The objective of this Standard is to set out the application of Tiers of Australian Accounting Standards to different categories of entities preparing general purpose financial statements.

Preamble

Pronouncement

This compiled Standard applies to annual periods beginning on or after 1 July 2021. Earlier application is permitted for annual periods beginning on or after 1 January 2014 but before 1 July 2021. It incorporates relevant amendments made up to and including 29 March 2021.

Prepared on 21 July 2021 by the staff of the Australian Accounting Standards Board.

Compilation no. 5

Compilation date: 30 June 2021

Obtaining copies of Accounting Standards

Compiled versions of Standards, original Standards and amending Standards (see Compilation Details) are available on the AASB website: www.aasb.gov.au.

Australian Accounting Standards Board

PO Box 204

Collins Street West

Victoria 8007

AUSTRALIA

Phone: (03) 9617 7600

E-mail: [email protected]

Website: www.aasb.gov.au

Other enquiries

Phone: (03) 9617 7600

E-mail: [email protected]

Copyright

© Commonwealth of Australia 2021

This work is copyright, including the digital devices and links. Apart from any use as permitted under the Copyright Act 1968, no part may be reproduced by any process without prior written permission. Reproduction within Australia in unaltered form (retaining this notice) is permitted for personal and non-commercial use subject to the inclusion of an acknowledgment of the source. Requests and enquiries concerning reproduction and rights should be addressed to The National Director, Australian Accounting Standards Board, PO Box 204, Collins Street West, Victoria 8007.

Rubric

Australian Accounting Standard AASB 1053 Application of Tiers of Australian Accounting Standards (as amended) is set out in paragraphs 1 – 23 and Appendices A, B and E. All the paragraphs have equal authority. Paragraphs in bold type state the main principles. Terms defined in Appendix A are in italics the first time they appear in the Standard. AASB 1053 is to be read in the context of other Australian Accounting Standards, including AASB 1048 Interpretation of Standards, which identifies the Australian Accounting Interpretations, and AASB 1057 Application of Australian Accounting Standards. In the absence of explicit guidance, AASB 108 Accounting Policies, Changes in Accounting Estimates and Errors provides a basis for selecting and applying accounting policies.

Comparison with IFRS for SMEs

The disclosures required by Tier 2 and the disclosures required by the IASB’s International Financial Reporting Standard for Small and Medium-sized Entities (IFRS for SMEs) are highly similar. However, Tier 2 requirements and the IFRS for SMEs are not directly comparable as a consequence of Tier 2 including recognition and measurement requirements corresponding to those in IFRS Standards, whereas the IFRS for SMEs includes limited modifications to those requirements.

In addition, the recognition, measurement and disclosure requirements that apply in accordance with Tier 2 are revised as Australian Accounting Standards are revised, whereas the IFRS for SMEs is expected to be revised only periodically for revisions of IFRS Standards.

Accounting Standard AASB 1053

The Australian Accounting Standards Board made Accounting Standard AASB 1053 Application of Tiers of Australian Accounting Standards under section 334 of the Corporations Act 2001 on 30 June 2010.

This compiled version of AASB 1053 applies to annual reporting periods beginning on or after 1 July 2021. It incorporates relevant amendments contained in other AASB Standards made by the AASB up to and including 29 March 2021 (see Compilation Details).

Objective

1

The objective of this Standard is to set out the application of Tiers of Australian Accounting Standards to different categories of entities preparing general purpose financial statements.

AusCF1

AusCF entities are:

(a) not-for-profit entities; and

(b) for-profit entities that are not applying the Conceptual Framework for Financial Reporting (as identified in AASB 1048 Interpretation of Standards).

For AusCF entities, the term ‘reporting entity’ is defined in AASB 1057 Application of Australian Accounting Standards and Statement of Accounting Concepts SAC 1 Definition of the Reporting Entity also applies. For-profit entities applying the Conceptual Framework for Financial Reporting are set out in paragraph Aus1.1 of the Conceptual Framework.

Application

2

[Deleted by the AASB]

3

This Standard applies to annual reporting periods beginning on or after 1 July 2013.

[Note: For application dates of paragraphs changed or added by an amending Standard, see Compilation Details.]

4

This Standard may be applied to annual reporting periods beginning on or after 1 July 2009 but before 1 July 2013. When an entity applies this Standard to such an annual reporting period it shall disclose that fact.

5

When an entity elects to early adopt this Standard for an annual reporting period beginning on or after 1 July 2009 but before 1 July 2013 and prepares Tier 2 general purpose financial statements, it shall also adopt the relevant Standards that specify Tier 2 reporting requirements.

6

[Deleted by the AASB]

Tiers of Reporting Requirements

7

Australian Accounting Standards consist of two Tiers of reporting requirements for preparing general purpose financial statements:

(a) Tier 1: Australian Accounting Standards; and

(b) Tier 2: Australian Accounting Standards – Simplified Disclosures.

8

Tier 1 incorporates International Financial Reporting Standards (IFRSs) issued by the International Accounting Standards Board (IASB) and include requirements that are specific to Australian entities.

9

Tier 2 comprises the recognition and measurement requirements of Tier 1 (including consolidation and the equity method of accounting) but substantially reduced disclosure requirements. Except for the presentation of a third statement of financial position under Tier 1[1] and the option of not presenting a statement of changes in equity[2], the presentation requirements under Tier 1 and Tier 2 are the same. Tier 2 disclosure requirements are set out in AASB 1060 General Purpose Financial Statements – Simplified Disclosures for For-Profit and Not-for-Profit Tier 2 Entities.

10

Each Australian Accounting Standard specifies the entities to which it applies and, where necessary, sets out disclosure requirements from which Tier 2 entities are exempt.

Under AASB 101 Presentation of Financial Statements, a complete set of financial statements includes a statement of financial position as at the beginning of the earliest comparative period when an entity applies an accounting policy retrospectively or makes a retrospective restatement of items in its financial statements, or when it reclassifies items in its financial statements.

AASB 1060 General Purpose Financial Statements – Simplified Disclosures for For-Profit and Not-for-Profit Tier 2 Entities, paragraph 26, permits the presentation of a single statement of income and retained earnings in place of the statement of changes in equity if the only changes to equity during the periods for which financial statements are presented arise from profit or loss, payment of dividends, corrections of prior period errors, and changes in accounting policies.

Application of Australian Accounting Standards under the Differential Reporting Framework

Application of Tier 1 Reporting Requirements

11

The following types of entities shall prepare general purpose financial statements that comply with Tier 1 reporting requirements:

(a) for-profit private sector entities that have public accountability and are required by legislation to prepare financial statements that comply with either Australian Accounting Standards or accounting standards; and

(b) the Australian Government and State, Territory and Local Governments.

12

Subject to AASB 1049, GGSs of the Australian Government and State and Territory Governments shall apply Tier 1 reporting requirements.

Application of Tier 2 Reporting Requirements

13

Tier 2 reporting requirements shall, as a minimum, apply to the general purpose financial statements of the following types of entities:

(a) for-profit private sector entities that do not have public accountability;

(b) not-for-profit private sector entities; and

(c) public sector entities, whether for-profit or not-for-profit, other than the Australian Government and State, Territory and Local Governments.

These types of entities may elect to apply Tier 1 reporting requirements in preparing general purpose financial statements.

14

Entities applying Tier 2 reporting requirements would not be able to state compliance with IFRSs.

15

Whilst Tier 2 reporting requirements are available under this Standard for general purpose financial statements of non-publicly accountable for-profit private sector entities, not-for-profit private sector entities and public sector entities (both for-profit or not-for-profit) other than those required to apply Tier 1 reporting requirements, regulators might exercise a power to require the application of Tier 1 reporting requirements.

16

Disclosures under Tier 2 reporting requirements are the minimum disclosures required to be included in general purpose financial statements. Entities may include additional disclosures using Tier 1 reporting requirements as a guide if, in their judgement, such additional disclosures are consistent with the objective of general purpose financial statements.

Application of AASB 1

17

Entities adopting Tier 2 reporting requirements for the first time that apply AASB 1 shall comply with the simplified disclosures under AASB 1060 paragraphs 206–213, including for the purposes of paragraphs 18A(a) and 18A(b).

First-time Adoption of Australian Accounting Standards

18

When applying Tier 1 reporting requirements for the first time, an entity that prepared its most recent previous financial statements in the form of special purpose financial statements shall apply all the relevant requirements of AASB 1.

18A

When applying Tier 2 reporting requirements for the first time, an entity that prepared its most recent previous financial statements in the form of special purpose financial statements:

(a) without applying, or only selectively applying, applicable recognition and measurement requirements of Australian Accounting Standards, including, if a parent entity, without presenting consolidated financial statements prepared in accordance with AASB 10 Consolidated Financial Statements (unless exempt), shall apply either:

(i) all the relevant requirements of AASB 1; or

(ii) Tier 2 reporting requirements directly using the requirements in AASB 108 Accounting Policies, Changes in Accounting Estimates and Errors;

(b) without presenting consolidated financial statements, on the basis that neither the parent nor the group was a reporting entity (as defined in AASB 1057), shall apply either:

(i) all the relevant requirements of AASB 1; or

(ii) Tier 2 reporting requirements directly using the requirements in AASB 108; and

(c) applying all applicable recognition and measurement requirements of Australian Accounting Standards, including, if a parent entity, presenting consolidated financial statements prepared in accordance with AASB 10 (unless exempt), shall not apply AASB 1.

18B

An entity applying paragraph 18A(c) continues applying the applicable recognition and measurement requirements of Australian Accounting Standards, whether it had previously initially applied recognition and measurement requirements consistent with AASB 1 or a predecessor to AASB 108, whichever was applicable at the time.

18C

Entities that are applying AASB 1060 shall provide the disclosures required under AASB 1060 paragraphs 206–213 if they are applying paragraph 18A(a)(i) or 18A(b)(i), or the disclosures required under AASB 1060 paragraphs 106–110 if they are applying paragraphs 18A(a)(ii) or 18A(b)(ii), instead of the disclosures required under AASB 1 or AASB 108.

18D

Paragraph 18A(a) addresses where an entity has not applied, or only selectively applied, applicable recognition and measurement requirements, rather than whether the entity had made an explicit and unreserved statement of compliance with such requirements. As such, if an entity becomes aware it had claimed compliance with applicable recognition and measurement requirements of Australian Accounting Standards in error in its most recent previous special purpose financial statements, the entity applies paragraph 18A(a).

Reapplication of Australian Accounting Standards other than Transitioning between Tiers

19

Subject to paragraphs 19A and 21, an entity that:

(a) has applied Tier 1 reporting requirements or IFRSs in a previous reporting period; but

(b) whose most recent previous annual financial statements did not contain an explicit and unreserved statement of compliance with Tier 1 reporting requirements[3] or IFRSs; and

(c) is resuming or commencing the application of Tier 1 reporting requirements;

shall apply all the relevant requirements of AASB 1, or the AASB 1 option for retrospective application of Australian Accounting Standards in accordance with AASB 108 as if the entity had never stopped applying Australian Accounting Standards or IFRSs.

Compliance with Tier 1 reporting requirements is a reference to compliance with Australian Accounting Standards (Tier 1).

19A

An entity that is to claim IFRS compliance on resuming Tier 1 reporting requirements under paragraph 19, shall not use the AASB 1 option for retrospective application of Australian Accounting Standards in accordance with AASB 108 if it was not previously IFRS compliant.

19B

Subject to paragraph 23, an entity that:

(a) has applied Tier 2 reporting requirements[4] in a previous reporting period; but

(b) whose most recent previous annual financial statements did not contain an explicit and unreserved statement of compliance with Tier 2 reporting requirements[5]; and

(c) is resuming the application of Tier 2 reporting requirements;

shall:

(d) apply all the relevant requirements of AASB 1, or the AASB 1 option for retrospective application of Australian Accounting Standards in accordance with AASB 108 as if the entity had never stopped applying Tier 2 reporting requirements, if the entity did not apply all applicable recognition and measurement requirements of Australian Accounting Standards; or

(e) not apply AASB 1, or the AASB 1 option for retrospective application of Australian Accounting Standards in accordance with AASB 108, if the entity applied all applicable recognition and measurement requirements of Australian Accounting Standards.

20

Entities described in paragraph 19B(a)-(c) resume the application of Tier 2 reporting requirements effectively using the same approach as an entity would for first transitioning from special purpose financial statements to Tier 2 reporting requirements set out in paragraph 18A. Accordingly, an entity that did not comply with Tier 2 reporting requirements due solely to omitting some disclosures, but otherwise continued to apply all applicable recognition and measurement requirements, is prohibited from applying AASB 1 on returning to Tier 2 requirements. Instead, it continues applying applicable recognition and measurement requirements, whether it had previously initially applied AASB 1 or a predecessor to AASB 108, whichever was applicable at the time. However, if such an entity did not continue to apply all applicable recognition and measurement requirements of Australian Accounting Standards in its most recent previous annual financial statements, that entity is required to apply AASB 1, or the AASB 1 option for retrospective application of Australian Accounting Standards in accordance with AASB 108, on resuming the application of Tier 2 reporting requirements.

22

In relation to paragraph 21(a), entities claiming compliance with IFRSs (which would include for-profit entities applying Tier 1 reporting requirements) need to apply the relevant requirements of AASB 1. This is because, in previously applying Tier 2 reporting requirements, these entities have applied only some of the disclosure requirements of AASB 1 or were prohibited or exempted from applying AASB 1.

23

An entity transitioning from Tier 1 to Tier 2 shall not apply AASB 1.

24

[Deleted by the AASB]

In this context, Tier 2 reporting requirements refers to either Australian Accounting Standards – Reduced Disclosure Requirements or Australian Accounting Standards – Simplified Disclosures, as appropriate.

Compliance with Tier 2 reporting requirements is a reference to compliance with Australian Accounting Standards – Simplified Disclosures.

Appendix A -- Defined Terms

This appendix is an integral part of AASB 1053.

The following terms have the meanings specified:

A[1]

General purpose financial statements are those intended to meet the needs of users who are not in a position to require an entity to prepare reports tailored to their particular information needs.

A[2]

Public accountability – an entity has public accountability if:

(a) its debt or equity instruments are traded in a public market or it is in the process of issuing such instruments for trading in a public market (a domestic or foreign stock exchange or an over-the-counter market, including local and regional markets); or

(b) it holds assets in a fiduciary capacity for a broad group of outsiders as one of its primary businesses.

Appendix B -- Public Accountability

This appendix is an integral part of AASB 1053.

B1

Public accountability is defined in Appendix A. The notion of public accountability is consistent with the notion adopted by the IASB in its International Financial Reporting Standard for Small and Medium-sized Entities (IFRS for SMEs). It is different from the notion of public accountability in the general sense of the term that is often employed in relation to not-for-profit, including public sector, entities.

B2

The following for-profit entities are deemed to have public accountability:

(a) disclosing entities, even if their debt or equity instruments are not traded in a public market or are not in the process of being issued for trading in a public market;

(b) co-operatives that issue debentures;

(c) registered managed investment schemes;

(d) superannuation plans regulated by the Australian Prudential Regulation Authority (APRA) other than Small APRA Funds as defined by APRA Superannuation Circular No. III.E.1 Regulation of Small APRA Funds, December 2000; and

(e) authorised deposit-taking institutions.

B3

Some entities may also hold assets in a fiduciary capacity for a broad group of outsiders because they hold and manage financial resources entrusted to them by clients, customers or members not involved in the management of the entity. However, if they do so for reasons incidental to a primary business (as, for example, may be the case for travel or real estate agents, schools, charitable organisations, co-operative enterprises requiring a nominal membership deposit and sellers that receive payment in advance of delivery of the goods or services such as utility companies), that does not make them publicly accountable.

B4

Examples of entities that hold assets in a fiduciary capacity for a broad group of outsiders as one of its primary businesses are most likely to include banks, credit unions, insurance companies, securities brokers/dealers, mutual funds and investment banks.

Appendix C -- Transition

This appendix accompanies, but is not part of, AASB 1053.

This Appendix is intended to facilitate the application of the requirements in paragraphs 17–23 of the Standard for the application of Tiers, and the transition between Tiers, of Australian Accounting Standards.

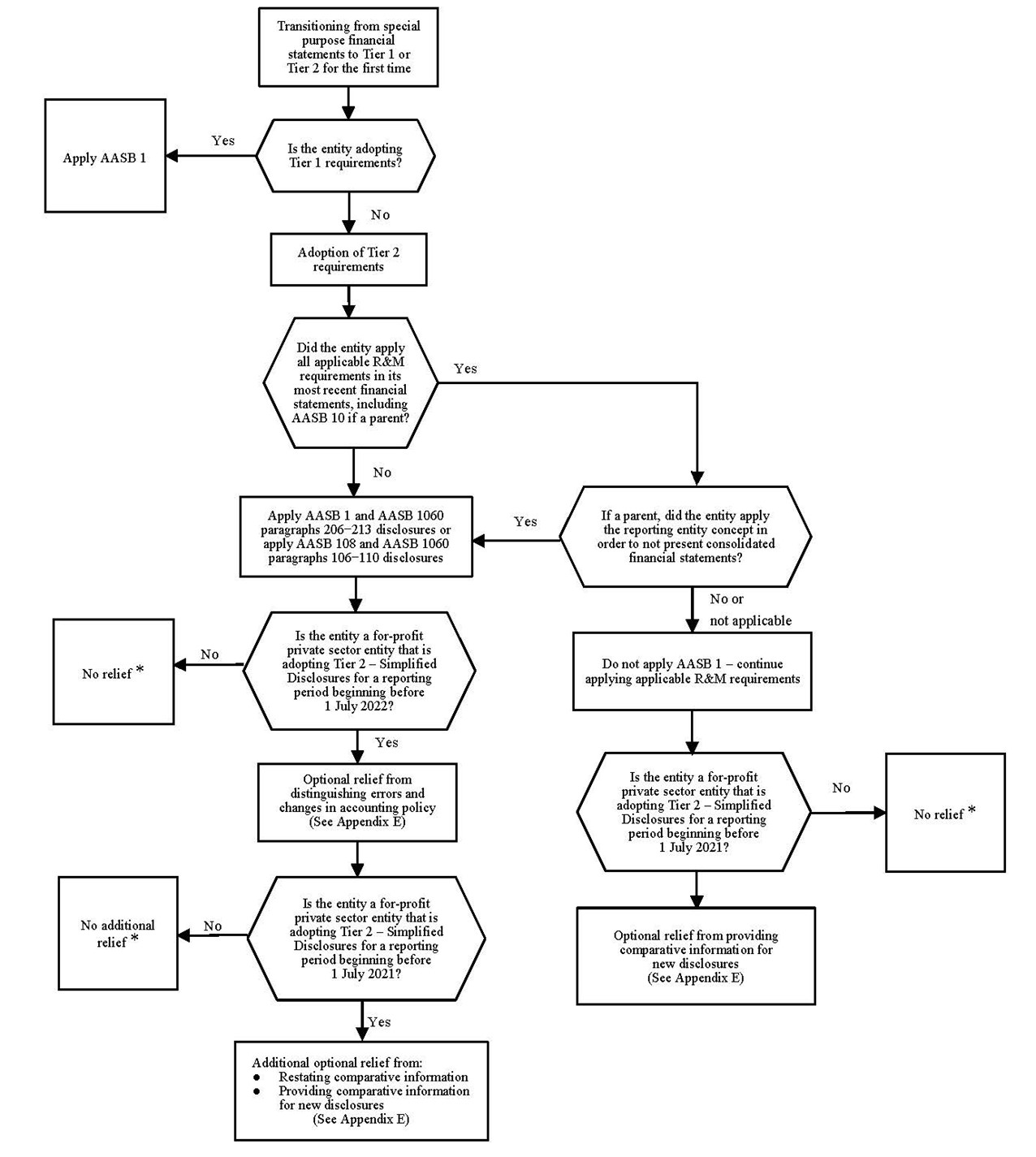

Chart 1: First-time Adoption of Tier 1 or Tier 2 Reporting Requirements (paragraphs 18–18D)

* AASB 1060, paragraph B1, provides optional relief from presenting comparative information for new disclosures for not-for-profit entities transitioning early from either Tier 1 or Tier 2 – Reduced Disclosure Requirements to Tier 2 – Simplified Disclosures.

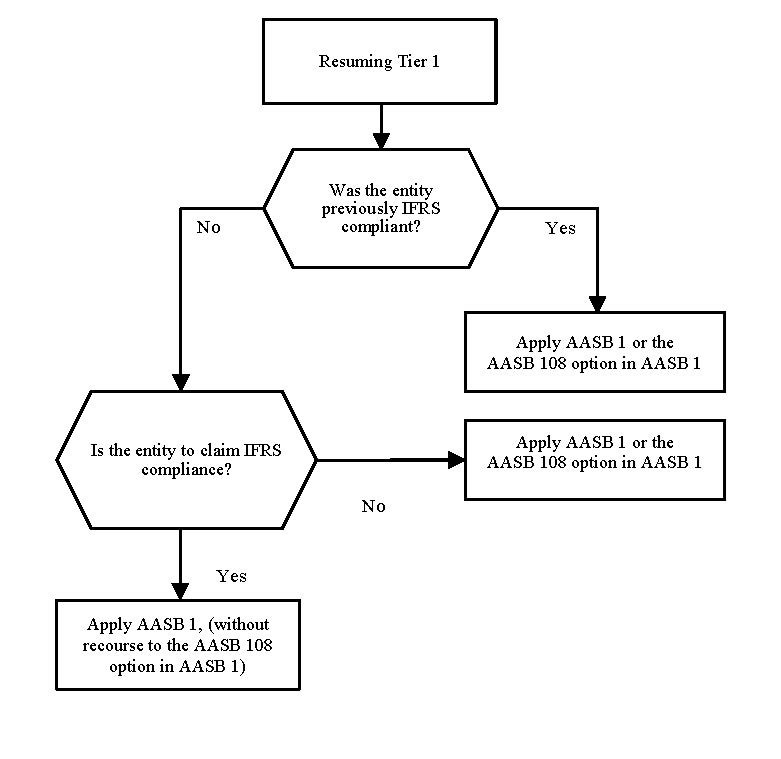

Chart 2: Re-application of Tier 1 Reporting Requirements (paragraphs 19 and 19A)

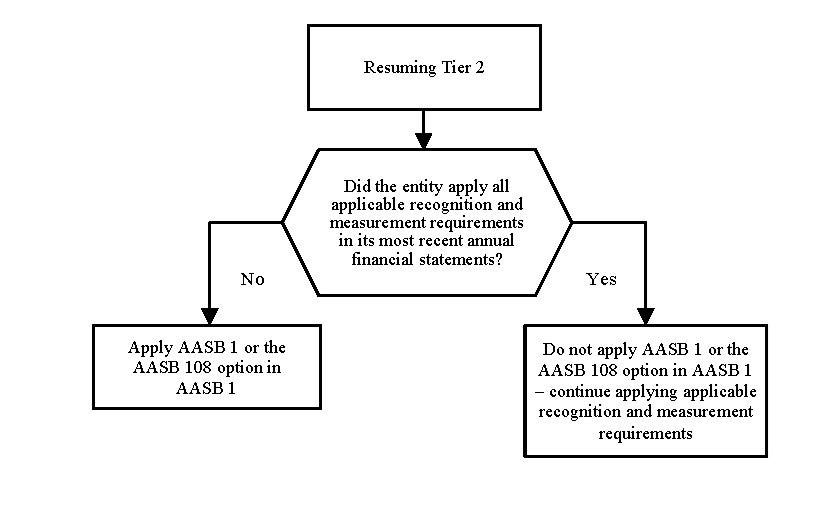

Chart 3: Re-application of Tier 2 Reporting Requirements (paragraph 19B)

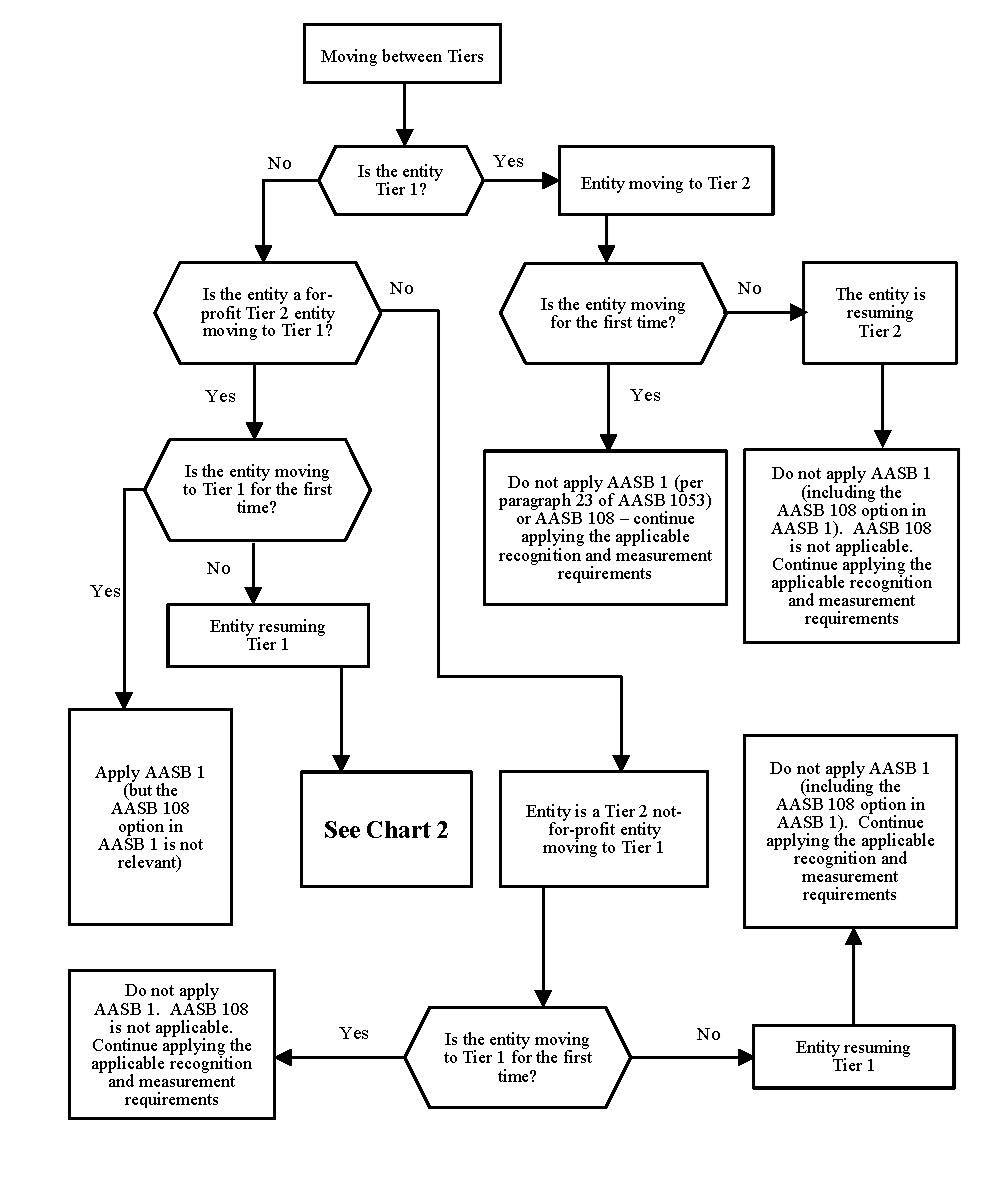

Chart 4: Moving between Tiers (paragraphs 21 and 23)

Appendix D -- Transition Scenarios

This appendix accompanies, but is not part of AASB 1053. It is intended to summarise which paragraphs of AASB 1053 (as revised by AASB 2014-2 Amendments to AASB 1053 – Transition to and between Tiers, and related Tier 2 Disclosure Requirements) would apply in particular common scenarios, and their consequences.

|

A previous reporting period |

The most recent previous reporting period |

Current reporting period |

Applicable paragraph of AASB 1053 |

Consequence |

Rationale |

Basis for Conclusions paragraph accompanying AASB 2014-2 |

|

|

|

First time adopt T1 |

|

|

|

|

|

SPFSs |

SPFSs using R&M |

T1 IFRS |

AASB 1 |

IFRS adoption |

BC17 |

|

|

SPFSs |

SPFSs using R&M |

T1 non-IFRS |

AASB 1 |

Consistent with IFRS |

BC17 |

|

|

SPFSs |

SPFSs not using R&M |

T1 IFRS |

AASB 1 |

IFRS adoption |

BC17 |

|

|

SPFSs |

SPFSs not using R&M |

T1 non-IFRS |

AASB 1 |

Consistent with IFRS |

BC17 |

|

|

SPFSs |

T2 |

T1 IFRS |

AASB 1 |

IFRS adoption |

BC22 |

|

|

SPFSs |

T2 |

T1 non-IFRS |

Not AASB 1 |

Continue R&M, & BC93 of AASB 1053[2] |

BC22 |

|

|

|

|

First time adopt T2 |

|

|

|

|

|

SPFSs |

SPFSs using R&M |

T2 |

Not AASB 1 |

Continue R&M, & BC93 of AASB 1053 |

BC18 |

|

|

SPFSs |

SPFSs not using R&M |

T2 |

AASB 1 or directly through AASB 108 |

Cost/benefit considerations |

BC17&BC19 |

|

|

SPFSs |

T1 IFRSs |

T2 |

Not AASB 1 |

Continue R&M, & BC93 of AASB 1053 |

BC22 |

|

|

SPFSs |

T1 non-IFRS |

T2 |

Not AASB 1 |

Continue R&M, & BC93 of AASB 1053 |

BC22 |

|

|

|

|

Resume T1 |

|

|

|

|

|

T1 IFRS |

SPFSs using R&M |

T1 IFRS |

AASB 1 or AASB 108 option in AASB 1 |

IFRS adoption |

BC13 |

|

|

T1 IFRS |

SPFSs using R&M |

T1 non-IFRS |

AASB 1 or AASB 108 option in AASB 1 |

Consistent with IFRS |

BC13 |

|

|

T1 IFRS |

SPFSs not using R&M |

T1 IFRS |

AASB 1 or AASB 108 option in AASB 1 |

IFRS adoption |

BC13 |

|

|

T1 IFRS |

SPFSs not using R&M |

T1 non-IFRS |

AASB 1 or AASB 108 option in AASB 1 |

Consistent with IFRS |

BC13 |

|

|

T1 IFRS |

T2 |

T1 IFRS |

AASB 1 or AASB 108 option in AASB 1 |

IFRS adoption |

BC22 |

|

|

T1 IFRS |

T2 |

T1 non-IFRS |

Not AASB 1 |

Continue R&M, & BC93 of AASB 1053 |

BC22 |

|

|

T1 non-IFRS |

SPFSs using R&M |

T1 IFRS |

AASB 1 (but not AASB 108 option in AASB 1) |

IFRS adoption |

BC12 |

|

|

T1 non-IFRS |

SPFSs using R&M |

T1 non-IFRS |

AASB 1 or AASB 108 option in AASB 1 |

Consistent with IFRS |

|

|

|

T1 non-IFRS |

SPFSs not using R&M |

T1 IFRS |

AASB 1 (but not AASB 108 option in AASB 1) |

IFRS adoption |

BC12 |

|

|

T1 non-IFRS |

SPFSs not using R&M |

T1 non-IFRS |

AASB 1 or AASB 108 option in AASB 1 |

Consistent with IFRS |

|

|

|

T1 non-IFRS |

T2 |

T1 IFRS |

AASB 1 (but not AASB 108 option in AASB 1) |

IFRS adoption |

BC12&BC22 |

|

|

T1 non-IFRS |

T2 |

T1 non-IFRS |

Not AASB 1 |

Continue R&M, & BC93 of AASB 1053 |

BC22 |

|

|

|

|

Resume T2 |

|

|

|

|

|

T2 |

SPFSs using R&M |

T2 |

Not AASB 1 or AASB 108 option in AASB 1 |

Continue R&M, & BC93 of AASB 1053 |

BC14 |

|

|

T2 |

SPFSs not using R&M |

T2 |

AASB 1 or AASB 108 option in AASB 1 |

Consistent with IFRS |

|

|

|

T2 |

T1 IFRS |

T2 |

Not AASB 1 or AASB 108 option in AASB 1 |

Continue R&M, & BC93 of AASB 1053 |

BC22 |

|

|

T2 |

T1 non-IFRS |

T2 |

Not AASB 1 or AASB 108 option in AASB 1 |

Continue R&M, & BC93 of AASB 1053 |

BC22 |

Legend:

SPFSs: special purpose financial statements;

R&M: recognition and measurement in Australian Accounting Standards;

T1: Tier 1;

T2: Tier 2; and

BC: Basis for Conclusions.

AASB 1053 Application of Tiers of Australian Accounting Standards (June 2010).

Appendix E -- Short-term exemptions for entities applying Tier 2 – Simplified Disclosures for periods beginning before 1 July 2022

This appendix is an integral part of AASB 1053

Short-term exemptions for for-profit private sector entities

E1

This appendix sets out optional short-term exemptions for for-profit private sector entities applying AASB 1060 General Purpose Financial Statements – Simplified Disclosures for For-Profit and Not-for-Profit Tier 2 Entities to periods beginning before 1 July 2022, as follows:

(a) relief from distinguishing the correction of errors and changes in accounting policy, for periods beginning before 1 July 2022 (see paragraph E3);

(b) relief from providing comparative information not previously disclosed in the notes, for periods beginning before 1 July 2021 (see paragraph E4); and

(c) relief from restating comparative information, for periods beginning before 1 July 2021 (see paragraphs E5–E7).

E2

If an entity applies one or more of the exemptions set out in this appendix, it shall disclose that fact.

Relief from distinguishing the correction of errors and changes in accounting policy

E3

For periods beginning before 1 July 2022, notwithstanding AASB 1060 paragraph 211 (for entities applying AASB 1 First-time Adoption of Australian Accounting Standards to the period) and AASB 1060 paragraph 110 (for entities applying AASB 108 Accounting Policies, Changes in Accounting Estimates and Errors instead of AASB 1), an entity applying paragraph 18A(a) or (b) need not distinguish the correction of errors and changes in accounting policies if the entity becomes aware of errors made in its most recent previous special purpose financial statements.

Relief from presenting comparative information not previously disclosed in the notes

E4

Notwithstanding AASB 1060 paragraph 20, entities that elect to apply AASB 1060 to periods beginning before 1 July 2021 (ie early application) need not present comparative information in the notes if the entity did not disclose the comparable information in its most recent previous financial statements.

Relief from restating comparative information for certain for-profit private sector entities

E5

Paragraphs E6–E7 apply to a for-profit private sector entity that elects to apply AASB 1060 to periods beginning before 1 July 2021 (ie early application) and also applies AASB 1 in preparing its first Australian-Accounting-Standards financial statements (Tier 2) for the period.

E6

Notwithstanding AASB 1 paragraph 7, comparative information need not be restated in the entity’s first Australian-Accounting-Standards financial statements (Tier 2). Under this approach, references to the ‘date of transition to Australian Accounting Standards’ in AASB 1 shall mean the beginning of the first Australian-Accounting-Standards reporting period. Consequently, consistent with AASB 1 paragraph 11, the entity shall recognise adjustments arising from any differences between the carrying amounts in its previous special purpose financial statements and its opening carrying amounts based on the retrospective application of Australian Accounting Standards directly in retained earnings (or, if appropriate, another category of equity) at the beginning of the first Australian-Accounting-Standards reporting period.

E7

An entity that elects to not restate comparative information in its first Australian-Accounting-Standards financial statements (Tier 2) in accordance with paragraph E6 need not provide the reconciliations required by AASB 1060 paragraphs 210(b) and (c). The entity shall:

(a) present two statements of financial position, two statements of profit or loss and other comprehensive income, two separate statements of profit or loss (if presented), two statements of cash flows and two statements of changes in equity and related notes, as follows:

(i) the statements and related notes as at the end of the first Australian-Accounting-Standards reporting period, compliant with Australian Accounting Standards; and

(ii) the statements and related notes presented in its most recent previous special purpose financial statements (not necessarily compliant with Australian Accounting Standards);

(b) disclose a reconciliation of its equity presented in its most recent previous special purpose financial statements to its equity determined in accordance with Australian Accounting Standards – Simplified Disclosures at the date of transition to Australian Accounting Standards – Simplified Disclosures;

(c) disclose a description of the main adjustments that would have been required to make the comparative statement of profit or loss and other comprehensive income and separate statement of profit or loss (if presented) compliant with Australian Accounting Standards. The entity need not quantify those adjustments; and

(d) prominently label the comparative information that is not compliant with Australian Accounting Standards as such.

Compilation details

Accounting Standard AASB 1053 Application of Tiers of Australian Accounting Standards (as amended)

Compilation details are not part of AASB 1053.

This compiled Standard applies to annual reporting periods beginning on or after 1 July 2021. It takes into account amendments up to and including 29 March 2021 and was prepared on 21 July 2021 by the staff of the Australian Accounting Standards Board (AASB).

This compilation is not a separate Accounting Standard made by the AASB. Instead, it is a representation of AASB 1053 (June 2010) as amended by other Accounting Standards, which are listed in the table below.

Table of Standards

Table of amendments to Standard

Table of amendments to Guidance

Basis for Conclusions on AASB 2014-2

This Basis for Conclusions accompanies, but is not part of, AASB 1053. The Basis for Conclusions was originally published with AASB 2014-2 Amendments to AASB 1053 – Transition to and between Tiers, and related Tier 2 Disclosure Requirements.

The Basis for Conclusions is provided with this Standard as a linked PDF document. See AASB Extras at right.