This Interpretation gives guidance on the accounting by operators for public-to-private service concession arrangements.

Preamble

Pronouncement

This compiled AASB Interpretation applies to annual reporting periods beginning on or after 1 January 2020. Earlier application is permitted for annual reporting periods beginning after 24 July 2014 but before 1 January 2020. It incorporates relevant amendments made up to and including 21 May 2019.

Prepared on 2 March 2020 by the staff of the Australian Accounting Standards Board.

Obtaining copies of Interpretations

Compiled versions of Interpretations, original Interpretations and amending pronouncements (see Compilation Details) are available on the AASB website: www.aasb.gov.au.

Australian Accounting Standards Board

PO Box 204

Collins Street West

Victoria 8007

AUSTRALIA

Phone: (03) 9617 7600

E-mail: [email protected]

Website: www.aasb.gov.au

Other enquiries

Phone: (03) 9617 7600

E-mail: [email protected]

Copyright

© Commonwealth of Australia 2020

This compiled AASB Interpretation contains IFRS Foundation copyright material. Digital devices and links are copyright of the Commonwealth. Reproduction within Australia in unaltered form (retaining this notice) is permitted for personal and non-commercial use subject to the inclusion of an acknowledgment of the source. Requests and enquiries concerning reproduction and rights for commercial purposes within Australia should be addressed to The National Director, Australian Accounting Standards Board, PO Box 204, Collins Street West, Victoria 8007.

All existing rights in this material are reserved outside Australia. Reproduction outside Australia in unaltered form (retaining this notice) is permitted for personal and non-commercial use only. Further information and requests for authorisation to reproduce IFRS Foundation copyright material for commercial purposes outside Australia should be addressed to the IFRS Foundation at www.ifrs.org.

Rubric

AASB Interpretation 12 Service Concession Arrangements (as amended) is set out in paragraphs 1 – Aus30.1 and Appendix A. Interpretations are listed in Australian Accounting Standard AASB 1048 Interpretation of Standards and AASB 1057 Application of Australian Accounting Standards sets out their application. In the absence of explicit guidance, AASB 108 Accounting Policies, Changes in Accounting Estimates and Errors provides a basis for selecting and applying accounting policies.

Comparison with IFRIC 12

AASB Interpretation 12 Service Concession Arrangements as amended incorporates Interpretation IFRIC 12 Service Concession Arrangements as issued and amended by the International Accounting Standards Board (IASB). Australian specific paragraphs (which are not included in IFRIC 12) are identified with the prefix “Aus”. Paragraphs that apply only to not-for-profit entities begin by identifying their limited applicability.

Tier 1

For-profit entities complying with AASB Interpretation 12 also comply with IFRIC 12.

Not-for-profit entities’ compliance with IFRIC 12 will depend on whether any “Aus” paragraphs that specifically apply to not-for-profit entities provide additional guidance or contain applicable requirements that are inconsistent with IFRIC 12.

AASB 1053 Application of Tiers of Australian Accounting Standards explains the two tiers of reporting requirements.

AASB Interpretation 12

Interpretation 12 was issued in August 2015.

This compiled version of Interpretation 12 applies to annual periods beginning on or after 1 January 2020. It incorporates relevant amendments contained in other AASB pronouncements up to and including 21 May 2019 (see Compilation Details).

References

• Framework for the Preparation and Presentation of Financial Statements[1]

• AASB 1 First-time Adoption of Australian Accounting Standards

• AASB 7 Financial Instruments: Disclosures

• AASB 9 Financial Instruments

• AASB 15 Revenue from Contracts with Customers

• AASB 16 Leases

• AASB 108 Accounting Policies, Changes in Accounting Estimates and Errors

• AASB 116 Property, Plant and Equipment

• AASB 120 Accounting for Government Grants and Disclosure of Government Assistance

• AASB 123 Borrowing Costs

• AASB 132 Financial Instruments: Presentation

• AASB 136 Impairment of Assets

• AASB 137 Provisions, Contingent Liabilities and Contingent Assets

• AASB 138 Intangible Assets

• AASB Interpretation 129 Service Concession Arrangements: Disclosures[2]

The reference is to the Framework for the Preparation and Presentation of Financial Statements adopted by the AASB in 2004 and in effect when the Interpretation was developed.

UIG Interpretation 129 Disclosure – Service Concession Arrangements was amended and reissued as AASB Interpretation 129 concurrently with the issue of this Interpretation.

Background

1

In many countries, infrastructure for public services—such as roads, bridges, tunnels, prisons, hospitals, airports, water distribution facilities, energy supply and telecommunication networks—has traditionally been constructed, operated and maintained by the public sector and financed through public budget appropriation.

2

In some countries, governments have introduced contractual service arrangements to attract private sector participation in the development, financing, operation and maintenance of such infrastructure. The infrastructure may already exist, or may be constructed during the period of the service arrangement. An arrangement within the scope of this Interpretation typically involves a private sector entity (an operator) constructing the infrastructure used to provide the public service or upgrading it (for example, by increasing its capacity) and operating and maintaining that infrastructure for a specified period of time. The operator is paid for its services over the period of the arrangement. The arrangement is governed by a contract that sets out performance standards, mechanisms for adjusting prices, and arrangements for arbitrating disputes. Such an arrangement is often described as a ‘build-operate-transfer’, a ‘rehabilitate-operate-transfer’ or a ‘public-to-private’ service concession arrangement.

3

A feature of these service arrangements is the public service nature of the obligation undertaken by the operator. Public policy is for the services related to the infrastructure to be provided to the public, irrespective of the identity of the party that operates the services. The service arrangement contractually obliges the operator to provide the services to the public on behalf of the public sector entity. Other common features are:

(a) the party that grants the service arrangement (the grantor) is a public sector entity, including a governmental body, or a private sector entity to which the responsibility for the service has been devolved.

(b) the operator is responsible for at least some of the management of the infrastructure and related services and does not merely act as an agent on behalf of the grantor.

(c) the contract sets the initial prices to be levied by the operator and regulates price revisions over the period of the service arrangement.

(d) the operator is obliged to hand over the infrastructure to the grantor in a specified condition at the end of the period of the arrangement, for little or no incremental consideration, irrespective of which party initially financed it.

Scope

4

This Interpretation gives guidance on the accounting by operators for public-to-private service concession arrangements.

5

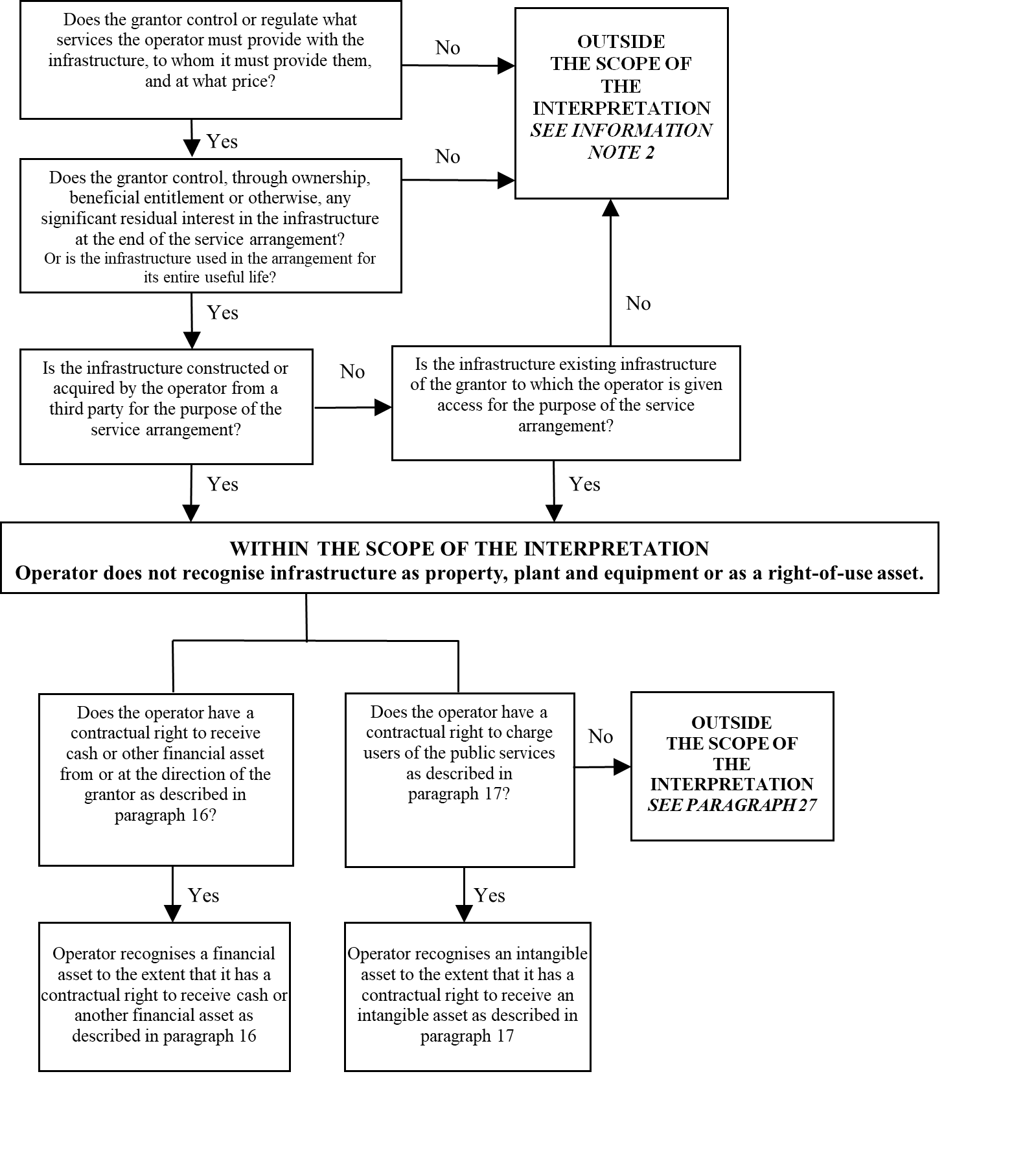

This Interpretation applies to public-to-private service concession arrangements if:

(a) the grantor controls or regulates what services the operator must provide with the infrastructure, to whom it must provide them, and at what price; and

(b) the grantor controls—through ownership, beneficial entitlement or otherwise—any significant residual interest in the infrastructure at the end of the term of the arrangement.

6

Infrastructure used in a public-to-private service concession arrangement for its entire useful life (whole of life assets) is within the scope of this Interpretation if the conditions in paragraph 5(a) are met. Paragraphs AG1–AG8 provide guidance on determining whether, and to what extent, public-to-private service concession arrangements are within the scope of this Interpretation.

7

This Interpretation applies to both:

(a) infrastructure that the operator constructs or acquires from a third party for the purpose of the service arrangement; and

(b) existing infrastructure to which the grantor gives the operator access for the purpose of the service arrangement.

8

This Interpretation does not specify the accounting for infrastructure that was held and recognised as property, plant and equipment by the operator before entering the service arrangement. The derecognition requirements of Australian Accounting Standards (set out in AASB 116) apply to such infrastructure.

9

This Interpretation does not specify the accounting by grantors.

Issues

10

This Interpretation sets out general principles on recognising and measuring the obligations and related rights in service concession arrangements. Requirements for disclosing information about service concession arrangements are in Interpretation 129. The issues addressed in this Interpretation are:

(a) treatment of the operator’s rights over the infrastructure;

(b) recognition and measurement of arrangement consideration;

(c) construction or upgrade services;

(d) operation services;

(e) borrowing costs;

(f) subsequent accounting treatment of a financial asset and an intangible asset; and

(g) items provided to the operator by the grantor.

Consensus

Treatment of the operator’s rights over the infrastructure

11

Infrastructure within the scope of this Interpretation shall not be recognised as property, plant and equipment of the operator because the contractual service arrangement does not convey the right to control the use of the public service infrastructure to the operator. The operator has access to operate the infrastructure to provide the public service on behalf of the grantor in accordance with the terms specified in the contract.

Recognition and measurement of arrangement consideration

12

Under the terms of contractual arrangements within the scope of this Interpretation, the operator acts as a service provider. The operator constructs or upgrades infrastructure (construction or upgrade services) used to provide a public service and operates and maintains that infrastructure (operation services) for a specified period of time.

13

The operator shall recognise and measure revenue in accordance with AASB 15 for the services it performs. The nature of the consideration determines its subsequent accounting treatment. The subsequent accounting for consideration received as a financial asset and as an intangible asset is detailed in paragraphs 23–26 below.

Construction or upgrade services

14

The operator shall account for construction or upgrade services in accordance with AASB 15.

Consideration given by the grantor to the operator

15

If the operator provides construction or upgrade services the consideration received or receivable by the operator shall be recognised in accordance with AASB 15. The consideration may be rights to:

(a) a financial asset, or

(b) an intangible asset.

16

The operator shall recognise a financial asset to the extent that it has an unconditional contractual right to receive cash or another financial asset from or at the direction of the grantor for the construction services; the grantor has little, if any, discretion to avoid payment, usually because the agreement is enforceable by law. The operator has an unconditional right to receive cash if the grantor contractually guarantees to pay the operator (a) specified or determinable amounts or (b) the shortfall, if any, between amounts received from users of the public service and specified or determinable amounts, even if payment is contingent on the operator ensuring that the infrastructure meets specified quality or efficiency requirements.

17

The operator shall recognise an intangible asset to the extent that it receives a right (a licence) to charge users of the public service. A right to charge users of the public service is not an unconditional right to receive cash because the amounts are contingent on the extent that the public uses the service.

18

If the operator is paid for the construction services partly by a financial asset and partly by an intangible asset it is necessary to account separately for each component of the operator’s consideration. The consideration received or receivable for both components shall be recognised initially in accordance with AASB 15.

19

The nature of the consideration given by the grantor to the operator shall be determined by reference to the contract terms and, when it exists, relevant contract law. The nature of the consideration determines the subsequent accounting as described in paragraphs 23–26. However, both types of consideration are classified as a contract asset during the construction or upgrade period in accordance with AASB 15.

Operation services

20

The operator shall account for operation services in accordance with AASB 15.

Contractual obligations to restore the infrastructure to a specified level of serviceability

21

The operator may have contractual obligations it must fulfil as a condition of its licence (a) to maintain the infrastructure to a specified level of serviceability or (b) to restore the infrastructure to a specified condition before it is handed over to the grantor at the end of the service arrangement. These contractual obligations to maintain or restore infrastructure, except for any upgrade element (see paragraph 14), shall be recognised and measured in accordance with AASB 137, ie at the best estimate of the expenditure that would be required to settle the present obligation at the end of the reporting period.

Borrowing costs incurred by the operator

22

In accordance with AASB 123, borrowing costs attributable to the arrangement shall be recognised as an expense in the period in which they are incurred unless the operator has a contractual right to receive an intangible asset (a right to charge users of the public service). In this case borrowing costs attributable to the arrangement shall be capitalised during the construction phase of the arrangement in accordance with that Standard.

Financial asset

23

AASB 132, AASB 7 and AASB 9 apply to the financial asset recognised under paragraphs 16 and 18.

24

The amount due from or at the direction of the grantor is accounted for in accordance with AASB 9 as measured at:

(a) amortised cost; or

(b) fair value through other comprehensive income; or

(c) fair value through profit or loss.

25

If the amount due from the grantor is measured at amortised cost or fair value through other comprehensive income, AASB 9 requires interest calculated using the effective interest method to be recognised in profit or loss.

Intangible asset

26

AASB 138 applies to the intangible asset recognised in accordance with paragraphs 17 and 18. Paragraphs 45–47 of AASB 138 provide guidance on measuring intangible assets acquired in exchange for a non-monetary asset or assets or a combination of monetary and non-monetary assets.

Items provided to the operator by the grantor

27

In accordance with paragraph 11, infrastructure items to which the operator is given access by the grantor for the purposes of the service arrangement are not recognised as property, plant and equipment of the operator. The grantor may also provide other items to the operator that the operator can keep or deal with as it wishes. If such assets form part of the consideration payable by the grantor for the services, they are not government grants as defined in AASB 120. Instead, they are accounted for as part of the transaction price as defined in AASB 15.

Effective date

28

An entity shall apply this Interpretation for annual periods beginning on or after 1 January 2018. Earlier application is permitted for periods beginning after 24 July 2014 but before 1 January 2018. If an entity applies this Interpretation for a period beginning before 1 January 2018, it shall disclose that fact.

28A–28C

[Deleted]

28D

AASB 2014-5 Amendments to Australian Accounting Standards arising from AASB 15, issued in December 2014, amended the ‘References’ section and paragraphs 13–15, 18–20 and 27. An entity shall apply those amendments when it applies AASB 15.

28E

AASB 2010-7 Amendments to Australian Accounting Standards arising from AASB 9 (December 2010) (as amended) and AASB 2014-7 Amendments to Australian Accounting Standards arising from AASB 9 (December 2014) amended the previous version of this Interpretation as follows: amended paragraphs 23–25 and deleted paragraph 28A. Paragraph 28B, added by AASB 2010-7, was deleted by AASB 2014-1 Amendments to Australian Accounting Standards. Paragraph 28C, added by AASB 2014-1, was deleted by AASB 2014-7. An entity shall apply those amendments when it applies AASB 9.

28F

AASB 16, issued in February 2016, amended paragraph AG8. An entity shall apply that amendment when it applies AASB 16.

Transition

29

Subject to paragraph 30, changes in accounting policies are accounted for in accordance with AASB 108, ie retrospectively.

30

If, for any particular service arrangement, it is impracticable for an operator to apply this Interpretation retrospectively at the start of the earliest period presented, it shall:

(a) recognise financial assets and intangible assets that existed at the start of the earliest period presented;

(b) use the previous carrying amounts of those financial and intangible assets (however previously classified) as their carrying amounts as at that date; and

(c) test financial and intangible assets recognised at that date for impairment, unless this is not practicable, in which case the amounts shall be tested for impairment as at the start of the current period.

Appendix A -- Application guidance

This appendix is an integral part of the Interpretation.

Scope (paragraph 5)

AG1

Paragraph 5 of this Interpretation specifies that infrastructure is within the scope of the Interpretation when the following conditions apply:

(a) the grantor controls or regulates what services the operator must provide with the infrastructure, to whom it must provide them, and at what price; and

(b) the grantor controls—through ownership, beneficial entitlement or otherwise—any significant residual interest in the infrastructure at the end of the term of the arrangement.

AG2

The control or regulation referred to in condition (a) could be by contract or otherwise (such as through a regulator), and includes circumstances in which the grantor buys all of the output as well as those in which some or all of the output is bought by other users. In applying this condition, the grantor and any related parties shall be considered together. If the grantor is a public sector entity, the public sector as a whole, together with any regulators acting in the public interest, shall be regarded as related to the grantor for the purposes of this Interpretation.

AG3

For the purpose of condition (a), the grantor does not need to have complete control of the price: it is sufficient for the price to be regulated by the grantor, contract or regulator, for example by a capping mechanism. However, the condition shall be applied to the substance of the agreement. Non-substantive features, such as a cap that will apply only in remote circumstances, shall be ignored. Conversely, if for example, a contract purports to give the operator freedom to set prices, but any excess profit is returned to the grantor, the operator’s return is capped and the price element of the control test is met.

AG4

For the purpose of condition (b), the grantor’s control over any significant residual interest should both restrict the operator’s practical ability to sell or pledge the infrastructure and give the grantor a continuing right of use throughout the period of the arrangement. The residual interest in the infrastructure is the estimated current value of the infrastructure as if it were already of the age and in the condition expected at the end of the period of the arrangement.

AG5

Control should be distinguished from management. If the grantor retains both the degree of control described in paragraph 5(a) and any significant residual interest in the infrastructure, the operator is only managing the infrastructure on the grantor’s behalf—even though, in many cases, it may have wide managerial discretion.

AG6

Conditions (a) and (b) together identify when the infrastructure, including any replacements required (see paragraph 21), is controlled by the grantor for the whole of its economic life. For example, if the operator has to replace part of an item of infrastructure during the period of the arrangement (eg the top layer of a road or the roof of a building), the item of infrastructure shall be considered as a whole. Thus condition (b) is met for the whole of the infrastructure, including the part that is replaced, if the grantor controls any significant residual interest in the final replacement of that part.

AG7

Sometimes the use of infrastructure is partly regulated in the manner described in paragraph 5(a) and partly unregulated. However, these arrangements take a variety of forms:

(a) any infrastructure that is physically separable and capable of being operated independently and meets the definition of a cash-generating unit as defined in AASB 136 shall be analysed separately if it is used wholly for unregulated purposes. For example, this might apply to a private wing of a hospital, where the remainder of the hospital is used by the grantor to treat public patients.

(b) when purely ancillary activities (such as a hospital shop) are unregulated, the control tests shall be applied as if those services did not exist, because in cases in which the grantor controls the services in the manner described in paragraph 5, the existence of ancillary activities does not detract from the grantor’s control of the infrastructure.

AG8

The operator may have a right to use the separable infrastructure described in paragraph AG7(a), or the facilities used to provide ancillary unregulated services described in paragraph AG7(b). In either case, there may in substance be a lease from the grantor to the operator; if so, it shall be accounted for in accordance with AASB 16.

Information note 2 -- References to AASB pronouncements that apply to typical types of public-to-private arrangements

This note accompanies, but is not part of, AASB Interpretation 12.

The table sets out the typical types of arrangements for private sector participation in the provision of public sector services and provides references to Australian Accounting Standards that apply to those arrangements. The list of arrangements types is not exhaustive. The purpose of the table is to highlight the continuum of arrangements. It is not the IFRIC’s intention to convey the impression that bright lines exist between the accounting requirements for public-to-private arrangements.

Category | Lessee | Service provider | Owner | |||

Typical arrangement types | Lease (eg Operator leases asset from grantor) | Service and/or maintenance contract (specific tasks eg debt collection) | Rehabilitate-operate-transfer | Build- | Build-own-operate | 100% Divestment/ Privatisation/ Corporation |

Asset ownership | Grantor | Operator | ||||

Capital investment | Grantor | Operator | ||||

Demand risk | Shared | Grantor | Operator and/or Grantor | Operator | ||

Typical duration | 8–20 years | 1–5 years | 25–30 years | Indefinite (or may be limited by licence) | ||

Residual interest | Grantor | Operator | ||||

Relevant pronouncement | Interpretation 12 | |||||

Illustrative examples

These examples accompany, but are not part of, AASB Interpretation 12.

Example 1: The grantor gives the operator a financial asset

Arrangement terms

IE1

The terms of the arrangement require an operator to construct a road—completing construction within two years—and maintain and operate the road to a specified standard for eight years (ie years 3–10). The terms of the arrangement also require the operator to resurface the road at the end of year 8. At the end of year 10, the arrangement will end. Assume that the operator identifies three performance obligations for construction services, operation services and road resurfacing. The operator estimates that the costs it will incur to fulfil its obligations will be:

Table 1.1 Contract costs

IE2

The terms of the arrangement require the grantor to pay the operator 200 currency units (CU200) per year in years 3–10 for making the road available to the public.

IE3

For the purpose of this illustration, it is assumed that all cash flows take place at the end of the year.

Revenue

IE4

The operator recognises revenue in accordance with AASB 15 Revenue from Contracts with Customers. Revenue—the amount of consideration to which the operator expects to be entitled from the grantor for the services provided—is recognised when (or as) the performance obligations are satisfied. Under the terms of the arrangement the operator is obliged to resurface the road at the end of year 8. In year 8 the operator will be reimbursed by the grantor for resurfacing the road.

IE5

The total expected consideration (CU200 in each of years 3–10) is allocated to the performance obligations based on the relative stand-alone selling prices of the construction services, operation services and road resurfacing, taking into account the significant financing component, as follows:

Table 1.2 Transaction price allocated to each performance obligation

IE6

In year 1, for example, construction costs of CU500, construction revenue of CU525, and hence construction profit of CU25 are recognised in profit or loss.

Financial asset

IE7

During the first two years, the entity recognises a contract asset and accounts for the significant financing component in the arrangement in accordance with AASB 15. Once the construction is complete, the amounts due from the grantor are accounted for in accordance with AASB 9 Financial Instruments as receivables.

IE8

If the cash flows and fair values remain the same as those forecast, the effective interest rate is 6.18 per cent per year and the receivable recognised at the end of years 1–3 will be:

Table 1.3 Measurement of contract asset/receivable

|

|

CU |

|

|

Amount due for construction in year 1 |

525 |

|

|

Contract asset at end of year 1(a) |

525 |

|

|

Effective interest in year 2 on contract asset at the end of year 1 (6.18% × CU525) |

32 |

|

|

Amount due for construction in year 2 |

525 |

|

|

Receivable at end of year 2 |

1,082 |

|

|

Effective interest in year 3 on receivable at the end of year 2 (6.18% × CU1,082) |

67 |

|

|

Amount due for operation in year 3 (CU10 x (1 + 20%)) |

12 |

|

|

Cash receipts in year 3 |

(200) |

|

|

Receivable at end of year 3 |

961 |

|

|

(a) No effective interest arises in year 1 because the cash flows are assumed to take place at the end of the year. |

||

Overview of cash flows, statement of comprehensive income and statement of financial position

IE9

For the purpose of this illustration, it is assumed that the operator finances the arrangement wholly with debt and retained profits. It pays interest at 6.7 per cent per year on outstanding debt. If the cash flows and fair values remain the same as those forecast, the operator’s cash flows, statement of comprehensive income and statement of financial position over the duration of the arrangement will be:

Table 1.4 Cash flows (currency units)

|

Year |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

Total |

|

Receipts |

- |

- |

200 |

200 |

200 |

200 |

200 |

200 |

200 |

200 |

1,600 |

|

Contract costs(a) |

(500) |

(500) |

(10) |

(10) |

(10) |

(10) |

(10) |

(110) |

(10) |

(10) |

(1,180) |

|

Borrowing costs(b) |

- |

(34) |

(69) |

(61) |

(53) |

(43) |

(33) |

(23) |

(19) |

(7) |

(342) |

|

Net inflow/(outflow) |

(500) |

(534) |

121 |

129 |

137 |

147 |

157 |

67 |

171 |

183 |

78 |

|

(a) Table 1.1 (b) Debt at start of year (table 1.6) x 6.7% |

|||||||||||

Table 1.5 Statement of comprehensive income (currency units)

|

Year |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

Total |

|

Revenue |

525 |

525 |

12 |

12 |

12 |

12 |

12 |

122 |

12 |

12 |

1,256 |

|

Contract costs |

(500) |

(500) |

(10) |

(10) |

(10) |

(10) |

(10) |

(110) |

(10) |

(10) |

(1,180) |

|

Finance income(a) |

- |

32 |

67 |

59 |

51 |

43 |

34 |

25 |

22 |

11 |

344 |

|

Borrowing costs(b) |

- |

(34) |

(69) |

(61) |

(53) |

(43) |

(33) |

(23) |

(19) |

(7) |

(342) |

|

Net profit |

25 |

23 |

- |

- |

- |

2 |

3 |

14 |

5 |

6 |

78 |

|

(a) Amount due from grantor at start of year (table 1.6) × 6.18% (b) Cash/(debt) (table 1.6) × 6.7% |

|||||||||||

Table 1.6 Statement of financial position (currency units)

|

End of year |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

|

Amount due from grantor(a) |

525 |

1,082 |

961 |

832 |

695 |

550 |

396 |

343 |

177 |

- |

|

Cash/(debt)(b) |

(500) |

(1,034) |

(913) |

(784) |

(647) |

(500) |

(343) |

(276) |

(105) |

78 |

|

Net assets |

25 |

48 |

48 |

48 |

48 |

50 |

53 |

67 |

72 |

78 |

|

(a) Amount due from grantor at start of year, plus revenue and finance income earned in year (table 1.5), less receipts in year (table 1.4). (b) Debt at start of year plus net cash flow in year (table 1.4). |

||||||||||

IE10

This example deals with only one of many possible types of arrangements. Its purpose is to illustrate the accounting treatment for some features that are commonly found in practice. To make the illustration as clear as possible, it has been assumed that the arrangement period is only ten years and that the operator’s annual receipts are constant over that period. In practice, arrangement periods may be much longer and annual revenues may increase with time. In such circumstances, the changes in net profit from year to year could be greater.

Example 2: The grantor gives the operator an intangible asset (a licence to charge users)

Arrangement terms

IE11

The terms of a service arrangement require an operator to construct a road—completing construction within two years—and maintain and operate the road to a specified standard for eight years (ie years 3–10). The terms of the arrangement also require the operator to resurface the road when the original surface has deteriorated below a specified condition. The operator estimates that it will have to undertake the resurfacing at the end of year 8. At the end of year 10, the service arrangement will end. Assume that the operator identifies a single performance obligation for construction services. The operator estimates that the costs it will incur to fulfil its obligations will be:

Table 2.1 Contract costs

|

|

Year |

CU(a) |

|

|

Construction services |

1 |

500 |

|

|

|

2 |

500 |

|

|

Operating the road (per year) |

3–10 |

10 |

|

|

Road resurfacing |

8 |

100 |

|

|

(a) in this example, monetary amounts are denominated in ‘currency units (CU)’. |

|||

IE12

The terms of the arrangement allow the operator to collect tolls from drivers using the road. The operator forecasts that vehicle numbers will remain constant over the duration of the contract and that it will receive tolls of 200 currency units (CU200) in each of years 3–10.

IE13

For the purpose of this illustration, it is assumed that all cash flows take place at the end of the year.

Intangible asset

IE14

The operator provides construction services to the grantor in exchange for an intangible asset, ie a right to collect tolls from road users in years 3–10. In accordance with AASB 15, the operator measures this non-cash consideration at fair value. In this case, the operator determines the fair value indirectly by reference to the stand-alone selling price of the construction services delivered.

IE15

During the construction phase of the arrangement the operator’s contract asset (representing its accumulating right to be paid for providing construction services) is presented as an intangible asset (licence to charge users of the infrastructure). The operator estimates the stand-alone selling price of the construction services to be equal to the forecast construction costs plus 5 per cent margin, which the operator concludes is consistent with the rate that a market participant would require as compensation for providing the construction services and for assuming the risk associated with the construction costs. It is also assumed that, in accordance with AASB 123 Borrowing Costs, the operator capitalises the borrowing costs, estimated at 6.7 per cent, during the construction phase of the arrangement:

Table 2.2 Initial measurement of intangible asset

|

|

CU |

|

|

Construction services in year 1 |

525 |

|

|

Capitalisation of borrowing costs (table 2.4) |

34 |

|

|

Construction services in year 2 |

525 |

|

|

Intangible asset at end of year 2 |

1,084 |

|

|

|

|

|

IE16

In accordance with AASB 138, the intangible asset is amortised over the period in which it is expected to be available for use by the operator, ie years 3–10. The depreciable amount of the intangible asset (CU1,084) is allocated using a straight-line method. The annual amortisation charge is therefore CU1,084 divided by 8 years, ie CU135 per year.

Construction costs and revenue

IE17

The operator accounts for the construction services in accordance with AASB 15. It measures revenue at the fair value of the non-cash consideration received or receivable. Thus in each of years 1 and 2 it recognises in its profit or loss construction costs of CU500, construction revenue of CU525 and, hence, construction profit of CU25.

Toll revenue

IE18

The road users pay for the public services at the same time as they receive them, ie when they use the road. The operator therefore recognises toll revenue when it collects the tolls.

Resurfacing obligations

IE19

The operator’s resurfacing obligation arises as a consequence of use of the road during the operating phase. It is recognised and measured in accordance with AASB 137 Provisions, Contingent Liabilities and Contingent Assets, ie at the best estimate of the expenditure required to settle the present obligation at the end of the reporting period.

IE20

For the purpose of this illustration, it is assumed that the terms of the operator’s contractual obligation are such that the best estimate of the expenditure required to settle the obligation at any date is proportional to the number of vehicles that have used the road by that date and increases by CU17 (discounted to a current value) each year. The operator discounts the provision to its present value in accordance with AASB 137. The charge recognised each period in profit or loss is:

Table 2.3 Resurfacing obligation (currency units)

|

Year |

3 |

4 |

5 |

6 |

7 |

8 |

Total |

|

Obligation arising in year (CU17 discounted at 6%) |

12 |

13 |

14 |

15 |

16 |

17 |

87 |

|

Increase in earlier years’ provision arising from passage of time |

0 |

1 |

1 |

2 |

4 |

5 |

13 |

|

Total expense recognised in profit or loss |

12 |

14 |

15 |

17 |

20 |

22 |

100 |

Overview of cash flows, statement of comprehensive income and statement of financial position

IE21

For the purposes of this illustration, it is assumed that the operator finances the arrangement wholly with debt and retained profits. It pays interest at 6.7 per cent per year on outstanding debt. If the cash flows and fair values remain the same as those forecast, the operator’s cash flows, statement of comprehensive income and statement of financial position over the duration of the arrangement will be:

Table 2.4 Cash flows (currency units)

|

Year |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

Total |

|

Receipts |

- |

- |

200 |

200 |

200 |

200 |

200 |

200 |

200 |

200 |

1,600 |

|

Contract costs(a) |

(500) |

(500) |

(10) |

(10) |

(10) |

(10) |

(10) |

(110) |

(10) |

(10) |

(1,180) |

|

Borrowing costs(b) |

- |

(34) |

(69) |

(61) |

(53) |

(43) |

(33) |

(23) |

(19) |

(7) |

(342) |

|

Net inflow/ (outflow) |

(500) |

(534) |

121 |

129 |

137 |

147 |

157 |

67 |

171 |

183 |

78 |

|

(a) Table 2.1 (b) Debt at start of year (table 2.6) × 6.7% |

|||||||||||

Table 2.5 Statement of comprehensive income (currency units)

|

Year |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

Total |

|

Revenue |

525 |

525 |

200 |

200 |

200 |

200 |

200 |

200 |

200 |

200 |

2,650 |

|

Amortisation |

- |

- |

(135) |

(135) |

(136) |

(136) |

(136) |

(136) |

(135) |

(135) |

(1,084) |

|

Resurfacing expense |

- |

- |

(12) |

(14) |

(15) |

(17) |

(20) |

(22) |

- |

- |

(100) |

|

Other contract costs |

(500) |

(500) |

(10) |

(10) |

(10) |

(10) |

(10) |

(10) |

(10) |

(10) |

(1,080) |

|

Borrowing costs(a)(b) |

- |

- |

(69) |

(61) |

(53) |

(43) |

(33) |

(23) |

(19) |

(7) |

(308) |

|

Net profit |

25 |

25 |

(26) |

(20) |

(14) |

(6) |

1 |

9 |

36 |

48 |

78 |

|

(a) Borrowing costs are capitalised during the construction phase. (b) Table 2.4 |

|||||||||||

Table 2.6 Statement of financial position (currency units)

|

End of year |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

|

Intangible asset |

525 |

1,084 |

949 |

814 |

678 |

542 |

406 |

270 |

135 |

- |

|

Cash/(debt)(a) |

(500) |

(1,034) |

(913) |

(784) |

(647) |

(500) |

(343) |

(276) |

(105) |

78 |

|

Resurfacing obligation |

- |

- |

(12) |

(26) |

(41) |

(58) |

(78) |

- |

- |

- |

|

Net assets |

25 |

50 |

24 |

4 |

(10) |

(16) |

(15) |

(6) |

30 |

78 |

|

(a) Debt at start of year plus net cash flow in year (table 2.4) |

||||||||||

IE22

This example deals with only one of many possible types of arrangements. Its purpose is to illustrate the accounting treatment for some features that are commonly found in practice. To make the illustration as clear as possible, it has been assumed that the arrangement period is only ten years and that the operator’s annual receipts are constant over that period. In practice, arrangement periods may be much longer and annual revenues may increase with time. In such circumstances, the changes in net profit from year to year could be greater.

Example 3: The grantor gives the operator a financial asset and an intangible asset

Arrangement terms

IE23

The terms of a service arrangement require an operator to construct a road—completing construction within two years—and to operate the road and maintain it to a specified standard for eight years (ie years 3–10). The terms of the arrangement also require the operator to resurface the road when the original surface has deteriorated below a specified condition. The operator estimates that it will have to undertake the resurfacing at the end of year 8. At the end of year 10, the arrangement will end. Assume that the operator identifies a single performance obligation for construction services. The operator estimates that the costs it will incur to fulfil its obligations will be:

Table 3.1 Contract costs

|

|

Year |

CU(a) |

|

Construction services |

1 |

500 |

|

|

2 |

500 |

|

Operating the road (per year) |

3–10 |

10 |

|

Road resurfacing |

8 |

100 |

|

(a) in this example, monetary amounts are denominated in ‘currency units (CU)’. |

||

IE24

The operator estimates the consideration in respect of construction services to be CU1,050 by reference to the stand-alone selling price of those services (which it estimates at forecast cost plus 5 per cent).

IE25

The terms of the arrangement allow the operator to collect tolls from drivers using the road. In addition, the grantor guarantees the operator a minimum amount of CU700 and interest at a specified rate of 6.18 per cent to reflect the timing of cash receipts. The operator forecasts that vehicle numbers will remain constant over the duration of the contract and that it will receive tolls of CU200 in each of years 3–10.

IE26

For the purpose of this illustration, it is assumed that all cash flows take place at the end of the year.

Dividing the arrangement

IE27

The contractual right to receive cash from the grantor for the services and the right to charge users for the public services should be regarded as two separate assets under Australian Accounting Standards. Therefore in this arrangement it is necessary to divide the operator’s contract asset during the construction phase into two components—a financial asset component based on the guaranteed amount and an intangible asset for the remainder. When the construction services are completed, the two components of the contract asset would be classified and measured as a financial asset and an intangible asset accordingly.

Table 3.2 Dividing the operator’s consideration

|

Year |

Total |

Financial |

Intangible |

|

Construction services in year 1 |

525 |

350 |

175 |

|

Construction services in year 2 |

525 |

350 |

175 |

|

Total construction services |

1,050 |

700 |

350 |

|

|

100% |

67%(a) |

33% |

|

Finance income, at specified rate of 6.18% on receivable (see table 3.3) |

22 |

22 |

– |

|

Borrowing costs capitalised (interest paid in years 1 and 2 × 33%) (see table 3.7) |

11 |

– |

11 |

|

Total fair value of the operator’s consideration |

1,083 |

722 |

361 |

|

(a) Amount guaranteed by the grantor as a proportion of the construction services |

|||

Financial asset

IE28

During the first two years, the entity recognises a contract asset and accounts for the significant financing component in the arrangement in accordance with AASB 15. Once the construction is complete, the amount due from, or at the direction of, the grantor in exchange for the construction services is accounted for in accordance with AASB 9 as a receivable.

IE29

On this basis the receivable recognised at the end of years 2 and 3 will be:

Table 3.3 Measurement of contract asset/receivable

|

|

CU |

|

|

Construction services in year 1 allocated to the contract asset |

350 |

|

|

Contract asset at end of year 1 |

350 |

|

|

Construction services in year 2 allocated to the contract asset |

350 |

|

|

Interest in year 2 on contract asset at end of year 1 (6.18% × CU350) |

22 |

|

|

Receivable at end of year 2 |

722 |

|

|

Interest in year 3 on receivable at end of year 2 (6.18% × CU722) |

45 |

|

|

Cash receipts in year 3 (see table 3.5) |

(117) |

|

|

Receivable at end of year 3 |

650 |

|

Intangible asset

IE30

In accordance with AASB 138 Intangible Assets, the operator recognises the intangible asset at cost, ie the fair value of the consideration received or receivable.

IE31

During the construction phase of the arrangement the portion of the operator’s contract asset that represents its accumulating right to be paid amounts in excess of the guaranteed amount for providing construction services is presented as a right to receive a licence to charge users of the infrastructure. The operator estimates the stand-alone selling price of the construction services as equal to the forecast construction costs plus 5 per cent, which the operator concludes is consistent with the rate that a market participant would require as compensation for providing the construction services and for assuming the risk associated with the construction costs. It is also assumed that, in accordance with AASB 123 Borrowing Costs, the operator capitalises the borrowing costs, estimated at 6.7 per cent, during the construction phase:

Table 3.4 Initial measurement of intangible asset

|

|

CU |

|

|

Construction services in year 1 |

175 |

|

|

Borrowing costs (interest paid in years 1 and 2 × 33%) |

11 |

|

|

Construction services in year 2 |

175 |

|

|

Intangible asset at the end of year 2 |

361 |

|

IE32

In accordance with AASB 138, the intangible asset is amortised over the period in which it is expected to be available for use by the operator, ie years 3–10. The depreciable amount of the intangible asset (CU361 including borrowing costs) is allocated using a straight-line method. The annual amortisation charge is therefore CU361 divided by 8 years, ie CU45 per year.

Revenue and costs

IE33

The operator provides construction services to the grantor in exchange for a financial asset and an intangible asset. Under both the financial asset model and intangible asset model, the operator accounts for the construction services in accordance with AASB 15. Thus in each of years 1 and 2 it recognises in profit or loss construction costs of CU500 and construction revenue of CU525.

Toll revenue

IE34

The road users pay for the public services at the same time as they receive them, ie when they use the road. Under the terms of this arrangement the cash flows are allocated to the financial asset and intangible asset in proportion, so the operator allocates the receipts from tolls between repayment of the financial asset and revenue earned from the intangible asset:

Table 3.5 Allocation of toll receipts

|

Year |

CU |

|

|

Guaranteed receipt from grantor |

700 |

|

|

Finance income (see table 3.8) |

237 |

|

|

Total |

937 |

|

|

Cash allocated to realisation of the financial asset per year (CU937/8 years) |

117 |

|

|

Receipts attributable to intangible asset (CU200 x 8 years – CU937) |

663 |

|

|

Annual receipt from intangible asset (CU663/8 years) |

83 |

|

Resurfacing obligations

IE35

The operator’s resurfacing obligation arises as a consequence of use of the road during the operation phase. It is recognised and measured in accordance with AASB 137 Provisions, Contingent Liabilities and Contingent Assets, ie at the best estimate of the expenditure required to settle the present obligation at the end of the reporting period.

IE36

For the purpose of this illustration, it is assumed that the terms of the operator’s contractual obligation are such that the best estimate of the expenditure required to settle the obligation at any date is proportional to the number of vehicles that have used the road by that date and increases by CU17 each year. The operator discounts the provision to its present value in accordance with AASB 137. The charge recognised each period in profit or loss is:

Table 3.6 Resurfacing obligation (currency units)

|

Year |

3 |

4 |

5 |

6 |

7 |

8 |

Total |

|

Obligation arising in year (CU17 discounted at 6%) |

12 |

13 |

14 |

15 |

16 |

17 |

87 |

|

Increase in earlier years’ provision arising from passage of time |

0 |

1 |

1 |

2 |

4 |

5 |

13 |

|

Total expense recognised in profit or loss |

12 |

14 |

15 |

17 |

20 |

22 |

100 |

Overview of cash flows, statement of comprehensive income and statement of financial position

IE37

For the purposes of this illustration, it is assumed that the operator finances the arrangement wholly with debt and retained profits. It pays interest at 6.7 per cent per year on outstanding debt. If the cash flows and fair values remain the same as those forecast, the operator’s cash flows, statement of comprehensive income and statement of financial position over the duration of the arrangement will be:

Table 3.7 Cash flows (currency units)

|

Year |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

Total |

|

Receipts |

- |

- |

200 |

200 |

200 |

200 |

200 |

200 |

200 |

200 |

1,600 |

|

Contract costs(a) |

(500) |

(500) |

(10) |

(10) |

(10) |

(10) |

(10) |

(110) |

(10) |

(10) |

(1,180) |

|

Borrowing costs(b) |

- |

(34) |

(69) |

(61) |

(53) |

(43) |

(33) |

(23) |

(19) |

(7) |

(342) |

|

Net inflow/(outflow) |

(500) |

(534) |

121 |

129 |

137 |

147 |

157 |

67 |

171 |

183 |

78 |

|

(a) Table 3.1 (b) Debt at start of year (table 3.9) × 6.7% |

|||||||||||

Table 3.8 Statement of comprehensive income (currency units)

|

Year |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

Total |

|

Revenue on construction |

525 |

525 |

- |

- |

- |

- |

- |

- |

- |

- |

1,050 |

|

Revenue from intangible asset |

- |

- |

83 |

83 |

83 |

83 |

83 |

83 |

83 |

83 |

663 |

|

Finance income(a) |

- |

22 |

45 |

40 |

35 |

30 |

25 |

19 |

13 |

7 |

237 |

|

Amortisation |

- |

- |

(45) |

(45) |

(45) |

(45) |

(45) |

(45) |

(45) |

(46) |

(361) |

|

Resurfacing expense |

- |

- |

(12) |

(14) |

(15) |

(17) |

(20) |

(22) |

- |

- |

(100) |

|

Construction costs |

(500) |

(500) |

|

|

|

|

|

|

|

|

(1,000) |

|

Other contract costs(b) |

|

|

(10) |

(10) |

(10) |

(10) |

(10) |

(10) |

(10) |

(10) |

(80) |

|

Borrowing costs (table 3.7)(c) |

- |

(23) |

(69) |

(61) |

(53) |

(43) |

(33) |

(23) |

(19) |

(7) |

(331) |

|

Net profit |

25 |

24 |

(8) |

(7) |

(5) |

(2) |

0 |

2 |

22 |

27 |

78 |

|

(a) Interest on receivable (b) Table 3.1 (c) In year 2, borrowing costs are stated net of amount capitalised in the intangible (see table 3.4). |

|||||||||||

Table 3.9 Statement of financial position (currency units)

|

End of year |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

|

Receivable |

350 |

722 |

650 |

573 |

491 |

404 |

312 |

214 |

110 |

- |

|

Intangible asset |

175 |

361 |

316 |

271 |

226 |

181 |

136 |

91 |

46 |

- |

|

Cash/(debt)(a) |

(500) |

(1,034) |

(913) |

(784) |

(647) |

(500) |

(343) |

(276) |

(105) |

78 |

|

Resurfacing obligation |

- |

- |

(12) |

(26) |

(41) |

(58) |

(78) |

- |

- |

- |

|

Net assets |

25 |

49 |

41 |

34 |

29 |

27 |

27 |

29 |

51 |

78 |

|

(a) Debt at start of year plus net cash flow in year (table 3.7) |

||||||||||

IE38

This example deals with only one of many possible types of arrangements. Its purpose is to illustrate the accounting treatment for some features that are commonly found in practice. To make the illustration as clear as possible, it has been assumed that the arrangement period is only ten years and that the operator’s annual receipts are constant over that period. In practice, arrangement periods may be much longer and annual revenues may increase with time. In such circumstances, the changes in net profit from year to year could be greater.

Compilation details

AASB Interpretation 12 Service Concession Arrangements (as amended)

Compilation details are not part of Interpretation 12.

This compiled Interpretation applies to annual reporting periods beginning on or after 1 January 2020. It takes into account amendments up to and including 21 May 2019 and was prepared on 2 March 2020 by the staff of the Australian Accounting Standards Board (AASB).

This compilation is not a separate Interpretation issued by the AASB. Instead, it is a representation of Interpretation 12 (August 2015) as amended by other pronouncements, which are listed in the table below.

Table of pronouncements

Table of amendments to Interpretation

Table of amendments to guidance

Basis for Conclusions on IFRIC 12

IFRIC 12 Service Concession Arrangements

This Basis for Conclusions accompanies, but is not part of, AASB Interpretation 12. An IFRIC Basis for Conclusions may be amended to reflect any additional requirements in the AASB Interpretation or AASB Accounting Standards.

Introduction

BC1

This Basis for Conclusions summarises the IFRIC’s considerations in reaching its consensus. Individual IFRIC members gave greater weight to some factors than to others.

Background (paragraphs 1–3)

BC2

SIC-29 Service Concession Arrangements: Disclosures (formerly Disclosure—Service Concession Arrangements) contains disclosure requirements in respect of public-to-private service arrangements, but does not specify how they should be accounted for.

BC3

There was widespread concern about the lack of such guidance. In particular, operators wished to know how to account for infrastructure that they either constructed or acquired for the purpose of a public-to-private service concession arrangement, or were given access to for the purpose of providing the public service. They also wanted to know how to account for other rights and obligations arising from these types of arrangements.

BC4

In response to this concern, the International Accounting Standards Board asked a working group comprising representatives of the standard-setters of Australia, France, Spain and the United Kingdom (four of the countries that had expressed such concern) to carry out initial research on the subject. The working group recommended that the IFRIC should seek to clarify how certain aspects of existing accounting standards were to be applied.

BC5

In March 2005 the IFRIC published for public comment three draft Interpretations: D12 Service Concession Arrangements—Determining the Accounting Model, D13 Service Concession Arrangements—The Financial Asset Model and D14 Service Concession Arrangements—The Intangible Asset Model. In response to the proposals 77 comment letters were received. In addition, in order to understand better the practical issues that would have arisen on implementing the proposed Interpretations, IASB staff met various interested parties, including preparers, auditors and regulators.

BC6

Most respondents to D12–D14 supported the IFRIC’s proposal to develop an Interpretation. However, nearly all respondents expressed concern with fundamental aspects of the proposals, some urging that the project be passed to the Board to develop a comprehensive standard.

BC7

In its redeliberation of the proposals the IFRIC acknowledged that the project was a large undertaking but concluded that it should continue its work because, given the limited scope of the project, it was by then better placed than the Board to deal with the issues in a timely way.

Terminology

BC8

SIC-29 used the terms ‘Concession Provider’ and ‘Concession Operator’ to describe, respectively, the grantor and operator of the service arrangement. Some commentators, and some members of the IFRIC, found these terms confusingly similar. The IFRIC decided to adopt the terms ‘grantor’ and ‘operator’, and amended SIC-29 accordingly.

Scope (paragraphs 4–9)

BC9

The IFRIC observed that public-to-private service arrangements take a variety of forms. The continued involvement of both grantor and operator over the term of the arrangement, accompanied by heavy upfront investment, raises questions over what assets and liabilities should be recognised by the operator.

BC10

The working group recommended that the scope of the IFRIC’s project should be restricted to public-to-private service concession arrangements.

BC11

In developing the proposals the IFRIC decided to address only arrangements in which the grantor (a) controlled or regulated the services provided by the operator, and (b) controlled any significant residual interest in the infrastructure at the end of the term of the arrangement. It also decided to specify the accounting treatment only for infrastructure that the operator constructed or acquired from a third party, or to which it was given access by the grantor, for the purpose of the arrangement. The IFRIC concluded that these conditions were likely to be met in most of the public-to-private arrangements for which guidance had been sought.

BC12

Commentators on the draft Interpretations argued that the proposals ignored many arrangements that were found in practice, in particular, when the infrastructure was leased to the operator or, conversely, when it was held as the property, plant and equipment of the operator before the start of the service arrangement.

BC13

In considering these comments, the IFRIC decided that the scope of the project should not be expanded because it already included the arrangements most in need of interpretative guidance and expansion would have significantly delayed the Interpretation. The scope of the project was considered at length during the initial stage, as indicated above. The IFRIC confirmed its view that the proposed Interpretation should address the issues set out in paragraph 10. Nonetheless, during its redeliberation the IFRIC considered the range of typical arrangements for private sector participation in the provision of public services, including some that were outside the scope of the proposed Interpretation. The IFRIC decided that the Interpretation could provide references to relevant standards that apply to arrangements outside the scope of the Interpretation without giving guidance on their application. If experience showed that such guidance was needed, a separate project could be undertaken at a later date. Information Note 2 contains a table of references to relevant standards for the types of arrangements considered by the IFRIC.

Private-to-private arrangements

BC14

Some respondents to the draft Interpretations suggested that the scope of the proposed Interpretation should be extended to include private-to-private service arrangements. The IFRIC noted that addressing the accounting for such arrangements was not the primary purpose of the project because the IFRIC had been asked to provide guidance for public-to-private arrangements that meet the requirements set out in paragraph 5 and have the characteristics described in paragraph 3. The IFRIC noted that application by analogy would be appropriate under the hierarchy set out in paragraphs 7–12 of IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors.

Grantor accounting

BC15

The Interpretation does not specify the accounting by grantors, because the IFRIC’s objective and priority were to establish guidance for operators. Some commentators asked the IFRIC to establish guidance for the accounting by grantors. The IFRIC discussed these comments but reaffirmed its view. It noted that in many cases the grantor is a government body, and that IFRSs are not designed to apply to not-for-profit activities in the private sector, public sector or government, though entities with such activities may find them appropriate (see Preface to IFRSs paragraph 9).

Existing assets of the operator

BC16

The Interpretation does not specify the treatment of existing assets of the operator because the IFRIC decided that it was unnecessary to address the derecognition requirements of existing standards.

BC17

Some respondents asked the IFRIC to provide guidance on the accounting for existing assets of the operator, stating that the scope exclusion would create uncertainty about the treatment of these assets.

BC18

In its redeliberations the IFRIC noted that one objective of the Interpretation is to address whether the operator should recognise as its property, plant and equipment the infrastructure it constructs or to which it is given access. The accounting issue to be addressed for existing assets of the operator is one of derecognition, which is already addressed in IFRSs (IAS 16 Property, Plant and Equipment). In the light of the comments received from respondents, the IFRIC decided to clarify that certain public-to-private service arrangements may convey to the grantor a right to use existing assets of the operator, in which case the operator would apply the derecognition requirements of IFRSs to determine whether it should derecognise its existing assets.

The significant residual interest criterion

BC19

Paragraph 5(b) of D12 proposed that for a service arrangement to be within its scope the residual interest in the infrastructure handed over to the grantor at the end of the arrangement must be significant. Respondents argued, and the IFRIC agreed, that the significant residual interest criterion would limit the usefulness of the guidance because a service arrangement for the entire physical life of the infrastructure would be excluded from the scope of the guidance. That result was not the IFRIC’s intention. In its redeliberation of the proposals, the IFRIC decided that it would not retain the proposal that the residual interest in the infrastructure handed over to the grantor at the end of the arrangement must be significant. As a consequence, ‘whole of life’ infrastructure (ie where the infrastructure is used in a public-to-private service arrangement for the entirety of its useful life) is within the scope of the Interpretation.

Treatment of the operator’s rights over the infrastructure (paragraph 11)

BC20

The IFRIC considered the nature of the rights conveyed to the operator in a service concession arrangement. It first examined whether the infrastructure used to provide public services could be classified as property, plant and equipment of the operator under IAS 16. It started from the principle that infrastructure used to provide public services should be recognised as property, plant and equipment of the party that controls its use. This principle determines which party should recognise the property, plant and equipment as its own. The reference to control stems from the Framework:[3]

(a) an asset is defined by the Framework as ‘a resource controlled by the entity as a result of past events and from which future economic benefits are expected to flow to the entity.’

(b) the Framework notes that many assets are associated with legal rights, including the right of ownership. It goes on to clarify that the right of ownership is not essential.

(c) rights are often unbundled. For example, they may be divided proportionately (undivided interests in land) or by specified cash flows (principal and interest on a bond) or over time (a lease).

References to the Framework are to IASC’s Framework for the Preparation and Presentation of Financial Statements, adopted by the IASB in 2001. In September 2010 the IASB replaced the Framework with the Conceptual Framework for Financial Reporting.

BC21

The IFRIC concluded that treatment of infrastructure that the operator constructs or acquires or to which the grantor gives the operator access for the purpose of the service arrangement should be determined by whether it is controlled by the grantor in the manner described in paragraph 5. If it is so controlled (as will be the case for all arrangements within the scope of the Interpretation), then, regardless of which party has legal title to it during the arrangement, the infrastructure should not be recognised as property, plant and equipment of the operator because the operator does not control the use of the public service infrastructure.

BC22

In reaching this conclusion the IFRIC observed that it is control of the right to use an asset that determines recognition under IAS 16 and the creation of a lease under IAS 17 Leases. IAS 16 defines property, plant and equipment as tangible items that ‘are held for use in the production or supply of goods or services, for rental to others or for administrative purposes …’. It requires items within this definition to be recognised as property, plant and equipment unless another standard requires or permits a different approach. As an example of a different approach, it highlights the requirement in IAS 17 for recognition of leased property, plant and equipment to be evaluated on the basis of the transfer of risks and rewards. That standard defines a lease as ‘an agreement whereby the lessor conveys to the lessee in return for a series of payments the right to use an asset’ and it sets out the requirements for classification of leases. IFRIC 4 Determining whether an Arrangement contains a Lease interprets the meaning of right to use an asset as ‘the arrangement conveys the right to control the use of the underlying asset.’

BC23

Accordingly, it is only if an arrangement conveys the right to control the use of the underlying asset that reference is made to IAS 17 to determine how such a lease should be classified. A lease is classified as a finance lease if it transfers substantially all the risks and rewards incidental to ownership. A lease is classified as an operating lease if it does not transfer substantially all the risks and rewards incidental to ownership.

BC24

The IFRIC considered whether arrangements within the scope of IFRIC 12 convey ‘the right to control the use of the underlying asset’ (the public service infrastructure) to the operator. The IFRIC decided that, if an arrangement met the conditions in paragraph 5, the operator would not have the right to control the use of the underlying asset and should therefore not recognise the infrastructure as a leased asset.

BC25

In arrangements within the scope of the Interpretation the operator acts as a service provider. The operator constructs or upgrades infrastructure used to provide a public service. Under the terms of the contract the operator has access to operate the infrastructure to provide the public service on the grantor’s behalf. The asset recognised by the operator is the consideration it receives in exchange for its services, not the public service infrastructure that it constructs or upgrades.

BC26

Respondents to the draft Interpretations disagreed that recognition should be determined solely on the basis of control of use without any assessment of the extent to which the operator or the grantor bears the risks and rewards of ownership. They questioned how the proposed approach could be reconciled to IAS 17, in which the leased asset is recognised by the party that bears substantially all the risks and rewards incidental to ownership.

BC27

During its redeliberation the IFRIC affirmed its decision that if an arrangement met the control conditions in paragraph 5 of the Interpretation the operator would not have the right to control the use of the underlying asset (public service infrastructure) and should therefore not recognise the infrastructure as its property, plant and equipment under IAS 16 or the creation of a lease under IAS 17. The contractual service arrangement between the grantor and operator would not convey the right to use the infrastructure to the operator. The IFRIC concluded that this treatment is also consistent with IAS 18 Revenue[4] because, for arrangements within the scope of the Interpretation, the second condition of paragraph 14 of IAS 18 is not satisfied. The grantor retains continuing managerial involvement to the degree usually associated with ownership and control over the infrastructure as described in paragraph 5.

IFRS 15 Revenue from Contracts with Customers, issued in May 2014, replaced IAS 18 Revenue.

BC28

In service concession arrangements rights are usually conveyed for a limited period, which is similar to a lease. However, for arrangements within the scope of the Interpretation, the operator’s right is different from that of a lessee: the grantor retains control over the use to which the infrastructure is put, by controlling or regulating what services the operator must provide, to whom it must provide them, and at what price, as described in paragraph 5(a). The grantor also retains control over any significant residual interest in the infrastructure throughout the period of the arrangement. Unlike a lessee, the operator does not have a right of use of the underlying asset: rather it has access to operate the infrastructure to provide the public service on behalf of the grantor in accordance with the terms specified in the contract.

BC29

The IFRIC considered whether the scope of the Interpretation might overlap with IFRIC 4. In particular, it noted the views expressed by some respondents that the contractual terms of certain service arrangements would be regarded as leases under IFRIC 4 and would also be regarded as meeting the scope criterion set out in paragraph 5 of IFRIC 12. The IFRIC did not regard the choice between accounting treatments as appropriate because it could lead to different accounting treatments for contracts that have similar economic effects. In the light of comments received the IFRIC amended the scope of IFRIC 4 to specify that if a service arrangement met the scope requirements of IFRIC 12 it would not be within the scope of IFRIC 4.

Recognition and measurement of arrangement consideration (paragraphs 12 and 13)

BC30

The accounting requirements for construction and service contracts are addressed in IAS 11 Construction Contracts[5] and IAS 18[6] . They require revenue to be recognised by reference to the stage of completion of the contract activity. IAS 18 states the general principle that revenue is measured at the fair value of the consideration received or receivable. However, the IFRIC observed that the fair value of the construction services delivered may in practice be the most appropriate method of establishing the fair value of the consideration received or receivable for the construction services. This will be the case in service concession arrangements, because the consideration attributable to the construction activity often has to be apportioned from a total sum receivable on the contract as a whole and, if it consists of an intangible asset, may also be subject to uncertainty in measurement.

IFRS 15 Revenue from Contracts with Customers, issued in May 2014, replaced IAS 11 Construction Contracts and IAS 18 Revenue. IFRS 15 requires revenue to be recognised when (or as) an entity satisfies a performance obligation by transferring a promised good or service to a customer. IFRS 15 measures the revenue by (a) determining the amount of consideration to which an entity expects to be entitled in exchange for transferring promised goods or services to a customer; and (b) allocating that amount to the performance obligations.

IFRS 15 Revenue from Contracts with Customers, issued in May 2014, replaced IAS 11 Construction Contracts and IAS 18 Revenue. IFRS 15 requires revenue to be recognised when (or as) an entity satisfies a performance obligation by transferring a promised good or service to a customer. IFRS 15 measures the revenue by (a) determining the amount of consideration to which an entity expects to be entitled in exchange for transferring promised goods or services to a customer; and (b) allocating that amount to the performance obligations.

BC31

The IFRIC noted that IAS 18[7] requires its recognition criteria to be applied separately to identifiable components of a single transaction in order to reflect the substance of the transaction. For example, when the selling price of a product includes an identifiable amount for subsequent servicing, that amount is deferred and is recognised as revenue over the period during which the service is performed. The IFRIC concluded that this requirement was relevant to service arrangements within the scope of the Interpretation. Arrangements within the scope of the Interpretation involve an operator providing more than one service, ie construction or upgrade services, and operation services. Although the contract for each service is generally negotiated as a single contract, its terms call for separate phases or elements because each separate phase or element has its own distinct skills, requirements and risks. The IFRIC noted that, in these circumstances, IAS 18 paragraphs 4 and 13 require the contract to be separated into two separate phases or elements, a construction element within the scope of IAS 11[8] and an operations element within the scope of IAS 18. Thus the operator might report different profit margins on each phase or element. The IFRIC noted that the amount for each service would be identifiable because such services were often provided as a single service. The IFRIC also noted that the combining and segmenting criteria of IAS 11 applied only to the construction element of the arrangement.