The objective of this Standard is to set out Australian-specific disclosure requirements that are in addition to disclosure requirements in International Financial Reporting Standards.

Preamble

Pronouncement

This compiled Standard applies to annual periods beginning on or after 1 July 2021. Earlier application is permitted for annual periods beginning on or after 1 January 2014 that end before 1 July 2021. It incorporates relevant amendments made up to and including 6 March 2020.

Prepared on 21 July 2021 by the staff of the Australian Accounting Standards Board.

Compilation no. 5

Compilation date: 30 June 2021

Obtaining copies of Accounting Standards

Compiled versions of Standards, original Standards and amending Standards (see Compilation Details) are available on the AASB website: www.aasb.gov.au.

Australian Accounting Standards Board

PO Box 204

Collins Street West

Victoria 8007

AUSTRALIA

Phone: (03) 9617 7600

E-mail: [email protected]

Website: www.aasb.gov.au

Other enquiries

Phone: (03) 9617 7600

E-mail: [email protected]

Copyright

© Commonwealth of Australia 2021

This work is copyright. Apart from any use as permitted under the Copyright Act 1968, no part may be reproduced by any process without prior written permission. Reproduction within Australia in unaltered form (retaining this notice) is permitted for personal and non-commercial use subject to the inclusion of an acknowledgment of the source. Requests and enquiries concerning reproduction and rights should be addressed to The National Director, Australian Accounting Standards Board, PO Box 204, Collins Street West, Victoria 8007.

Rubric

Australian Accounting Standard AASB 1054 Australian Additional Disclosures (as amended) is set out in paragraphs 1 – 17 and Appendix A. All the paragraphs have equal authority. Paragraphs in bold type state the main principles. AASB 1054 is to be read in the context of other Australian Accounting Standards, including AASB 1048 Interpretation Standards, which identifies the Australian Accounting Interpretations, and AASB 1057 Application of Australian Accounting Standards. In the absence of explicit guidance, AASB 108 Accounting Policies, Changes in Accounting Estimates and Errors provides a basis for selecting and applying accounting policies.

Comparison with IFRS Standards

AASB 1054 Australian Additional Disclosures includes disclosure requirements and definitions which are additional to International Financial Reporting Standards issued by the International Accounting Standards Board (IASB).

Compliance with AASB 1054 is not needed for IFRS compliance, with the exception of paragraph 17.

Accounting Standard AASB 1054

The Australian Accounting Standards Board made Accounting Standard AASB 1054 Australian Additional Disclosures under section 334 of the Corporations Act 2001 on 11 May 2011.

This compiled version of AASB 1054 applies to annual periods beginning on or after 1 July 2021. It incorporates relevant amendments contained in other AASB Standards made by the AASB up to and including 6 March 2020 (see Compilation Details).

Application

2

[Deleted by the AASB]

3

This Standard applies to annual reporting periods beginning on or after 1 July 2011.

[Note: For application dates of paragraphs changed or added by an amending Standard, see Compilation Details.]

4

This Standard, or individual disclosure requirements, may be applied to annual reporting periods beginning on or after 1 January 2005 but before 1 July 2011, provided that AASB 2011-1 Amendments to Australian Accounting Standards arising from the Trans-Tasman Convergence Project, or its relevant individual amendments, is also adopted early for the same period. When an entity applies this Standard, or individual disclosure requirements, to such an annual reporting period, it shall disclose that fact.

5

[Deleted by the AASB]

5A–5C

[Deleted by the AASB]

Definitions

6

The following terms are used in this Standard with the meanings specified.

6[1]

Annual reporting period means the financial year or similar period to which annual financial statements relate.

6[2]

Special purpose financial statements are financial statements other than general purpose financial statements.

Compliance with Australian Accounting Standards

7

An entity whose financial statements comply with Australian Accounting Standards shall make an explicit and unreserved statement of such compliance in the notes. An entity shall not describe financial statements as complying with Australian Accounting Standards unless they comply with all the requirements of Australian Accounting Standards.

General Purpose or Special Purpose Financial Statements

9

An entity shall disclose in the notes whether the financial statements are general purpose financial statements or special purpose financial statements.

Information about special purpose financial statements

9A

A not-for-profit private sector entity that prepares special purpose financial statements shall:

(a) disclose the basis on which the decision to prepare special purpose financial statements was made;

(b) where the entity has interests in other entities – disclose either:

(i) whether or not its subsidiaries and investments in associates or joint ventures have been consolidated or equity accounted in a manner consistent with the requirements set out in AASB 10 Consolidated Financial Statements or AASB 128 Investments in Associates and Joint Ventures, as appropriate. If the entity has not consolidated its subsidiaries or equity accounted its investments in associates or joint ventures consistently with those requirements, it shall disclose that fact, and the reasons why; or

(ii) that the entity has not determined whether its interests in other entities give rise to interests in subsidiaries, associates or joint ventures, provided it is not required by legislation to make such an assessment for the purpose of assessing its financial reporting requirements and has not made such an assessment;

(c) for each material accounting policy applied and disclosed in the financial statements that does not comply with all the recognition and measurement requirements in Australian Accounting Standards (except for requirements set out in AASB 10 or AASB 128), disclose an indication of how it does not comply; or if such an assessment has not been made, disclose that fact; and

(d) disclose whether or not the financial statements overall comply with all the recognition and measurement requirements in Australian Accounting Standards (except for requirements set out in AASB 10 or AASB 128) or that such an assessment has not been made.

9B

Implementation guidance and illustrative examples for not-for-profit private sector entities accompanies this Standard. It illustrates the application of the requirements in paragraph 9A and their relationship to the requirements in AASB 101 Presentation of Financial Statements for the disclosure of an entity’s significant accounting policies.

Audit Fees

10

An entity shall disclose fees to each auditor or reviewer, including any network firm, separately for:

(a) the audit or review of the financial statements; and

(b) all other services performed during the reporting period.

11

For paragraph 10(b) above, an entity shall describe the nature of other services.

Imputation Credits

12

The term ‘imputation credits’ is used in paragraphs 13-15 to also mean ‘franking credits’. The disclosures required by paragraphs 13 and 15 shall be made separately in respect of any New Zealand imputation credits and any Australian imputation credits.

13

An entity shall disclose the amount of imputation credits available for use in subsequent reporting periods.

14

For the purposes of determining the amount required to be disclosed in accordance with paragraph 13, entities may have:

(a) imputation credits that will arise from the payment of the amount of the provision for income tax;

(b) imputation debits that will arise from the payment of dividends recognised as a liability at the reporting date; and

(c) imputation credits that will arise from the receipt of dividends recognised as receivables at the reporting date.

15

Where there are different classes of investors with different entitlements to imputation credits, disclosures shall be made about the nature of those entitlements for each class where this is relevant to an understanding of them.

IFRS Standard Not Yet Issued in Australia

17

When an IFRS Standard has been issued by the International Accounting Standards Board but the equivalent Australian Accounting Standard has yet to be issued by the AASB, an entity intending to comply with IFRS Standards shall disclose the information specified in paragraphs 30 and 31 of AASB 108 Accounting Policies, Changes in Accounting Estimates and Errors in relation to that IFRS Standard.

Appendix A -- Australian simplified disclosures for Tier 2 entities

This appendix is an integral part of the Standard.

AusA1

Paragraphs 7–16 do not apply to entities preparing general purpose financial statements that apply AASB 1060 General Purpose Financial Statements – Simplified Disclosures for For-Profit and Not-for-Profit Tier 2 Entities.

Implementation guidance and illustrative examples for not-for-profit private sector entities

The following implementation guidance and illustrative examples accompany, but are not part of, AASB 1054 Australian Additional Disclosures. They illustrate aspects of AASB 1054 but are not intended to provide interpretative guidance.

IG1

The AASB has prepared this guidance and examples to explain and illustrate the application of the requirements in paragraph 9A of this Standard and their relationship to the requirements in AASB 101 Presentation of Financial Statements for the disclosure of a not-for-profit private sector entity’s significant accounting policies. These requirements apply to entities applying this Standard, including those required by legislation to comply. An entity preparing special purpose financial statements that is not specifically required to comply with AASB 1054 may elect not to comply with these requirements, however, is encouraged to do so.

IG2

The table below has been provided for ease of reference to illustrate the types of entities that would be generally within the scope of the requirements in paragraph 9A of this Standard, but some entities may have different specific requirements.

# | Entity | In scope/out of scope |

1 | For-profit private and for-profit public sector entities preparing special purpose financial statements | Not in scope |

2 | Not-for-profit private sector entities | |

Charities registered with the Australian Charities and Not-for-profits Commission (ACNC) | ||

- that have annual revenue of $250,000 or more (ie medium and large charities), preparing special purpose financial statements and required to comply with the ACNC reporting requirements for such financial statements | In scope, must comply with AASB 1054 | |

- that have annual revenue of less than $250,000 (ie small charities) | Not in scope | |

- that have annual revenue of $250,000 or more, preparing special purpose financial statements and not required to comply with the ACNC reporting requirements for such financial statements | Not in scope | |

Not-for-profit entities not registered with ACNC | ||

- lodging special purpose financial statements with the Australian Securities and Investments Commission (ASIC) under the Corporations Act 2001 (eg companies limited by guarantee) | In scope, must comply with AASB 1054 | |

- required by Federal or State/Territory legislation to prepare financial statements in accordance with Australian Accounting Standards or accounting standards (eg incorporated associations, co-operatives and charitable fundraising organisations), that are preparing special purpose financial statements and not specifically required to comply with AASB 1054 | Not in scope | |

3 | Other not-for-profit entities, including not-for-profit public sector entities, entities not specified above and entities not required to comply with AASB 1054 by legislation or otherwise | Not in scope |

IG3

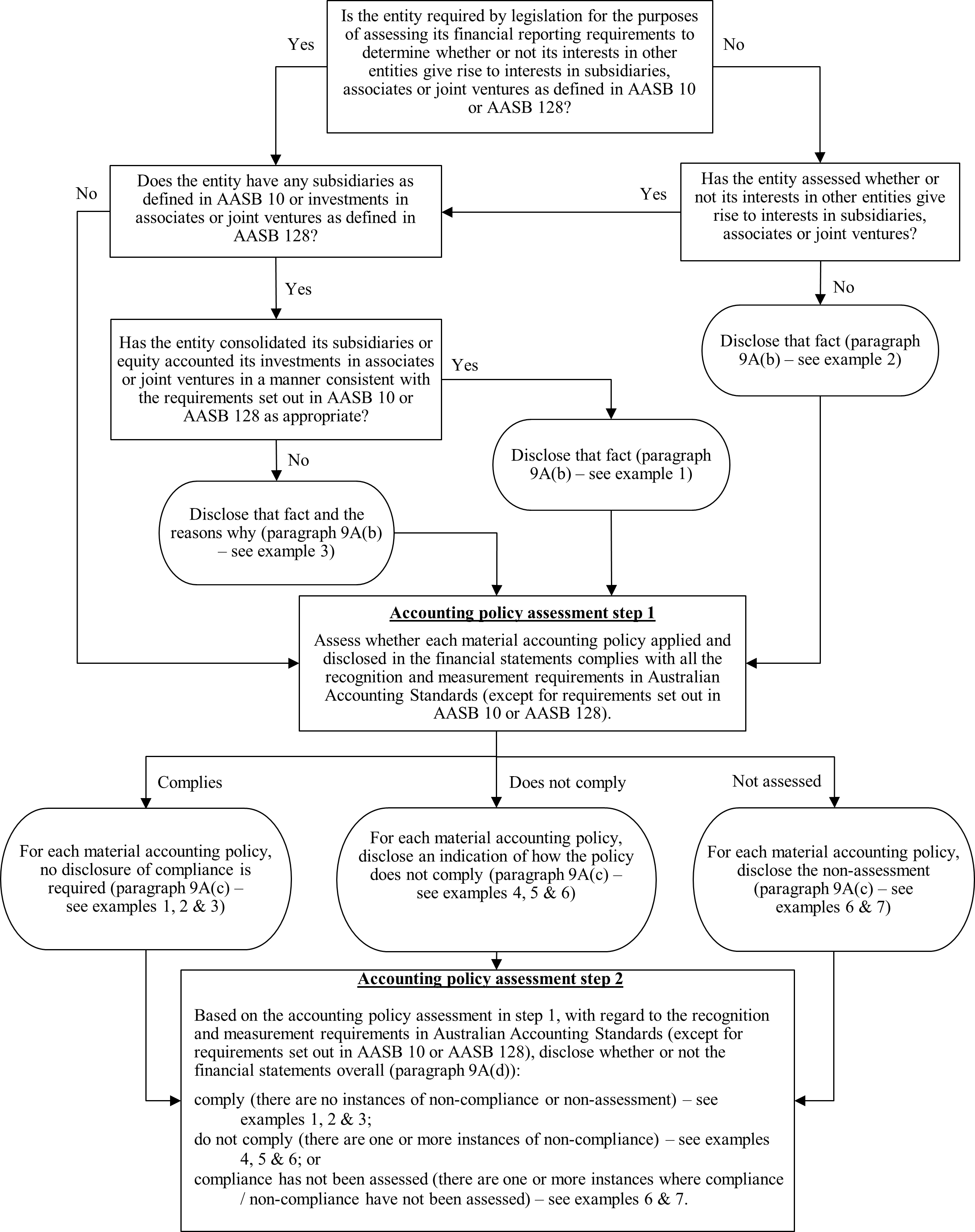

The following flowchart summarises some of the key decisions in determining how to apply the disclosure requirements in paragraph 9A of this Standard in relation to special purpose financial statements.

IG4

In disclosing the information required by paragraph 9A of this Standard, entities are not expected to provide quantitative information, or reconciliations, where accounting policies do not comply with all the recognition and measurement requirements in Australian Accounting Standards.

Chart 1 – Not-for-profit private sector entities preparing special purpose financial statements

Disclosure of accounting policies

IG5

Not-for-profit private sector entities required to apply AASB 1054 in their special purpose financial statements (including those lodged with ASIC or the ACNC), whether consolidated or unconsolidated, are also required to apply AASB 101 and AASB 108 Accounting Policies, Changes in Accounting Estimates and Errors, including:

(a) paragraph 15 of AASB 101, which requires the fair presentation of financial statements;

(b) paragraphs 10-12 of AASB 108, which address the selection of accounting policies in the absence of an Australian Accounting Standard that specifically applies to a transaction, other event or condition; and

(c) paragraph 117 of AASB 101, which requires disclosure of significant accounting policies comprising the measurement basis (or bases) and the other accounting policies used that are relevant to an understanding of the financial statements.

As a result, sufficient information to enable users of special purpose financial statements to obtain an understanding of the accounting policies adopted is required to be disclosed. This includes where an entity has selected and applied accounting policies that differ from the recognition and measurement requirements in Australian Accounting Standards (except for requirements set out in AASB 10 Consolidated Financial Statements or AASB 128 Investments in Associates and Joint Ventures).

Accounting policy assessment step 1: Assessing compliance with the recognition and measurement requirements in Australian Accounting Standards (except for requirements set out in AASB 10 or AASB 128) at the accounting policy level

IG6

Paragraph 9A(c) of this Standard requires an entity, for each material accounting policy applied and disclosed in the financial statements to first assess, based on already known information, whether that policy complies with the recognition and measurement requirements in Australian Accounting Standards (except for requirements set out in AASB 10 or AASB 128), does not comply, or compliance has not been assessed. An entity is not expected to perform a detailed assessment of recognition and measurement differences if that has not already been performed.

IG7

Using those assessments:

(a) an entity discloses for those policies not complying with the recognition and measurement requirements in Australian Accounting Standards (except for requirements set out in AASB 10 or AASB 128) or not assessed for compliance, an indication of how it does not comply or that such an assessment has not been made; or

(b) if the material accounting policies applied and disclosed in the financial statements comply with the recognition and measurement requirements in Australian Accounting Standards (except for requirements set out in AASB 10 or AASB 128) no additional disclosures are required.

IG8

Where an entity’s accounting policies do not comply with the recognition and measurement requirements in Australian Accounting Standards (except for requirements set out in AASB 10 or AASB 128), the presentation of the disclosure providing an indication of that non-compliance may differ depending on the extent of non-compliance. Entities may choose to provide disclosures for non-compliance and non-assessed policies in one place or placed with each accounting policy disclosed in the financial statements as appropriate. For example:

(a) an entity may choose to disclose which Australian Accounting Standards they have not complied with and provide details of the non-compliance in one place for example within the basis of preparation note, where the instance of non-compliance are not extensive (see Example 4 below); or alternatively

(b) where the instances of non-compliance are extensive, details of the non-compliance may be provided within the relevant accounting policy note (see Example 5 below).

Accounting policy assessment step 2:

Disclosing whether or not the financial statements comply overall with all the recognition and measurement requirements in Australian Accounting Standards (except for requirements set out in AASB 10 or AASB 128) or that compliance has not been assessed

IG9

Based on the assessment in paragraph 9A(c), paragraph 9A(d) then requires an entity to disclose whether or not overall the material accounting policies applied and disclosed in the financial statements comply (that is there are no instances of non-compliance or non-assessment) (see Examples 1, 2 and 3 below) or do not comply (there are one or more instances of non-compliance) with all the recognition and measurement requirements in Australian Accounting Standards (except for requirements set out in AASB 10 or AASB 128) (see Examples 4, 5 and 6 below), or that an assessment has not been made (there are one or more instances of compliance / non-compliance not having been assessed) (see Examples 6 and 7 below).

IG10

Based on the AASB’s research, some of the most frequent examples of non-compliance with recognition and measurement requirements in Australian Accounting Standards include:

(a) in accounting for income, recognition of grant income for a specified time period, or which has no conditions that need to be met, is deferred until the related expenses are incurred, or all grant income is deferred, without assessing whether a performance obligation exists, which does not comply with AASB 15 Revenue from Contracts with Customers or AASB 1058 Income of Not-for-Profit Entities;

(b) in accounting for property, plant and equipment, assets were not depreciated based on their useful lives, which does not comply with AASB 116 Property, Plant and Equipment;

(c) in accounting for impairments, the recoverable amount for impairment testing was calculated on an undiscounted basis, which does not comply with AASB 136 Impairment of Assets; and

(d) in accounting for employee benefits, the long-term provision for long service leave is not recognised, or not discounted, which does not comply with AASB 119 Employee Benefits.

Application of the consolidation and equity accounting requirements

IG11

In relation to paragraph 9A(b) of this Standard, information about the accounting for subsidiaries and investments in associates and joint ventures is fundamental for a user’s understanding of the scope of the financial statements. Some entities are required to determine their financial reporting requirements based on the application of recognition and measurement requirements in Australian Accounting Standards, including consolidation, for example a proprietary company subject to section 45A of the Corporations Act 2001 is required to determine whether it is a small or large proprietary company on a consolidated basis (ie the parent and the entities it controls (subsidiaries)) in accordance with the accounting standards even if the standards do not otherwise apply to some or all of the companies concerned. Other entities, typically lodging financial reports with the ACNC, make their assessments based on individual entity circumstances only. In instances where legislation does not require assessment on a consolidated basis, and an entity has not made an assessment of whether its interests in other entities are subsidiaries, associates or joint ventures, an entity shall make a statement that they have not been assessed (see Example 2 below).

IG12

Exemptions from consolidation of subsidiaries are provided in AASB 10, paragraphs 4(a) and Aus4.1 (as modified by paragraph Aus4.2), including when the entity is a wholly-owned subsidiary and its ultimate parent produces consolidated financial statements that are available for public use and comply with accounting standards. Directors preparing special purpose financial statements might have other reasons for non-consolidation of some or all of an entity’s subsidiaries, and paragraph 9A(b) requires these reasons to be disclosed (see Example 3 below).

IG13

The following illustrative examples are provided:

IG14

The following examples illustrate how an entity might apply the disclosure requirements in paragraph 9A of this Standard within the context of the requirements in AASB 101 and AASB 108 referred to in paragraph IG5 above to the special purpose financial statements they prepare, on the basis of the limited facts presented. Although some aspects of the examples might be present in actual fact patterns, all relevant facts and circumstances of a particular fact pattern need to be evaluated when applying disclosure requirements of this Standard.

# | Example | Illustrative disclosure |

1 | Compliance with all recognition and measurement requirements in Australian Accounting Standards including AASB 10 and AASB 128 Charity A Inc, a not-for-profit parent, prepares consolidated special purpose financial statements that: · consolidate all its subsidiaries in a manner consistent with the requirements set out in AASB 10; · equity account all its investments in associates and joint ventures in a manner consistent with the requirements set out in AASB 128; and · apply accounting policies that comply with all the recognition and measurement requirements in Australian Accounting Standards. | Charity A Inc is a not-for-profit entity. The Members of the Governing / Management Committee are of the opinion that the Association is not a reporting entity as users may obtain the financial information they require upon request. These special purpose financial statements have therefore been prepared in order to meet the requirements of the [Australian Charities and Not-for-profits Commission Act 2012 / insert further details of the not-for-profit reporting framework under which the financial statements are prepared]. Charity A Inc has consolidated all its subsidiaries consistent with the requirements set out in AASB 10 Consolidated Financial Statements and equity accounted for its investments in associates and joint ventures in a manner consistent with the requirements set out in AASB 128 Investments in Associates and Joint Ventures. These consolidated special purpose financial statements comply with all the recognition and measurement requirements in Australian Accounting Standards. |

2 | Compliance with all recognition and measurement requirements in Australian Accounting Standards except for AASB 10 and AASB 128 (interests in other entities not assessed) Charity B Inc, a not-for-profit entity, prepares special purpose financial statements that: · do not consolidate or equity account any entities as Charity B Inc did not determine whether its interests in other entities give rise to interests in subsidiaries or investments in associates or joint ventures; and · apply accounting policies that comply with all the recognition and measurement requirements in Australian Accounting Standards. The legislative framework in which Charity B Inc operates does not require it to identify subsidiaries, associates or joint ventures to determine its financial reporting requirements. | Charity B Inc is a not-for-profit entity. In the opinion of the Management Committee, Charity B Inc is not a reporting entity as its users may request the financial information they need. These special purpose financial statements have been prepared for distribution to members and for the purposes of fulfilling the reporting requirements under the [Australian Charities and Not-for-profits Commission Act 2012 / insert further details of the not-for-profit reporting framework under which the financial statements are prepared]. Charity B Inc has not assessed whether it has relationships with other entities which, for financial reporting purposes, might be considered subsidiaries, associates or joint ventures as it is not required by the [Australian Charities and Not-for-profits Commission Act 2012] to do so. These special purpose financial statements comply with all the recognition and measurement requirements in Australian Accounting Standards (except for the requirements set out in AASB 10 Consolidated Financial Statements or AASB 128 Investments in Associates and Joint Ventures). |

Compliance with all recognition and measurement requirements in Australian Accounting Standards except for AASB 10 and AASB 128 (some subsidiaries not consolidated and some associates and joint ventures not equity accounted) MNO Ltd, a parent that is a charity, prepares partially consolidated special purpose financial statements that: · consolidate some but not all of its subsidiaries (and are therefore inconsistent with the requirements set out in AASB 10); · do not equity account all its investments in associates and investments in joint ventures in a manner consistent with the requirements set out in AASB 128; and · apply accounting policies to those partially consolidated financial statements that comply with all the recognition and measurement requirements in Australian Accounting Standards (except for requirements set out in AASB 10 or AASB 128). | MNO Ltd, a not-for-profit entity, has prepared special purpose financial statements as, in the opinion of the Directors, it is unlikely there are users of these financial statements who are not in a position to require the preparation of reports tailored to their information needs. Accordingly, these financial statements have been prepared to satisfy the Directors’ reporting requirements under the [Australian Charities and Not-for-profits Commission Act 2012 / insert further details of the not-for-profit reporting framework under which the financial statements are prepared]. These financial statements do not consolidate all of MNO Ltd’s subsidiaries or equity account all its investments in associates and investments in joint ventures as the Directors [did not perform a detailed assessment of all of MNO Ltd’s relationships with other entities, and instead elected to only consolidate those entities MNO Ltd has a 100% ownership interest in / insert an explanation of why some subsidiaries, associates and joint ventures are not consolidated / equity accounted.] MNO Ltd’s partially consolidated special purpose financial statements comply with all the recognition and measurement requirements in Australian Accounting Standards (except for the requirements set out in AASB 10 Consolidated Financial Statements or AASB 128 Investments in Associates and Joint Ventures). | |

4 | Known non-compliance with all recognition and measurement requirements in Australian Accounting Standards that is not extensive XYZ Ltd, a not-for-profit entity that is not a charity, determined that it does not have any subsidiaries, associates or joint ventures (and therefore requirements set out in AASB 10 and AASB 128 are not applicable) and prepares special purpose financial statements that apply material accounting policies that do not comply with all the recognition and measurement requirements in Australian Accounting Standards. The differences are not extensive. | XYZ Ltd, a not-for-profit entity, has prepared special purpose financial statements as, in the opinion of the Directors, it is unlikely there are users of these financial statements who are not in a position to require the preparation of reports tailored to their information needs. Accordingly, these financial statements have been prepared to satisfy the Directors’ reporting requirements under the Corporations Act 2001. These special purpose financial statements do not comply with all the recognition and measurement requirements in Australian Accounting Standards. The recognition and measurement requirements that have not been complied with are those specified in AASB 15 Revenue from Contracts with Customers and AASB 1058 Income of Not-for-Profit Entities as, in accounting for income, recognition of all grant income has been deferred [[until the related expenses are incurred without assessing whether there are enforceable performance obligations to transfer a good or service to a third party which are sufficiently specific to know when the performance obligation has been satisfied] / [where the grant is for multi-years without assessing whether there is a performance obligation or the grantor retains control of the remainder of the grant at the end of each year] / insert further details including an indication of how material recognition and measurement requirements in Australian Accounting Standards have not been complied with]. |

5 | Known non-compliance with all recognition and measurement requirements in Australian Accounting Standards that is extensive Charity D Inc, a not-for-profit entity, does not have any subsidiaries, associates or joint ventures (and therefore requirements set out in AASB 10 and AASB 128 are not applicable) and prepares special purpose financial statements that apply material accounting policies that do not comply with all the recognition and measurement requirements in Australian Accounting Standards. Although the differences have not been quantified, they are extensive and an indication of the differences are presented with the appropriate note disclosing the accounting policy. | Charity D Inc, a not-for-profit entity, has prepared special purpose financial statements as, in the opinion of the Management Committee, it is unlikely there are users of these financial statements who are not in a position to require the preparation of reports tailored to their information needs. Accordingly, these financial statements have been prepared to satisfy the Management Committee’s reporting requirements under the [Australian Charities and Not-for-profits Commission Act 2012 / insert further details of the not-for-profit reporting framework under which the financial statements are prepared]. These special purpose financial statements do not comply with all the recognition and measurement requirements in Australian Accounting Standards. [The material accounting policies adopted in the special purpose financial statements are set out in notes X-Y and indicate how the recognition and measurement requirements in Australian Accounting Standards have not been complied with. … Note X: Revenue … All grant income has been deferred upon receipt and not recognised as revenue until the related expenses are incurred, without assessing whether enforceable performance obligations exist. This does not comply with AASB 15 Revenue from Contracts with Customers or AASB 1058 Income of Not-for-Profit Entities. … Note Y: Employee Benefits … Long-term provision recognised for long service leave has been measured on the undiscounted basis which does not comply with AASB 119 Employee Benefits. …] |

6 | At least one material accounting policy not assessed for compliance with recognition and measurement requirements in Australian Accounting Standards (combined with known non-compliance with recognition and measurement requirements in Australian Accounting Standards) MLK Ltd, a not-for-profit entity, does not have any subsidiaries, associates or joint ventures (and therefore requirements set out in AASB 10 and AASB 128 are not applicable) and prepares special purpose financial statements that apply some material accounting policies that do not comply with the recognition and measurement requirements in Australian Accounting Standards and some material accounting policies that have not been assessed for compliance with the recognition and measurement requirements in Australian Accounting Standards. | MLK Ltd is a not-for-profit entity. In the opinion of the Directors Charity E Ltd is not a reporting entity as its users may request the financial information they need. These special purpose financial statements have been prepared for distribution to members and for the purposes of fulfilling the requirements of the Corporations Act 2001. These special purpose financial statements do not comply with all the recognition and measurement requirements in Australian Accounting Standards. The material accounting policies adopted in the special purpose financial statements include: - [deferring all grant income upon receipt and not recognising as revenue until the related expenses are incurred, without assessing whether enforceable performance obligations exist, which does not comply with AASB 15 Revenue from Contracts with Customers or AASB 1058 Income of Not-for-Profit Entities; - insert further details including an indication of how material recognition and measurement requirements in Australian Accounting Standards have not been complied with]. The material accounting policies disclosed in note X that have not been assessed for compliance with the recognition and measurement requirements of Australian Accounting Standards include: - Long-service leave; and - Impairment of assets. |

7 | At least one material accounting policy not assessed for compliance with recognition and measurement requirements in Australian Accounting Standards (all other material accounting policies comply with recognition and measurement requirements in Australian Accounting Standards) Charity F Inc, a not-for-profit entity, does not have any subsidiaries, associates or joint ventures (and therefore requirements set out in AASB 10 and AASB 128 are not applicable) and prepares special purpose financial statements that apply some material accounting policies that have not been assessed for compliance with the recognition and measurement requirements in Australian Accounting Standards. All other material accounting policies comply with the recognition and measurement requirements in Australian Accounting Standards. | Charity F Inc, a not-for-profit entity, has prepared special purpose financial statements as, in the opinion of the Management Committee, it is unlikely there are users of these financial statements who are not in a position to require the preparation of reports tailored to their information needs. Accordingly, these financial statements have been prepared to satisfy the Management Committee’s reporting requirements under [the Australian Charities and Not-for-profits Commission Act 2012 / insert details of the not-for-profit reporting framework under which the financial statements are prepared]. Charity F Inc has not assessed whether these special purpose financial statements comply with all the recognition and measurement requirements in Australian Accounting Standards. [The material accounting policies disclosed in note X that have not been assessed for compliance with Australian Accounting Standards include: - Recognition of income; and - Long-service leave.] OR [The material accounting policies adopted in the special purpose financial statements are set out in notes X-Y and indicate how they have not been assessed for compliance with the recognition and measurement requirements in Australian Accounting Standards. … Note X: Revenue All grant income has been deferred upon receipt and not recognised as revenue until the related expenses are incurred, and has not been assessed for compliance with the recognition and measurement requirements in Australian Accounting Standards. … Note Y: Employee Benefits … Long-term provision recognised for long service leave has been measured to reflect the directors best estimate of the amounts payable for those employees expected to achieve seven years of service at the reporting date, and has not been assessed for compliance with the recognition and measurement requirements in Australian Accounting Standards.] |

Compilation details

Accounting Standard AASB 1054 Australian Additional Disclosures (as amended)

This compiled Standard applies to annual periods beginning on or after 1 July 2021. It takes into account amendments up to and including 6 March 2020 and was prepared on 21 July 2021 by the staff of the Australian Accounting Standards Board (AASB).

This compilation is not a separate Accounting Standard made by the AASB. Instead, it is a representation of AASB 1054 (May 2011) as amended by other Accounting Standards, which are listed in the table below.

Table of Standards

Table of amendments to Standard

Table of amendments to guidance

Basis for Conclusions on AASB 2019-4

This Basis for Conclusions accompanies, but is not part of, AASB 1054. The Basis for Conclusions was originally published with AASB 2019-4 Amendments to Australian Accounting Standards – Disclosure in Special Purpose Financial Statements of Not-for-Profit Private Sector Entities on Compliance with Recognition and Measurement Requirements.

The Basis for Conclusions is provided with this Standard as a linked PDF document. See AASB Extras at right.

Basis for Conclusions on AASB 2019-5

This Basis for Conclusions accompanies, but is not part of, AASB 1054. The Basis for Conclusions was originally published with AASB 2019-5 Amendments to Australian Accounting Standards – Disclosure of the Effect of New IFRS Standards Not Yet Issued in Australia.

The Basis for Conclusions is provided with this Standard as a linked PDF document. See AASB Extras at right.