Appendix A -- Application guidance

This appendix is an integral part of the Standard.

Exchangeability

A1

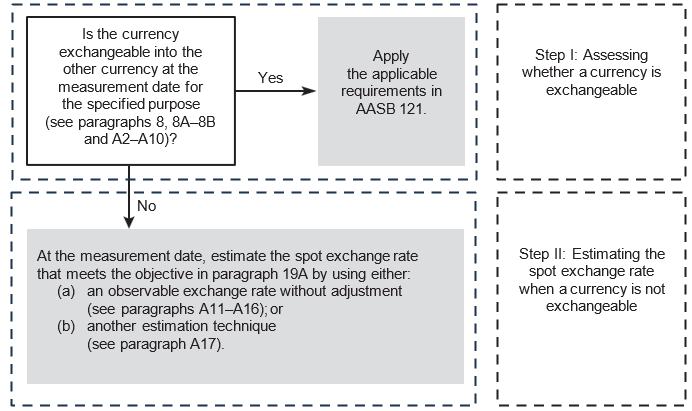

The purpose of the following diagram is to help entities assess whether a currency is exchangeable and estimate the spot exchange rate when a currency is not exchangeable.

Step I: Assessing whether a currency is exchangeable (paragraphs 8 and 8A–8B)

A2

Paragraphs A3–A10 set out application guidance to help an entity assess whether a currency is exchangeable into another currency. An entity might determine that a currency is not exchangeable into another currency, even though that other currency might be exchangeable in the other direction. For example, an entity might determine that currency PC is not exchangeable into currency LC, even though currency LC is exchangeable into currency PC.

Time frame

A3

Paragraph 8 defines a spot exchange rate as the exchange rate for immediate delivery. However, an exchange transaction might not always complete instantaneously because of legal or regulatory requirements, or for practical reasons such as public holidays. A normal administrative delay in obtaining the other currency does not preclude a currency from being exchangeable into that other currency. What constitutes a normal administrative delay depends on facts and circumstances.

A3

Paragraph 8 defines a spot exchange rate as the exchange rate for immediate delivery. However, an exchange transaction might not always complete instantaneously because of legal or regulatory requirements, or for practical reasons such as public holidays. A normal administrative delay in obtaining the other currency does not preclude a currency from being exchangeable into that other currency. What constitutes a normal administrative delay depends on facts and circumstances.

Ability to obtain the other currency

A4

In assessing whether a currency is exchangeable into another currency, an entity shall consider its ability to obtain the other currency, rather than its intention or decision to do so. Subject to the other requirements in paragraphs A2–A10, a currency is exchangeable into another currency if an entity is able to obtain the other currency – either directly or indirectly – even if it intends or decides not to do so. For example, subject to the other requirements in paragraphs A2–A10, regardless of whether the entity intends or decides to obtain PC, currency LC is exchangeable into currency PC if an entity is able to either exchange LC for PC, or exchange LC for another currency (FC) and then exchange FC for PC.

A4

In assessing whether a currency is exchangeable into another currency, an entity shall consider its ability to obtain the other currency, rather than its intention or decision to do so. Subject to the other requirements in paragraphs A2–A10, a currency is exchangeable into another currency if an entity is able to obtain the other currency – either directly or indirectly – even if it intends or decides not to do so. For example, subject to the other requirements in paragraphs A2–A10, regardless of whether the entity intends or decides to obtain PC, currency LC is exchangeable into currency PC if an entity is able to either exchange LC for PC, or exchange LC for another currency (FC) and then exchange FC for PC.

Markets or exchange mechanisms

A5

In assessing whether a currency is exchangeable into another currency, an entity shall consider only markets or exchange mechanisms in which a transaction to exchange the currency for the other currency would create enforceable rights and obligations. Enforceability is a matter of law. Whether an exchange transaction in a market or exchange mechanism would create enforceable rights and obligations depends on facts and circumstances.

A5

In assessing whether a currency is exchangeable into another currency, an entity shall consider only markets or exchange mechanisms in which a transaction to exchange the currency for the other currency would create enforceable rights and obligations. Enforceability is a matter of law. Whether an exchange transaction in a market or exchange mechanism would create enforceable rights and obligations depends on facts and circumstances.

Purpose of obtaining the other currency

A6

Different exchange rates might be available for different uses of a currency. For example, a jurisdiction facing pressure on its balance of payments might wish to deter capital remittances (such as dividend payments) to other jurisdictions but encourage imports of specific goods from those jurisdictions. In such circumstances, the relevant authorities might:

(a) set a preferential exchange rate for imports of those goods and a ‘penalty’ exchange rate for capital remittances to other jurisdictions, thus resulting in different exchange rates applying to different exchange transactions; or

(b) make the other currency available only to pay for imports of those goods and not for capital remittances to other jurisdictions.

A6

Different exchange rates might be available for different uses of a currency. For example, a jurisdiction facing pressure on its balance of payments might wish to deter capital remittances (such as dividend payments) to other jurisdictions but encourage imports of specific goods from those jurisdictions. In such circumstances, the relevant authorities might:

(a) set a preferential exchange rate for imports of those goods and a ‘penalty’ exchange rate for capital remittances to other jurisdictions, thus resulting in different exchange rates applying to different exchange transactions; or

(b) make the other currency available only to pay for imports of those goods and not for capital remittances to other jurisdictions.

A7

Accordingly, whether a currency is exchangeable into another currency could depend on the purpose for which the entity obtains (or hypothetically might need to obtain) the other currency. In assessing exchangeability:

(a) when an entity reports foreign currency transactions in its functional currency (see paragraphs 20–37), the entity shall assume its purpose in obtaining the other currency is to realise or settle individual foreign currency transactions, assets or liabilities.

(b) when an entity uses a presentation currency other than its functional currency (see paragraphs 38–43), the entity shall assume its purpose in obtaining the other currency is to realise or settle its net assets or net liabilities.

(c) when an entity translates the results and financial position of a foreign operation into the presentation currency (see paragraphs 44–47), the entity shall assume its purpose in obtaining the other currency is to realise or settle its net investment in the foreign operation.

A8

An entity’s net assets or net investment in a foreign operation might be realised by, for example:

(a) the distribution of a financial return to the entity’s owners;

(b) the receipt of a financial return from the entity’s foreign operation; or

(c) the recovery of the investment by the entity or the entity’s owners, such as through disposal of the investment.

A9

An entity shall assess whether a currency is exchangeable into another currency separately for each purpose specified in paragraph A7. For example, an entity shall assess exchangeability for the purpose of reporting foreign currency transactions in its functional currency (see paragraph A7(a)) separately from exchangeability for the purpose of translating the results and financial position of a foreign operation (see paragraph A7(c)).

Ability to obtain only limited amounts of the other currency

A10

A currency is not exchangeable into another currency if, for a purpose specified in paragraph A7, an entity is able to obtain no more than an insignificant amount of the other currency. An entity shall assess the significance of the amount of the other currency it is able to obtain for a specified purpose by comparing that amount with the total amount of the other currency required for that purpose. For example, an entity with a functional currency of LC has liabilities denominated in currency FC. The entity assesses whether the total amount of FC it can obtain for the purpose of settling those liabilities is no more than an insignificant amount compared with the aggregated amount (the sum) of its liability balances denominated in FC.

A10

A currency is not exchangeable into another currency if, for a purpose specified in paragraph A7, an entity is able to obtain no more than an insignificant amount of the other currency. An entity shall assess the significance of the amount of the other currency it is able to obtain for a specified purpose by comparing that amount with the total amount of the other currency required for that purpose. For example, an entity with a functional currency of LC has liabilities denominated in currency FC. The entity assesses whether the total amount of FC it can obtain for the purpose of settling those liabilities is no more than an insignificant amount compared with the aggregated amount (the sum) of its liability balances denominated in FC.

Step II: Estimating the spot exchange rate when a currency is not exchangeable (paragraph 19A)

A11

This Standard does not specify how an entity estimates the spot exchange rate to meet the objective in paragraph 19A. An entity can use an observable exchange rate without adjustment (see paragraphs A12–A16) or another estimation technique (see paragraph A17).

Using an observable exchange rate without adjustment

A12

In estimating the spot exchange rate as required by paragraph 19A, an entity may use an observable exchange rate without adjustment if that observable exchange rate meets the objective in paragraph 19A. Examples of an observable exchange rate include:

(a) a spot exchange rate for a purpose other than that for which an entity assesses exchangeability (see paragraphs A13–A14); and

(b) the first exchange rate at which an entity is able to obtain the other currency for the specified purpose after exchangeability of the currency is restored (first subsequent exchange rate) (see paragraphs A15–A16).

A12

In estimating the spot exchange rate as required by paragraph 19A, an entity may use an observable exchange rate without adjustment if that observable exchange rate meets the objective in paragraph 19A. Examples of an observable exchange rate include:

(a) a spot exchange rate for a purpose other than that for which an entity assesses exchangeability (see paragraphs A13–A14); and

(b) the first exchange rate at which an entity is able to obtain the other currency for the specified purpose after exchangeability of the currency is restored (first subsequent exchange rate) (see paragraphs A15–A16).

Using an observable exchange rate for another purpose

A13

A currency that is not exchangeable into another currency for one purpose might be exchangeable into that currency for another purpose. For example, an entity might be able to obtain a currency to import specific goods but not to pay dividends. In such situations, the entity might conclude that an observable exchange rate for another purpose meets the objective in paragraph 19A. If the rate meets the objective in paragraph 19A, an entity may use that rate as the estimated spot exchange rate.

A14

In assessing whether such an observable exchange rate meets the objective in paragraph 19A, an entity shall consider, among other factors:

(a) whether several observable exchange rates exist – the existence of more than one observable exchange rate might indicate that exchange rates are set to encourage, or deter, entities from obtaining the other currency for particular purposes. These observable exchange rates might include an ‘incentive’ or ‘penalty’ and therefore might not reflect the prevailing economic conditions.

(b) the purpose for which the currency is exchangeable – if an entity is able to obtain the other currency only for limited purposes (such as to import emergency supplies), the observable exchange rate might not reflect the prevailing economic conditions.

(c) the nature of the exchange rate – a free-floating observable exchange rate is more likely to reflect the prevailing economic conditions than an exchange rate set through regular interventions by the relevant authorities.

(d) the frequency with which exchange rates are updated – an observable exchange rate unchanged over time is less likely to reflect the prevailing economic conditions than an observable exchange rate that is updated on a daily basis (or even more frequently).

Using the first subsequent exchange rate

A15

A currency that is not exchangeable into another currency at the measurement date for a specified purpose might subsequently become exchangeable into that currency for that purpose. In such situations, an entity might conclude that the first subsequent exchange rate meets the objective in paragraph 19A. If the rate meets the objective in paragraph 19A, an entity may use that rate as the estimated spot exchange rate.

A16

In assessing whether the first subsequent exchange rate meets the objective in paragraph 19A, an entity shall consider, among other factors:

(a) the time between the measurement date and the date at which exchangeability is restored – the shorter this period, the more likely the first subsequent exchange rate will reflect the prevailing economic conditions.

(b) inflation rates – when an economy is subject to high inflation, including when an economy is hyperinflationary (as specified in AASB 129 Financial Reporting in Hyperinflationary Economies), prices often change quickly, perhaps several times a day. Accordingly, the first subsequent exchange rate for a currency of such an economy might not reflect the prevailing economic conditions.

Using another estimation technique

A17

An entity using another estimation technique may use any observable exchange rate – including rates from exchange transactions in markets or exchange mechanisms that do not create enforceable rights and obligations – and adjust that rate, as necessary, to meet the objective in paragraph 19A.

A17

An entity using another estimation technique may use any observable exchange rate – including rates from exchange transactions in markets or exchange mechanisms that do not create enforceable rights and obligations – and adjust that rate, as necessary, to meet the objective in paragraph 19A.

Disclosure when a currency is not exchangeable

A18

An entity shall consider how much detail is necessary to satisfy the disclosure objective in paragraph 57A. An entity shall disclose the information specified in paragraphs A19–A20 and any additional information necessary to meet the disclosure objective in paragraph 57A.

A19

In applying paragraph 57A, an entity shall disclose:

(a) the currency and a description of the restrictions that result in that currency not being exchangeable into the other currency;

(b) a description of affected transactions;

(c) the carrying amount of affected assets and liabilities;

(d) the spot exchange rates used and whether those rates are:

(i) observable exchange rates without adjustment (see paragraphs A12–A16); or

(ii) spot exchange rates estimated using another estimation technique (see paragraph A17);

(e) a description of any estimation technique the entity has used, and qualitative and quantitative information about the inputs and assumptions used in that estimation technique; and

(f) qualitative information about each type of risk to which the entity is exposed because the currency is not exchangeable into the other currency, and the nature and carrying amount of assets and liabilities exposed to each type of risk.

A20

When a foreign operation’s functional currency is not exchangeable into the presentation currency or, if applicable, the presentation currency is not exchangeable into a foreign operation’s functional currency, an entity shall also disclose:

(a) the name of the foreign operation; whether the foreign operation is a subsidiary, joint operation, joint venture, associate or branch; and its principal place of business;

(b) summarised financial information about the foreign operation; and

(c) the nature and terms of any contractual arrangements that could require the entity to provide financial support to the foreign operation, including events or circumstances that could expose the entity to a loss.