by the grantor in a regulated environment when a third-party regulator regulates the pricing of the services provided with a service concession asset. The regulation removes the ability of the operator to determine the price and, for the purpose of paragraph 5(a), the pricing of the services is considered to be set implicitly by the grantor as the contract between the grantor and the operator effectively incorporates the price regulation. In some cases, the grantor could have specified an alternative pricing regime but has chosen not to do so, effectively asserting ‘passive’ control of the pricing. If the contract specifies the grantor controls the services and the recipients of the services, the third-party regulation of the pricing of the services means that the operator does not control the pricing or the other criteria specified in paragraph 5(a), and accordingly the grantor controls the asset. If the operator is able to determine to whom the services are provided, but is subject to grantor control over what services may be provided and the pricing, the grantor does not control the asset. The accompanying Implementation Guidance illustrates common types of arrangements where the grantor or the operator might control the various factors.

B21

Where a third-party regulator regulates the pricing or the services that the asset must provide (as specified in paragraph 5(a)), it is not essential for the grantor to control or direct the activities of the third-party regulator for the grantor to have control of the service concession asset. For example, a State grantor in a service concession arrangement might meet the regulated pricing condition specified in paragraph 5(a) even though the relevant regulation is carried out by an independent Commonwealth regulator. Furthermore, it is not necessary for the grantor to refer to the regulator in the contract. The grantor might rely on the regulator exercising its powers within the parameters applicable to the regulator at the inception of the contract.

B22

Governments often have the power to regulate the behaviour of entities operating in certain sectors of the economy, either directly or through specifically created agencies. For the purpose of paragraph 5(a), such broad regulatory powers do not constitute control. In this Standard, the term ‘regulate’ is intended to be applied only in the context of the terms and conditions of the service concession arrangement. For example, a regulator of rail services may determine rates that apply to the rail industry as a whole. Depending on the legal framework in a jurisdiction, such rates may be implicit in the contract governing a service concession arrangement involving the provision of railway transportation, or they may be specifically referred to therein. However, in both cases, the control of the pricing of the service concession asset is derived from either the contract or the specific regulation applicable to rail services, without considering whether the grantor is related to the regulator of rail services.

B23

Where a service concession arrangement does not clearly fall within an existing regulatory framework (eg where there is more than one possible source of regulation), the contract will need to incorporate the specific regulatory framework that stipulates the services, the users and/or the pricing to be charged for the services in order for the requirements of paragraph 5(a) to be met.

B24

For a grantor to control any of the factors listed in paragraph 5(a) through third-party regulation, the regulation must be substantive. Non-substantive features, such as a cap that will apply only in remote circumstances, shall be ignored. Conversely, if, for example, an arrangement purports to give the operator freedom to set prices but any excess profit is returned to the grantor, the operator’s return is capped and the price element of the control test is met.

Partly regulated asset

B25

Sometimes the use of a service concession asset is partly regulated in the manner described in paragraph 5(a) and partly unregulated. These arrangements may take a variety of forms, such as:

(a) any asset that is physically separable and capable of being operated independently and meets the definition of a cash-generating unit as defined in AASB 136 is analysed separately to determine whether the conditions set out in paragraph 5(a) are met if it is used wholly for unregulated purposes (eg this might apply to a private wing of a hospital, where the remainder of the hospital is used to treat public patients); and

(b) when purely ancillary activities (such as a hospital shop) are unregulated, the control tests shall be applied as if those services did not exist, because in cases in which the grantor controls the services in the manner described in paragraph 5(a), the existence of ancillary activities does not detract from the grantor’s control of the service concession asset.

B26

There may be arrangements that include unregulated services that are neither purely ancillary nor delivered by using a physically separable portion of the total asset. For example, a grantor may control prices charged to children and seniors at a sports facility but the amounts charged to adults are not controlled. The same facilities are being used by all, regardless of the amount they pay. Alternatively, prices could be regulated by the grantor for services provided at certain times of the day rather than for different classes of users. In such cases, it will be a matter of judgement whether enough of the service is regulated in order to demonstrate that the grantor has control of the asset.

B27

The operator may have a right to use the separable asset described in paragraph B25(a), or the facilities used to provide ancillary unregulated services described in paragraph B25(b). In either case, there may in substance be a lease from the grantor to the operator; if so, it shall be accounted for in accordance with AASB 16 Leases.

Control concept in other Australian Accounting Standards

B28

If an asset meets the conditions in paragraph 5 (or paragraph 6), the grantor controls the use of the asset and therefore recognises the asset in accordance with this Standard. An asset that does not meet the control criteria of this Standard is assessed to determine whether it is recognised under another Accounting Standard, such as AASB 16, AASB 116 or AASB 138. The Implementation Guidance accompanying this Standard contains a table that highlights the continuum of typical arrangements and relevant accounting requirements.

B28

If an asset meets the conditions in paragraph 5 (or paragraph 6), the grantor controls the use of the asset and therefore recognises the asset in accordance with this Standard. An asset that does not meet the control criteria of this Standard is assessed to determine whether it is recognised under another Accounting Standard, such as AASB 16, AASB 116 or AASB 138. The Implementation Guidance accompanying this Standard contains a table that highlights the continuum of typical arrangements and relevant accounting requirements.

Long-term leases, outsourcing or privatisation

B29

Assessment of whether long-term leasing, outsourcing, service and privatisation arrangements are within the scope of this Standard addresses whether the ‘grantor’ entity controls the underlying asset(s) of the arrangement in accordance with the control criteria of paragraph 5 (or paragraph 6). For example:

(a) if the grantor does not retain control of an existing asset under such an arrangement, the grantor considers whether to derecognise the asset as a sale or privatisation; or

(b) if the grantor retains control of an existing asset and gives the ‘operator’ the right to use the asset, or the operator controls an asset and gives the grantor the right to use the asset, the grantor considers whether to recognise a lease in relation to the asset as lessor or lessee respectively. This contrasts with a service concession arrangement, where the grantor provides the operator with the right to access the service concession asset, rather than a right to use the asset.

B29

Assessment of whether long-term leasing, outsourcing, service and privatisation arrangements are within the scope of this Standard addresses whether the ‘grantor’ entity controls the underlying asset(s) of the arrangement in accordance with the control criteria of paragraph 5 (or paragraph 6). For example:

(a) if the grantor does not retain control of an existing asset under such an arrangement, the grantor considers whether to derecognise the asset as a sale or privatisation; or

(b) if the grantor retains control of an existing asset and gives the ‘operator’ the right to use the asset, or the operator controls an asset and gives the grantor the right to use the asset, the grantor considers whether to recognise a lease in relation to the asset as lessor or lessee respectively. This contrasts with a service concession arrangement, where the grantor provides the operator with the right to access the service concession asset, rather than a right to use the asset.

Changes in control

B30

The grantor’s control of the service concession asset may change during the term of the service concession arrangement. The change in the grantor’s control of the asset may arise from changes in the terms of the service concession contract, or changes in third-party regulation of the price and/or services.

B30

The grantor’s control of the service concession asset may change during the term of the service concession arrangement. The change in the grantor’s control of the asset may arise from changes in the terms of the service concession contract, or changes in third-party regulation of the price and/or services.

B31

Where there is a change in facts or circumstances that indicate the grantor’s control of the asset may have changed, the grantor assesses whether the asset is still within the scope of this Standard or should be reclassified within the scope of another Standard. Where the grantor no longer has control of the asset in accordance with this Standard, the grantor determines whether the asset continues to be recognised and accounted for under other Accounting Standards or else derecognised, except internally generated identifiable intangible assets initially recognised by the grantor under a service concession arrangement continue to be recognised by the grantor while control is retained, rather than derecognised under AASB 138.

Residual interest

B32

The grantor must also control through ownership, beneficial entitlement or otherwise any significant residual interest in the asset at the end of the term of the arrangement (paragraph 5(b)).

B32

The grantor must also control through ownership, beneficial entitlement or otherwise any significant residual interest in the asset at the end of the term of the arrangement (paragraph 5(b)).

B33

For the purpose of paragraph 5(b), the grantor’s control over any significant residual interest would both restrict the operator’s practical ability to sell or pledge the asset (by acknowledging the grantor’s residual interest in the asset) and effectively give the grantor control of the asset throughout the period of the service concession arrangement. Consequently, where the grantor has substantive, rather than merely protective, rights to prevent the operator selling or pledging the asset during the service concession arrangement (eg the grantor must formally approve the transferee, rather than being able to refuse merely on the grounds that the transferee is not fit and proper), then the grantor is likely to have control of any significant residual interest in the asset.

B34

The residual interest in the asset is the estimated fair value (current replacement cost) of the asset, determined at the inception of the arrangement, as if it were already of the age and in the condition expected at the end of the service concession arrangement.

B35

Paragraph 5 identifies whether the asset, including any replacements required, is controlled by the grantor for the whole of its economic life, beyond the term of the service concession arrangement. For example, if the operator has to replace part of an asset during the period of the arrangement (eg the top layer of a road or the roof of a building), the asset shall be considered as a whole. Thus the condition in paragraph 5(b) is met for the whole of the asset, including the part that is replaced, if the grantor controls any significant residual interest in the final replacement of that part. However, replacements of major components are treated as a separate service concession asset (see paragraphs B38 and B48).

Whole-of-life assets

B36

For the purpose of paragraph 6, a whole-of-life asset is an asset that will be used in a service concession arrangement for either its entire economic life or the major part of its economic life. In both cases, there is no significant residual interest in the asset at the end of the arrangement, so that the condition in paragraph 5(b) is not relevant.

B36

For the purpose of paragraph 6, a whole-of-life asset is an asset that will be used in a service concession arrangement for either its entire economic life or the major part of its economic life. In both cases, there is no significant residual interest in the asset at the end of the arrangement, so that the condition in paragraph 5(b) is not relevant.

Existing assets of the grantor

B37

The arrangement may involve an existing asset (tangible or intangible) of the grantor:

(a) to which the grantor gives the operator access for the purpose of the service concession arrangement; or

(b) to which the grantor gives the operator access for the purpose of the operator generating revenues as compensation for the service concession asset.

B37

The arrangement may involve an existing asset (tangible or intangible) of the grantor:

(a) to which the grantor gives the operator access for the purpose of the service concession arrangement; or

(b) to which the grantor gives the operator access for the purpose of the operator generating revenues as compensation for the service concession asset.

B38

Existing assets of the grantor used in the service concession arrangement shall be classified under this Standard (paragraph 8) as service concession assets. This includes identifiable intangible assets and land under roads of the grantor that have not been recognised previously by the grantor. The grantor shall recognise the upgrade of an existing asset of the grantor (eg an increase in capacity) or the replacement of a major component of an asset as a service concession asset in accordance with paragraph 5 (or paragraph 6 for a whole-of-life asset). The grantor also recognises a corresponding liability, when the upgrade or replacement occurs.

Intangible assets and land under roads

B39

In applying paragraphs 8–10 and B38 to an identifiable intangible asset or land under roads that has not been recognised previously by the grantor, the grantor shall:

(a) initially recognise the asset as a service concession asset, measured at current replacement cost in accordance with the cost approach to fair value in AASB 13. In accordance with paragraphs 8 and 11, the grantor shall account for the recognition of the asset at fair value (current replacement cost) as if it is a revaluation of the asset (ie as a revaluation surplus) and shall recognise a liability only to the extent of additional consideration provided by the operator;

(b) after initial recognition of the asset and while controlled by the grantor, account for the asset in accordance with AASB 116 or AASB 138, as appropriate, subject to paragraph 9, as follows:

(i) depreciate or amortise the depreciable amount of the asset over its useful life; and

(ii) if applying the revaluation model to the asset, current replacement cost continues to be used as the basis for fair value measurement without applying, in the case of an intangible asset, the active market requirements in AASB 138; and

(c) after the end of the service concession arrangement, account for the asset in accordance with other Accounting Standards. This requires the grantor to reclassify the asset, continue to recognise the intangible asset while controlled by the grantor, and account for depreciation or amortisation over its useful life and revaluation in accordance with the other Standards and derecognise the asset in accordance with AASB 116 or AASB 138 only when control is lost. For example, this means that an internally generated intangible asset is not derecognised under AASB 138 until control is lost, even if the asset would not have satisfied the initial recognition criteria in AASB 138.

Impairment and loss of control

B40

In applying the impairment tests to service concession assets accounted for under the cost model in AASB 116 or AASB 138, as appropriate, the grantor does not necessarily consider the granting of the service concession to the operator as a circumstance that causes impairment, unless there has been a change in use of the asset that affects its future economic benefits or service potential. The grantor shall refer to AASB 136 to determine whether any of the indicators of impairment have been triggered under such circumstances. AASB 136 does not apply to primarily non-cash-generating specialised assets of not-for-profit entities that are regularly revalued to fair value (current replacement cost) under the revaluation model in AASB 116 or AASB 138.

B40

In applying the impairment tests to service concession assets accounted for under the cost model in AASB 116 or AASB 138, as appropriate, the grantor does not necessarily consider the granting of the service concession to the operator as a circumstance that causes impairment, unless there has been a change in use of the asset that affects its future economic benefits or service potential. The grantor shall refer to AASB 136 to determine whether any of the indicators of impairment have been triggered under such circumstances. AASB 136 does not apply to primarily non-cash-generating specialised assets of not-for-profit entities that are regularly revalued to fair value (current replacement cost) under the revaluation model in AASB 116 or AASB 138.

B41

Subject to paragraph B39(c), if the asset no longer meets the conditions for recognition in paragraph 5 (or paragraph 6 for a whole-of-life asset), the grantor shall follow the principles in AASB 116 or AASB 138, as appropriate. For example, if control of the asset is transferred to the operator on a permanent basis, it shall be derecognised. Alternatively, the grantor may be required to derecognise the asset when it or a third-party regulator no longer regulates the pricing, but rather allows the operator to freely set prices for the services provided through the service concession asset.

B42

If control of the asset is transferred on a temporary basis, the grantor considers the substance of this term of the service concession arrangement in determining whether the asset should be derecognised. In such cases, the grantor shall also consider whether the arrangement is a lease transaction or a sale and leaseback transaction that should be accounted for in accordance with AASB 16.

Existing assets of the operator

B43

The operator may provide an asset for use in the service concession arrangement that it has not constructed, developed, or acquired for the purpose of the arrangement. If the arrangement involves an existing asset of the operator that the operator uses for the purpose of the service concession arrangement, the grantor shall determine whether the asset meets the conditions in paragraph 5 (or paragraph 6 for a whole-of-life asset). If the conditions for recognition are met, the grantor shall recognise the asset as a service concession asset and account for it in accordance with this Standard.

B43

The operator may provide an asset for use in the service concession arrangement that it has not constructed, developed, or acquired for the purpose of the arrangement. If the arrangement involves an existing asset of the operator that the operator uses for the purpose of the service concession arrangement, the grantor shall determine whether the asset meets the conditions in paragraph 5 (or paragraph 6 for a whole-of-life asset). If the conditions for recognition are met, the grantor shall recognise the asset as a service concession asset and account for it in accordance with this Standard.

Constructed or developed assets

B44

When a constructed or developed asset meets the conditions in paragraph 5 (or paragraph 6 for a whole-of-life asset), the grantor shall recognise and measure the asset in accordance with this Standard. This recognition also depends on the asset meeting the recognition criteria in AASB 116 or AASB 138:

(a) AASB 116 requires that the cost of an item of property, plant and equipment shall be recognised as an asset if, and only if:

(i) it is probable that future economic benefits associated with the asset will flow to the entity; and

(ii) the cost of the item can be measured reliably;

(b) AASB 138 requires that an intangible asset shall be recognised if, and only if:

(i) it is probable that the expected future economic benefits that are attributable to the asset will flow to the entity; and

(ii) the cost of the asset can be measured reliably.

B44

When a constructed or developed asset meets the conditions in paragraph 5 (or paragraph 6 for a whole-of-life asset), the grantor shall recognise and measure the asset in accordance with this Standard. This recognition also depends on the asset meeting the recognition criteria in AASB 116 or AASB 138:

(a) AASB 116 requires that the cost of an item of property, plant and equipment shall be recognised as an asset if, and only if:

(i) it is probable that future economic benefits associated with the asset will flow to the entity; and

(ii) the cost of the item can be measured reliably;

(b) AASB 138 requires that an intangible asset shall be recognised if, and only if:

(i) it is probable that the expected future economic benefits that are attributable to the asset will flow to the entity; and

(ii) the cost of the asset can be measured reliably.

B45

Those criteria, together with the terms and conditions of the contract, need to be considered by the grantor in determining whether to recognise the service concession asset during the period in which the asset is constructed or developed. For property, plant and equipment and intangible assets, if the recognition criteria are met during the construction or development period, the grantor recognises the service concession asset to the appropriate extent during that period.

B46

The first recognition criterion requires the flow of economic benefits to the grantor. According to the Framework for the Preparation and Presentation of Financial Statements, as identified in AASB 1048 Interpretation of Standards, for not-for-profit entities, future economic benefits are synonymous with the notion of service potential. From the grantor’s point of view, the primary purpose of a service concession asset is to provide service potential on behalf of the public sector grantor. Similar to an asset the grantor constructs or develops for its own use, the grantor would assess, at the time the costs of construction or development are incurred, the terms of the contract to determine whether, in addition to retaining control of the land on which the service concession asset is being developed, economic benefits embodied in the service concession asset are controlled by the grantor at that time.

B47

The second recognition criterion requires that the cost of the asset can be measured reliably. Accordingly, to meet the recognition criteria in AASB 116 or AASB 138, as appropriate, the grantor must have reliable information about the cost of the asset during its construction or development. For example, if the service concession arrangement requires the operator to provide the grantor with progress reports during the asset’s construction or development, the costs incurred may be measurable, and would therefore meet the recognition criteria in AASB 116 for constructed assets or in AASB 138 for developed intangible assets. Also, where the grantor has little ability to avoid accepting an asset constructed or developed to meet the specifications of the service concession arrangement, the costs shall be recognised as progress is made towards completion of the asset. Thus, the grantor shall recognise a service concession asset and an associated liability.

Upgrades or replacement of major components

B48

The grantor shall recognise an upgrade, or the replacement of a major component, of (1) an existing asset of the grantor, or (2) an asset constructed, developed, acquired or otherwise provided by the operator, as a separate service concession asset in accordance with paragraph 5 (or paragraph 6 for a whole-of-life asset). The grantor shall also recognise the related liability in accordance with paragraph 11 when the upgrade or replacement occurs.

B48

The grantor shall recognise an upgrade, or the replacement of a major component, of (1) an existing asset of the grantor, or (2) an asset constructed, developed, acquired or otherwise provided by the operator, as a separate service concession asset in accordance with paragraph 5 (or paragraph 6 for a whole-of-life asset). The grantor shall also recognise the related liability in accordance with paragraph 11 when the upgrade or replacement occurs.

Measurement of service concession assets

B49

Paragraph 7 requires service concession assets recognised in accordance with paragraph 5 (or paragraph 6 for a whole-of-life asset) to be measured initially at current replacement cost. This is in accordance with the cost approach to fair value in AASB 13. In particular, the cost approach is used to determine the cost of a constructed or developed service concession asset or the cost of any upgrades to existing assets, on initial recognition. The requirement to measure the asset at current replacement cost also applies to existing assets, both tangible and intangible, of the grantor that are reclassified as service concession assets, in accordance with paragraph 8 of this Standard. The use of fair value (current replacement cost) on initial recognition or reclassification of a service concession asset does not constitute a revaluation under AASB 116 or AASB 138. Therefore, future revaluations of the asset are not required unless the entity adopts the revaluation model under the relevant Standard.

Types of compensation

B50

Service concession arrangements are rarely, if ever, the same: technical requirements vary by sector and by jurisdiction. Furthermore, the terms of the arrangement may also depend on the specific features of the overall legal framework, including contract law, of the particular jurisdiction.

B50

Service concession arrangements are rarely, if ever, the same: technical requirements vary by sector and by jurisdiction. Furthermore, the terms of the arrangement may also depend on the specific features of the overall legal framework, including contract law, of the particular jurisdiction.

B51

Depending on the terms of the service concession arrangement, the grantor may compensate the operator for the service concession asset and service provision by any combination of the following:

(a) making payments (eg cash) to the operator; and

(b) compensating the operator by other means, such as:

(i) granting the operator the right to earn revenue from third-party users of the service concession asset; or

(ii) granting the operator access to another revenue-generating asset for its use.

B52

When the grantor compensates the operator for the service concession asset by making payments to the operator, the asset and service components of the payments may be separately identifiable (eg the contract specifies the amount of the predetermined payment or series of payments to be allocated to the service concession asset). The asset and service components of the service concession arrangement are accounted for separately, in accordance with paragraph 20.

Separately identifiable payments

B53

A service concession arrangement may have separately identifiable asset and service components of the payments in a variety of circumstances, including, but not limited to, the following:

(a) part of a payment stream that varies according to the availability of the service concession asset itself and another part that varies according to usage or performance of certain services can be identified;

(b) different components of the service concession arrangement run for different periods or can be terminated separately. For example, an individual service component can be terminated without affecting the continuation of the rest of the arrangement; or

(c) different components of the service concession arrangement can be renegotiated separately. For example, the upgrade or replacement of major components of a service concession asset are addressed separately, or a service component is market tested and some or all of the cost increases or reductions are passed on to the grantor in such a way that the part of the payment by the grantor that relates specifically to that service can be identified.

Payments not separately identifiable

B54

For the purpose of applying the requirements of this Standard, payments and other consideration required by the arrangement are allocated at the inception of the arrangement or upon a reassessment of the arrangement into those for the service concession asset and those for other components of the service concession arrangement (eg maintenance and operation services) on the basis of their relative fair values. The fair value (current replacement cost) of the service concession asset represents amounts related to the asset and excludes other components of the service concession arrangement. In some cases, identifying payments for the asset and payments for other components of the service concession arrangement will require the grantor to use an estimation technique. For example, a grantor may estimate the payments related to the asset by reference to the fair value of a comparable asset in an agreement that contains no other components, or by estimating the payments for the other components in the service concession arrangement by reference to comparable arrangements and then deducting these payments from the total payments under the arrangement.

Operator receives other forms of compensation

B55

The types of compensation transactions referred to in paragraph 14(b) are non-monetary exchange transactions. Paragraph 24 of AASB 116 and paragraph 45 of AASB 138, as appropriate, provide guidance on these circumstances.

B56

When the operator is granted the right to earn revenue from third-party users of the service concession asset, or from another revenue-generating asset, or receives non-cash compensation from the grantor, the grantor does not incur a cost directly for acquiring the service concession asset. These forms of consideration to the operator may be intended to compensate the operator both for the cost of the service concession asset and for operating it during the term of the service concession arrangement. The grantor therefore needs to initially measure the asset component in a manner consistent with paragraph 7.

Fair value measurement

B57