Appendix G -- Australian implementation guidance for not-for-profit public sector licensors

This appendix is an integral part of AASB 15 and has the same authority as other parts of the Standard. The appendix applies only to not-for-profit public sector licensors.

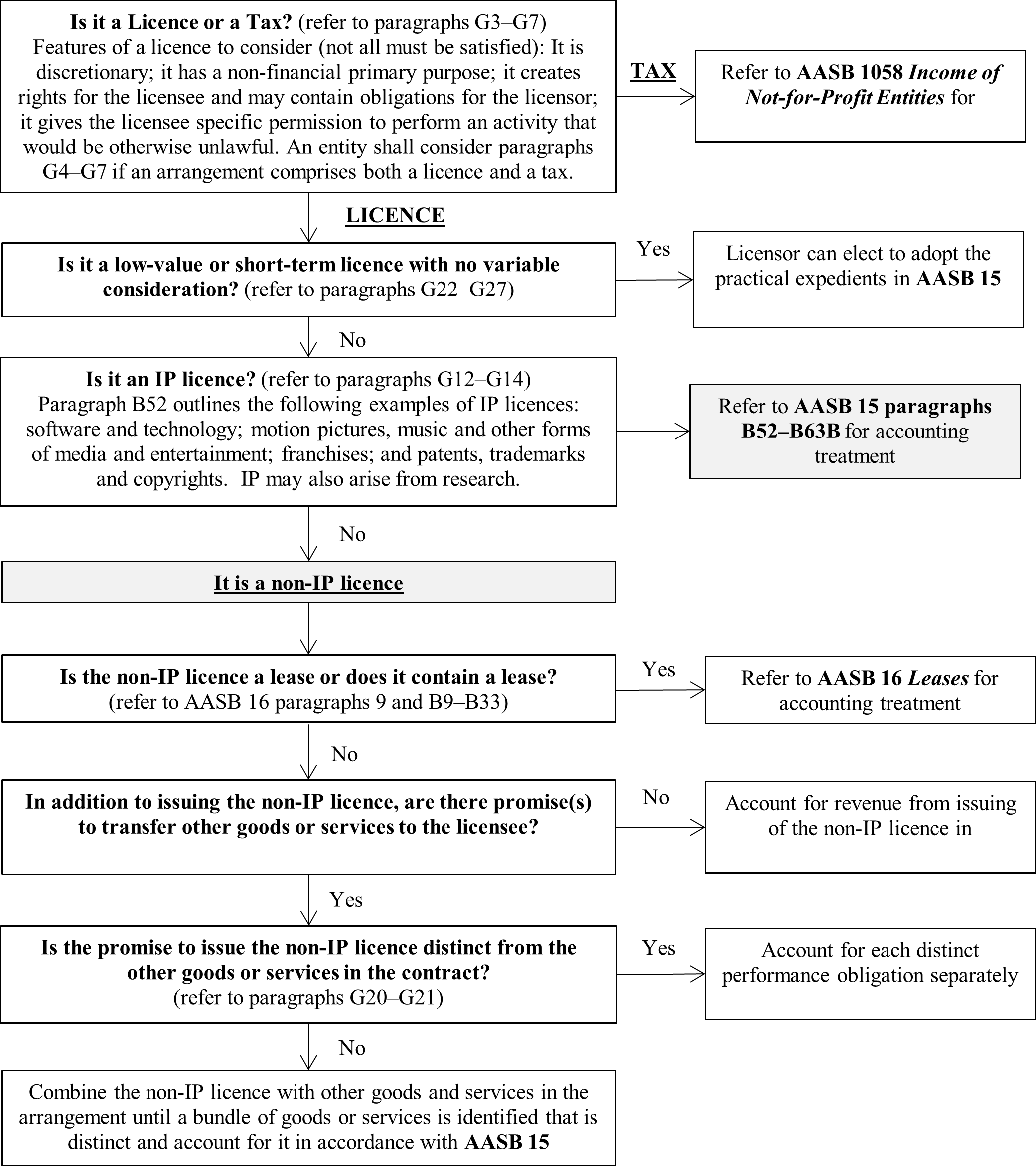

Overview – Accounting framework for licences issued by not-for-profit public sector licensors

G1

The diagram below summarises the accounting requirements under AASB 15 applicable to not-for-profit public sector licensors when determining how to account for revenue from licences. The diagram should be read in conjunction with the guidance set out in paragraphs G2–G27, and as referenced in the diagram.

Introduction

G2

AASB 15 Revenue from Contracts with Customers incorporates International Financial Reporting Standard IFRS 15 Revenue from Contracts with Customers, issued by the International Accounting Standards Board. Consequently, the text of AASB 15 is generally expressed from the perspective of for-profit entities in the private sector. AASB 15 provides explicit Application Guidance for intellectual property (IP) licences. It does not provide explicit guidance for non-IP licences. The AASB has prepared this Appendix to explain and illustrate the principles in the Standard from the perspective of not-for-profit public sector licensors with respect to non-IP licences. The Appendix does not apply to for-profit entities or not-for-profit private sector entities, or affect their application of AASB 15.

Distinguishing a licence from a tax

G3

In determining whether a transaction is a licence subject to this Standard, as distinct from a tax subject to AASB 1058 Income of Not-for-Profit Entities[1], the following features are pertinent. These features are not an exhaustive list and not all features need to be present for an arrangement to be a licence:

|

Feature |

Licence |

Tax |

|

(a) Is the arrangement discretionary rather than compulsory for the payer? |

Discretionary |

Compulsory |

|

(b) What is the primary purpose? |

Non-financial purpose (eg equitable allocation of a public resource) |

Generating income for the public sector entity (eg very high proceeds in relation to the costs incurred might be indicative of a tax element) |

|

(c) Does the arrangement create direct rights to use or access an asset for the payer, or perform an activity, and, depending on the type of arrangement, direct obligations of the payee? |

Creates direct rights for the payer (licensee), and could create direct obligations for the payee (licensor) |

No specific rights for the payer or obligations for the payee |

|

(d) Does the arrangement give the payer specific permission that must be obtained prior to performing an activity or using or accessing a resource of the payee that would otherwise be unlawful? |

Yes |

No |

|

(e) Does the arrangement transfer control of the payee’s underlying asset? |

No |

Not relevant |

AASB 1058 defines taxes as “Economic benefits compulsorily paid or payable to public sector entities in accordance with laws and/or regulations established to provide income to the government. Taxes exclude fines.”

G4

A not-for-profit public sector entity may enter into an arrangement with a dual purpose of issuing a licence and imposing a tax. Consistent with paragraph F28 of AASB 15, the rebuttable presumption is for the not-for-profit public sector licensor to allocate the transaction price wholly to the promise to issue a licence.

G5

The presumption is rebutted if one of the following criteria are satisfied:

(a) the transaction price is partially refundable in the event the entity does not issue the licence; or

(b) a similar activity effected through a different transaction or organisational structure is subject to a tax, providing evidence of the composite nature of the arrangement or there is other evidence supporting that there is a tax not specific to the licencing arrangement.

G6

Where the presumption is rebutted the entity shall disaggregate the transaction price and account for the component that relates to the licence in accordance with AASB 15. The remainder of the transaction price that is determined to be a tax shall be accounted for in accordance with AASB 1058. Whether the element not related to the licence is material, and therefore needs to be accounted for separately, shall be assessed in relation to the individual arrangement, without reassessment at an aggregate or portfolio level.

G7

For example, a casino licence permits gaming activities to be conducted. Similar gaming activities are also conducted online by third parties who are not subject to a casino or any other kind of licence and are taxed at a rate of 10 per cent of proceeds received. This provides evidence that the casino arrangement contains both a licence and a tax and that the presumption in G4 should be rebutted. The tax rate charged to the third party provides evidence of the amount that should be disaggregated as the tax component.

Non-contractual licences arising from statutory requirements

G8

The scope of AASB 15 is underpinned by the definition of a contract in Appendix A, which is an agreement between two or more parties that creates enforceable rights and obligations. When determining whether a licence is a contract with a customer a not-for-profit public sector entity shall consider paragraphs F5–F19 of AASB 15, also having regard to paragraphs G9 and G10.

G9

Enforceable rights and obligations between parties may arise from statutory requirements even though no contractual relationship exists. For example, a not-for-profit public sector entity may enter into an agreement with another entity without satisfying the formative elements required to establish a contract (such as the reciprocal intention to create legal relations). Similarly, where an involuntary payment is made to obtain a licence, the arrangement may not be considered a contract under Australian law, despite being economically similar to a contractual relationship.

G10

Determining whether a licence issued by a not-for-profit public sector licensor is created by contract or by statute alone may require significant analysis as to whether there is sufficient ‘voluntariness’ and ‘reciprocity’ to evidence an intention to create a contract, particularly where a voluntary decision to undertake an activity results in an involuntary fee. However, the requirements of AASB 15 focus on whether enforceable rights and obligations are present, and as noted in paragraph F13, the enforceability of agreements does not depend on their form. Accordingly, a licence issued by a not-for-profit public sector licensor, with enforceable rights and obligations, would be within the scope of AASB 15 (subject to the other requirements of the Standard) regardless of whether it is considered under Australian law to have been created by contract or by statute.

Types of licences issued by not-for-profit public sector licensors

G11

Paragraphs B52–B63B describe the application of AASB 15 to licences of intellectual property (IP). Licences issued by not-for-profit public sector licensors extend beyond IP licences to include licensing arrangements in which the licence does not relate to IP (ie non‑IP licences).

IP licences

G12

Not-for-profit public sector licensors shall apply the Application Guidance in paragraphs B52–B63B to account for the revenue from licences of IP, unless the licensor decides to apply the recognition exemptions set out in paragraphs Aus8.1–Aus8.5.

G13

AASB 15 does not define IP, and consequently judgement is required in determining whether a licence is a licence of IP or not. Paragraph B52 notes that IP may include, but is not limited to, any of the following:

(a) software and technology;

(b) motion pictures, music and other forms of media and entertainment;

(c) franchises; and

(d) patents, trademarks and copyrights.

G14

IP may also arise from research activities. Example 3 in paragraph IE3 provides an example of accounting for such a licence.

Non-IP licences

G15

Where a not-for-profit public sector licensor determines that a licence is a non-IP licence, the licensor shall consider whether the licence is for:

(a) rights over the licensor’s identified asset(s), in which case the arrangement might be a lease (or contain a lease), and fall within the scope of AASB 16;

(b) rights over the licensor’s non-identified asset(s), in which case the licence might:

(i) not be distinct from other promised goods or services in the arrangement, and shall therefore be combined with the other goods or services and accounted for as a bundle of goods or services (see paragraphs G20 and G21); or

(ii) be distinct from other promised goods or services, and shall therefore be accounted for as a separate performance obligation in accordance with the principles of AASB 15 (see paragraphs G16–G21 for guidance on applying certain aspects of the principles). The Application Guidance for licences of IP in paragraphs B52–B63B shall not be applied to this type of licence; or

(c) the right to perform an activity, which would not involve an asset or assets of the licensor, and if distinct from other goods or services, shall be accounted for as a separate performance obligation in accordance with the principles of AASB 15 (see paragraphs G16–G21 for guidance on applying certain aspects of the principles). The Application Guidance for licences of IP in paragraphs B52–B63B shall not be applied to this type of licence.

Identifying performance obligations

G16

Where a licensor issues a non-IP licence that transfers to the licensee either rights over the licensor’s non-identified assets or a right to the licensee to perform an activity (that does not involve an asset or assets of the licensor, for example the right to operate a casino), the licensor shall assess goods or services promised in the arrangement and shall identify each distinct performance obligation promised to the licensee in accordance with paragraphs 22–30 of AASB 15.

Identifying the customer

G17

Appendix A defines a customer for the purpose of this Standard. In the context of non-IP licences, the customer is the licensee who contracted with the licensor to be issued the rights associated with the licence.

Identifying the goods or services

G18

The good or service being transferred in a non-IP licence by a licensor would most commonly be either issuing rights over the licensor’s non-identified assets or issuing rights to the licensee to perform an activity (ie issuing the licence itself is the sole good or service). However, an entity shall also assess the arrangement to identify any other goods or services promised to the licensee.

G19

In accordance with paragraph 25, performance obligations do not include activities that a licensor must undertake to fulfil a contract unless those activities transfer a good or service additional to the licence issued to the licensee. For example:

(a) a promise to the licensee that the right is restricted to the licensee is not a performance obligation. A promise in the licence terms that the licensor will not issue a similar right to another party (ie exclusivity to the licensee) is considered an attribute of the arrangement and does not transfer a good or service additional to the licence. Although the licensor maintaining exclusivity maintains the value of the licence, and has a greater value than a non-exclusive licence, it does not transfer an additional good or service. The licensor refraining from issuing another licence to a new licensee only confirms the licence meets the attributes promised at inception of the licence. Similarly, if a licensor carries out activities to ensure that no other party engages in the activities that the licensee has an exclusive right to, this does not provide a service to the licensee, but instead is an activity that confirms the licence meets the attributes promised at inception of the licence;

(b) activities that a licensor is required to undertake in the context of a non-IP licence to benefit the general public or to confirm the terms of the licence are being met (for example ‘policing’ activities to ensure licensee is not carrying out illegal activities or customers of the licensee are of a legally allowable age) are not performance obligations. Such activities do not transfer additional goods or services to the licensee (even though the licensee could benefit from those activities); and

(c) activities that a licensor performs to check that a licensee continues to meet the eligibility requirements of the arrangement are not performance obligations. The licensee controls whether they meet the eligibility requirements of the arrangement. Activities performed by the licensor to uphold the integrity of the licence merely confirm that the arrangement is not breached, and do not transfer goods or services to the licensee.

Licences distinct from other goods and services

G20

If the promise to issue a non-IP licence is not distinct from other promised goods or services in the arrangement in accordance with paragraphs 26–30, the licensor shall combine the promise to issue that licence with the other goods or services and account for the bundle of goods or services together as a single performance obligation.

G21

When determining whether the non-IP licence is distinct from other goods or services (in accordance with paragraphs 26–30), a licensor shall consider the benefits or desired outputs for which the licence was issued. For example, in the case of a commercial fishing licence where a quota of fish is specified in the agreement, the purpose of obtaining the licence is to obtain goods (ie the fish), and the licence is not separately identifiable from the fish, given:

(a) the licensor is using the licence as an input to deliver the fish to the licensee, which is the output to the licensee; and

(b) the licence and the promise to deliver the fish are highly interrelated – the licensor would not be able to fulfil its promise of delivering the fish independently of issuing the licence without undermining its policies and customary business practices (ie the fish can only be delivered when a fishing licence has been issued).

In these circumstances, the licence is not separately identifiable from other promises in the arrangement, in accordance with paragraphs 29(a) and (c) of AASB 15.

Recognition exemption: low-value licences (paragraphs Aus8.1–Aus8.3)

G22

This Standard permits a not-for-profit public sector licensor to apply paragraph Aus8.3 in accounting for low-value licences. A licensor shall assess the transaction price of a licence on an absolute basis when the licence is issued.

G23

Notwithstanding paragraph G22, the option allowed in paragraph Aus8.1 is not available to licences including variable consideration.

G24

Low-value licences qualify for the accounting treatment in paragraph Aus8.3 regardless of whether those licences are material in aggregate to the licensor. The assessment is not affected by the size, nature or circumstances of the licensor. Accordingly, different licensors would be expected to reach the same conclusions about whether a particular licence has a low-value transaction price.

G25

A licence does not qualify as a low-value licence if the nature of the licence is such that the licence is not typically of low value. For example, casino licences would not qualify as low-value licences because casino licences would typically not be of low value.

G26

Examples of low-value licences include driver licences, marriage licences and working with children permits.

Recognition exemption: short-term licences (paragraphs Aus8.1–Aus8.5)

G27

The Standard permits a not-for-profit public sector licensor to apply paragraph Aus8.3 in accounting for short-term licences. In determining the licence term, the licensor shall disregard any option to extend the licence, regardless of whether the licensee is reasonably certain to exercise that option.